5 Ways App Banks Are Changing Financial Services Marketing

In late January, a technology headline on the Wall Street Journal’s website said it all: “Even Facebook Must Change – Transforming Into a Mobile Business Means Teaching New Skills, New Products.” The article begins with a fiscal rationale: “To reclaim its status as a $100 billion company, Facebook Inc. is re-engineering itself into a mobile business.” In other words, mobile is challenging Facebook to reposition itself in order to maintain a robust bottom line. And Facebook’s not alone.

Mobile devices and apps are affecting others — including the financial services industry — in dramatic ways, as well. For example, mobile isn’t just a portable brand experience or banking feature (though it’s popular; Bank of America adds 10,000 new mobile users every day) — it’s a platform that’s spawning new banks.

Called “app banks,” these exclusively online/mobile banks have caused some to speculate about the demise of bank branches (as they compile lists of banks that operate primarily on virtual models). Without a doubt, there is a shift away from the “branch centric view” of banking and an evolution of bank accounts toward mobilization, but what we’re really seeing is the latest disruption… a call-to-action for financial services companies of all iterations to revamp financial products themselves and develop new marketing strategies.

Here are five ways app banks are changing marketing strategies in the industry:

- Financial services marketing teams are learning to be more agile (and less siloed) with data. The new marketplace requires more precise targeting and faster turn-around. Data is key as it helps banks create singular, robust customer profiles – including not only demographic and account details but also cardholder preferences and needs.

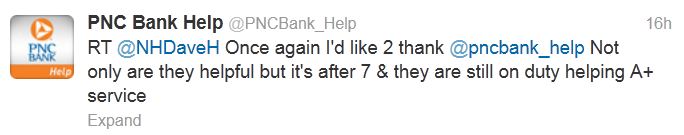

- Banks are translating the customer relationship across platforms. The quality and tenor of the customer relationship can be what differentiates banks from one another. Whether customers reach out via Facebook or at a branch location, they should be able to rely on excellent service. Banks like PNC make service a priority in all channels, handling customer service inquiries wherever they finds their customers, including social platforms like Twitter:

- Product and services marketing materials must emphasize security. As customers use account data in more and more online and physical locations (and on multiple devices), banks are constantly challenged to step up protection of customer data. While this is an imperative for all financial services institutions, we love what Visa’s done: it’s created an entirely new product focused on securing customer data. With V.me, Visa thoroughly re-imagined the online check-out process.

- Banks are targeting niche segments more skillfully, including the underbanked, the affluent and early adapters. Inspired by (or challenged by) app banks to meet very specific and immediate needs, financial services institutions are targeting niche segments with a range of products from credit building cards (like this one from Bank of America) to cards for ultra-high net worth customers (like the J.P. Morgan Palladium card from Chase).

- Banks are going to be partnering with brand new industries. Consumer adoption of smartphones has created demand not only for app banks specifically, but also for financial apps (known as “finapps”) as a broader category. Finapp development is an emerging service industry, and companies like Yodlee are creating products specifically for financial institutions.