AEP Marketing Tactics of Plans with Top Medicare Enrollment Gains

According to CMS, the biggest enrollment gains during this past year’s Medicare Annual Election Period (AEP) came from UnitedHealthcare (+825,879), Humana (+122,953), Aetna (+110,938), Kaiser Permanente (+65,682), Horizon Blue Cross Blue Shield of New Jersey (+60,452) and Anthem Blue Cross Blue Shield (+58,388). With some help* from Competiscan, we took a look at the creative components of each of these insurers’ Medicare marketing campaigns.

In reviewing the direct mail, print and direct response TV elements from the top insurers, some common threads in strategy, design and messaging stood out. These marketing themes may be contributing factors to each brand’s enrollment growth. These observations, however, do not take into account major determinants in enrollment gains, including marketing budgets, market competition and salesforce experience.

Here are a few common themes that we noticed weaved throughout the Medicare enrollment winners’ marketing strategies:

Leading with $0 or low price points

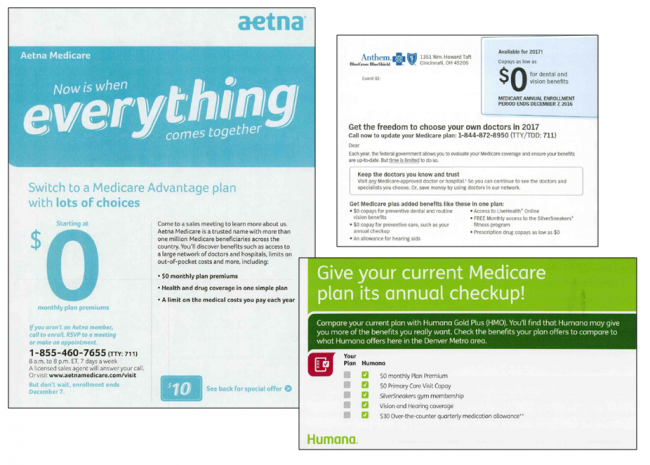

In what continues to be a leading strategy among enrollment winners, many of this past year’s direct mail (DM) packages, print and DRTV spots emphasize low or $0 premiums, deductibles or copays. Based on the findings from our Medicare messaging for DM report, it’s no surprise that low and no cost options are played up early and often in these insurers’ pieces – it’s a primary motivator for the Medicare audience. Print and DM pieces from Aetna, Anthem Blue Cross Blue Shield and Humana, pictured below, use oversized zeroes and bold icons to promote premiums and co-pays starting at $0.

Differentiating beyond $0 and price

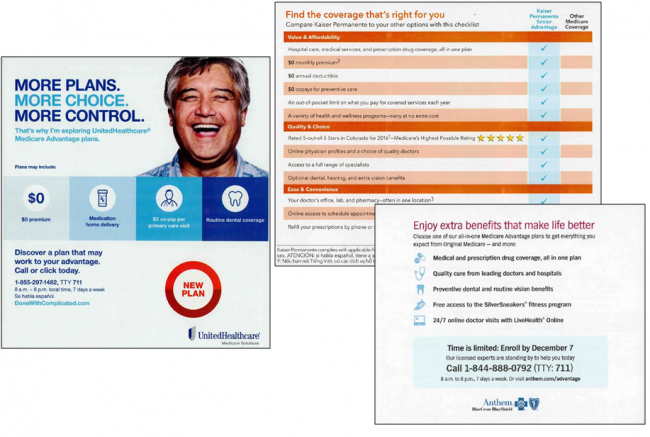

And while $0 options continue to be a leading motivator for consumers, it’s not the only factor that matters to the Medicare audience. Insurers with the highest enrollment gains are using their messaging to highlight other plan offerings, including prescription drug coverage and delivery, physician networks, preventive care, wellness programs and coverage for dental, vision and hearing. While most insurers offer similar $0 options, these differentiating plan attributes are a way for insurers to stand out from their competitors. In United Healthcare’s free standing insert (FSI), for example, these key benefits are given as much real estate as the $0 premiums. Similarly, Kaiser Permanente and Anthem Blue Cross Blue Shield use their direct mail to advertise different plan add-ons associated with quality, ease and convenience, in addition to cost savings.

Simplifying complex products with icons and graphics

For complex Medicare products, graphic elements – like icons and charts – make the content more scannable, helping consumers to focus on the key details. By drawing attention to eye-catching icons in a sea of black text, marketers are able to create more digestible DM packages. In the example below, Humana uses its branded icons to ensure that the plan benefits are the focal point in its piece. Kaiser Permanente relies on two sets of graphics with two different objectives – the first to share what makes the brand unique, and the second to highlight different methods of enrollment.

United Healthcare makes use of the same strategy with its DRTV spot, using simple animation, graphic icons and voiceover to communicate its messaging clearly and effectively.

Using facts and figures to convey expertise

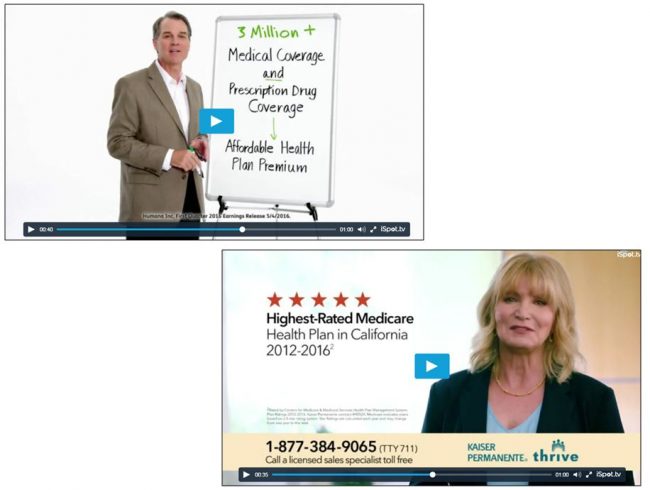

Using Medicare marketing as a means of storytelling can be warm and memorable, but getting straight to the point with facts may be more effective. A few of the insurers employ spokespeople to focus the message on ratings and enrollment figures. In Humana’s DRTV spot, for example, its spokesperson highlights its current membership size of 3 million members (in Humana-branded lime green) to convey the established trust the Medicare audience has in the brand. The spokesperson for Kaiser Permanente points out its 5 out of 5 star CMS rating and that it’s the highest-rated health plan in California, an indisputable fact likely to resonate with prospective seniors.

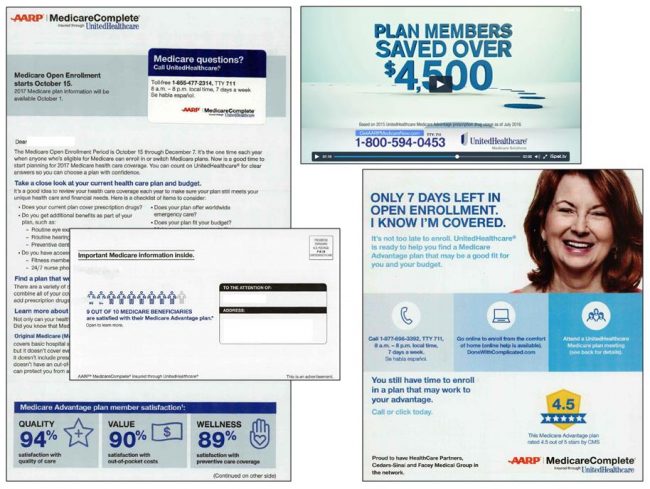

Though its DRTV spot takes a slightly different approach (relying on simple animation, rather than a spokesperson), United Healthcare doesn’t shy away from facts and figures to highlight savings, satisfaction and star ratings. The TV commercial put a dollar amount on member savings – an average of over $4,500 per member. Additionally, the brand’s print marketing pieces promote its 4.5 out of 5 star CMS rating and include multiple figures on high member satisfaction, pictured below.

Clear, frequent and repeated CTAs

Having eye-catching design and compelling messaging doesn’t mean much if it doesn’t prompt conversions. That’s where effective calls to action (CTAs) come in. Strong CTAs are nothing new for Medicare marketing, but with so many options for enrollment and lead generation – not to mention competitors – it’s essential for consumers to easily spot the CTAs and understand how to learn more or enroll. In Humana’s DRTV commercial, 40 seconds of the 60-second spot features an 800-number and website URL in the lower third or full screen, as well as voiceover that creates a sense of urgency to call or go online in order to take the next step.

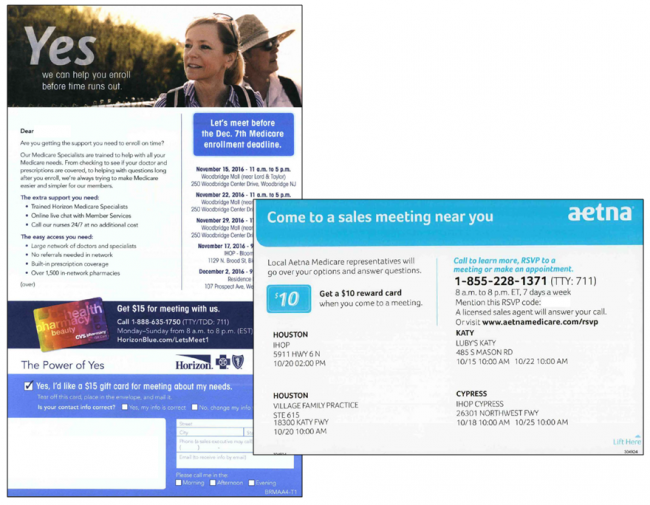

In its direct mail outreach, Horizon Blue Cross Blue Shield highlights in-person meetings, a phone number and website, but also adds conversational tones (“Let’s meet before the December 7th Medicare enrollment deadline.”) and an incentivized offer with a business reply envelopes – a method that’s shown to be powerful with the Medicare audience. Similarly Aetna offers a reward (in this instance for attending a sales meeting) in its self-mailer and includes its phone number and website in bold text.

While there’s no secret sauce to a successful Medicare marketing campaign, it’s clear that the insurers who gained the most enrollees during this past year’s AEP overlapped on some winning design and messaging strategies. Interested in what we’d do for your Medicare direct mail, DRTV and print marketing initiatives? Give us a call today.

*Direct mail communications (screenshots) sourced from Competiscan, a full-service, competitive intelligence market research firm. Competiscan enables clients to study marketing and loyalty strategies by industry, company, product or recipient demographic. Media channels tracked include direct mail, email, online display, social media and print. Competiscan clients utilize a web-based search facility to understand what consumers, business owners, financial advisors and insurance producers are viewing in the marketplace.