Co-Brand Partnerships: 2024 AEP Creative Review and Enrollment Results

The 2024 Annual Enrollment Period (AEP) featured several co-brand MA plans, three of which were just announced in the second half of 2023. We kept an eye on these offerings to understand how they were promoted in direct mail and social media. We also were interested in how the Medicare Advantage plans fared in terms of enrollment numbers.

The initiatives we looked at included partnerships between Alignment Healthcare and Instacart, announced Oct. 3, 2023; Alignment Healthcare and Walgreens, which was unveiled Oct. 17, 2023; Select Health and Kroger Health, which was publicized on August 15, 2023; and UnitedHealthcare (UHC), Walgreens and AARP, which was announced in November of 2019.

Here’s a look at some direct mail and social media marketing creative for each of these partnerships.

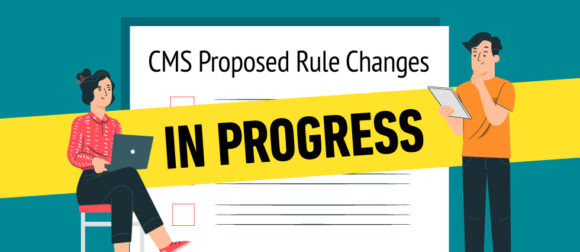

Alignment Healthcare and Instacart

This Medicare Advantage (MA) plan, available in 13 counties in California and Nevada, promotes holistic health, which aligns with Instacart’s “food as medicine” programs and emphasis on food access. Qualifying members receive a $50 to $100 quarterly Instacart grocery allowance and a complementary Instacart+ membership, which comes with free delivery on orders over $35.

Here’s what we noticed in the creative.

- A range of social media ads each focus on a single advantage of Alignment MA plans, one of them being the co-brand relationship with Instacart, which offers members savings on grocery deliveries.

- Using clever play on words and clear benefits, some of the direct mail communicates how the relationship offers a grocery benefit for new members. In these pieces, the Instacart logo is used to further leverage the partnership.

- The print ad, however, barely mentions the co-brand, except in the copy of one of the benefits featured in the ad – most likely because it is not available to all those within the reach of the print ad.

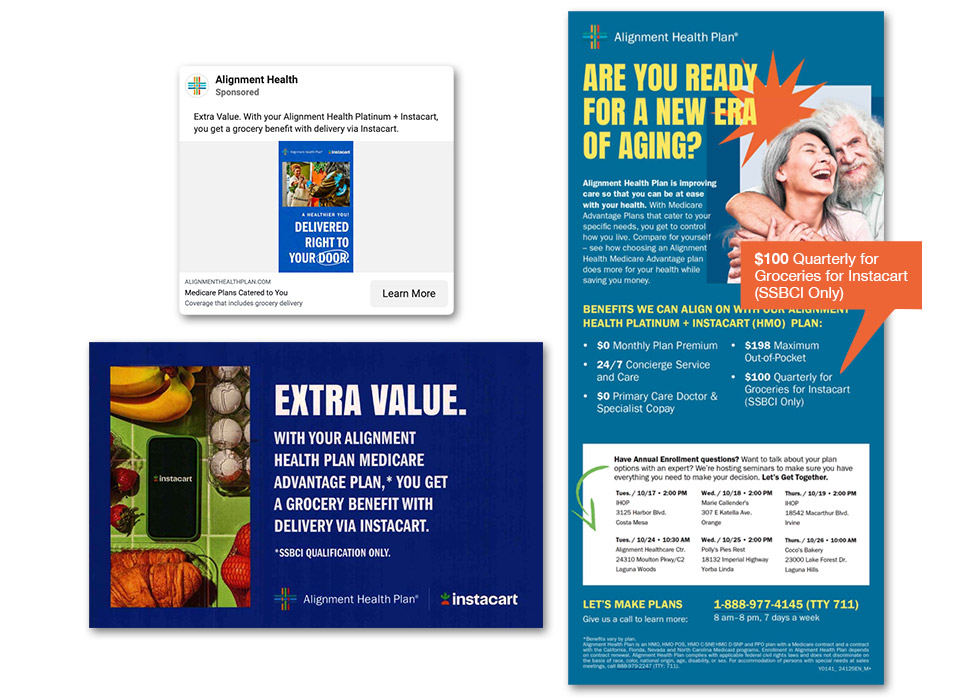

Alignment Healthcare and Walgreens

These co-branded MA plans, available in 10 counties in Arizona, California, Florida and Texas, include over-the-counter benefits for use at Walgreens and a $0 copay on thousands of prescription medications.

Here’s what stood out to us in the social media and direct mail creative.

- Social media posts introduced the co-brand relationship but missed an opportunity to connect prospects directly to the plans. Instead, the posts linked to the press release.

- The direct mail follows general best practices – leading with $0 plans, using strong calls-to-action and highlighting easy-to-scan benefits – but doesn’t even mention the co-brand relationship until readers are deep into the inside spread.

- More importantly, the direct mail creative doesn’t offer compelling reasons as to why this partnership is valuable to prospects.

Select Health and Kroger Health

The Select Health Medicare + Kroger (HMO) and Select Health Medicare Dual (HMO-D-SNP) plans are available in Colorado, Idaho, Nevada and Utah. The plans come with a monthly stipend of $55 to $85 (depending on the state) for over-the-counter purchases – which, for quality members with chronic health concerns, can include approved groceries.

Here are our thoughts on the creative.

- The self-mailer focuses on key $0 benefits, which are highly important to prospects.

- However, it comes at the expense of not offering up the benefit of the Kroger partnership, other than a targeted mention of the grocery store chain connected to the MA plan’s grocery benefit.

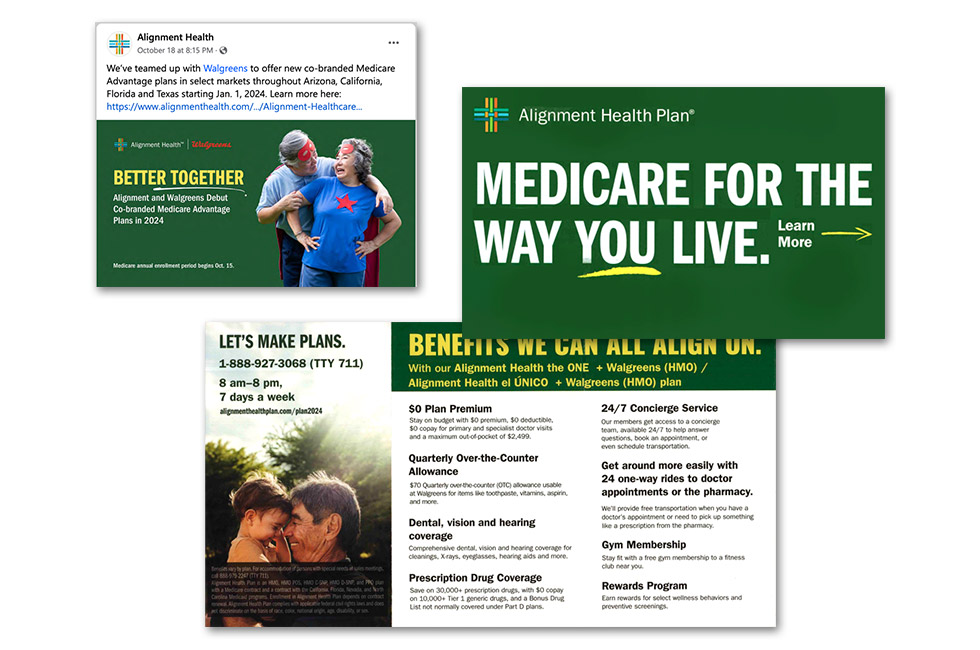

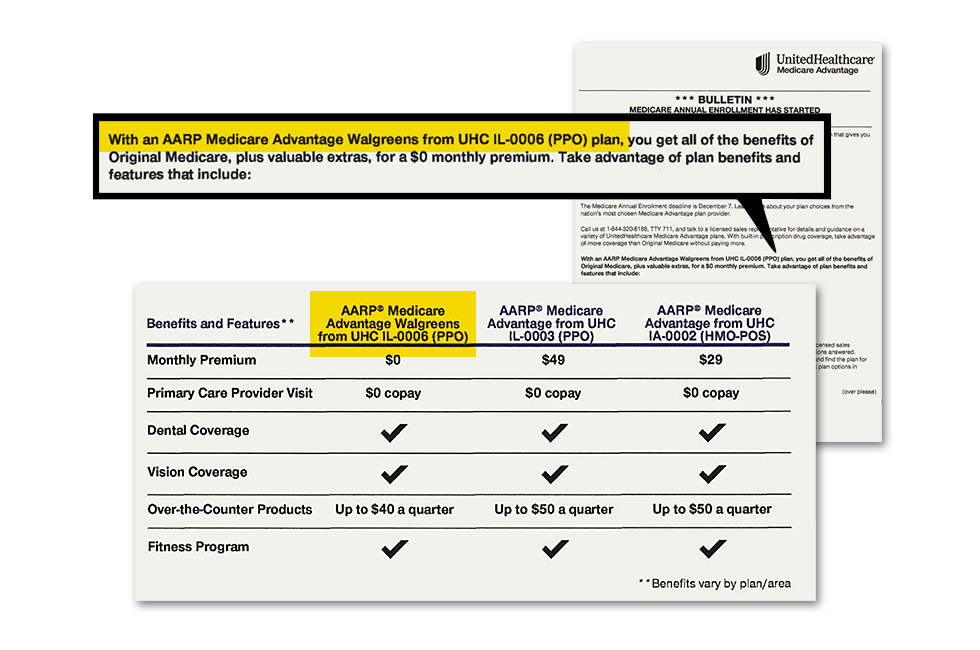

UnitedHealthcare, Walgreens and AARP

The AARP Medicare Advantage Walgreens plans from UHC are made up of 46 plans across 24 states. Members can access lower prescription drug copays and additional discounts when shopping at Walgreens.

Here’s what we noticed in the creative.

- All the UnitedHealthcare (UHC) direct mail pieces follow the same “official stealth” approach that UHC has used for years. Because of this, there is very little room for any type of co-branding.

- At best, a few of their mailings mention the Walgreens name as part of the plan name (along with AARP) and as part of the prescription drug benefit.

2024 AEP Enrollment Results

During AEP, overall Medicare Advantage enrollment increased by 2.9%. Alignment Healthcare membership grew much faster than that average, with 27,842 new members equating to a 23.82% membership increase.

From October 2023 to January 2024, Select Health’s membership grew by 4,310, representing an 8.5% growth.

UHC’s growth fell below average, with a 1.6% growth of 149,560 new members during 2024 AEP.

Stay tuned for a more in-depth look at this year’s winners and losers of Medicare Advantage enrollment, as well as a creative review of the most and least impactful direct mail tactics, coming soon.

Any questions? Reach out to Media Logic today.