6 Direct Mail Marketing Observations from 2021 D-SNP Plans

We continue to see a growth in popularity of dual-eligible special needs plans (D-SNPs) for both for payers and dual eligible beneficiaries. According to Milliman, the number of D-SNPs will increase by more than 10% in CY 2020, and their growth will outpace general enrollment plans by 4%. Growth is attributed to both expanded plan offerings from existing Medicare Advantage organizations (MAOs) and new plans from MAOs new to the market.

Here at Media Logic, we are always interested in how D-SNP plans position themselves. With some help from Mintel,* we analyzed direct mail marketing campaigns aimed at dual-eligible prospects. Creative samples chosen came from D-SNP plans with significant YoY enrollment gains during the full 2020 calendar year.+ Based on our review, we found six common themes.

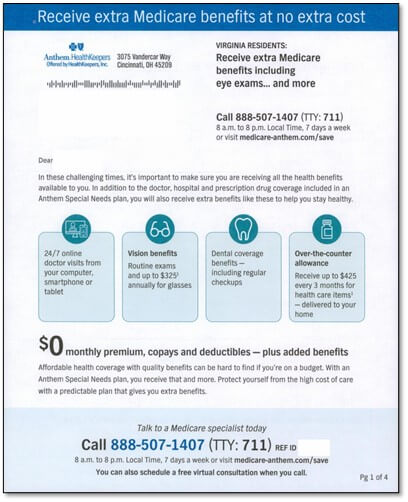

1. More emphasis on over-the-counter (OTC) allowance

This year, we noticed an overall increase in mentions of OTC allowances. Some payers such as Anthem HealthKeepers present it as one of their featured benefits.

2. Personalized mailings

Knowing most D-SNP consumers prefer human help with enrolling in a health plan, direct mail communications have always put an emphasis on connecting via phone. This year, payers such as UnitedHealthcare delivered customized mailings with the photo, name and contact information of a specific sales representative.

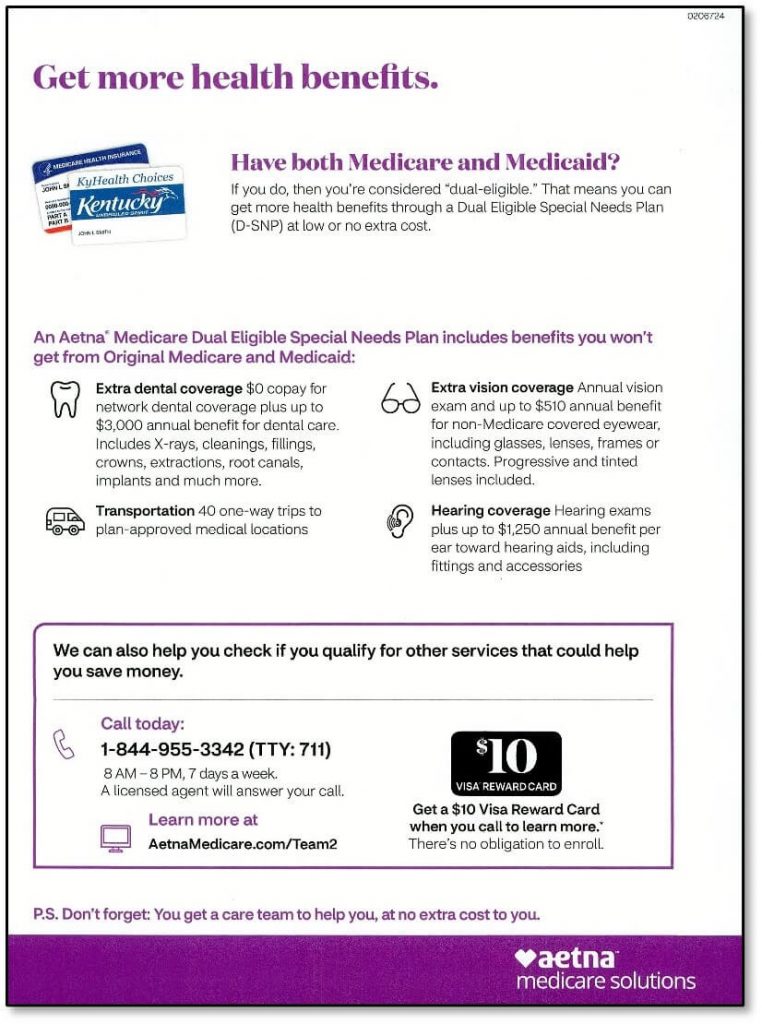

3. Incentive offers

Aetna took an approach we have not seen a lot of in D-SNP communications: an incentive offer. They offered a $10 Visa Gift Card just for calling to talk about D-SNP plans – with no obligation. We’ve frequently seen offers used in the past with Medicare and new-to-Medicare mailings as a successful way to encourage attendance of seminars.

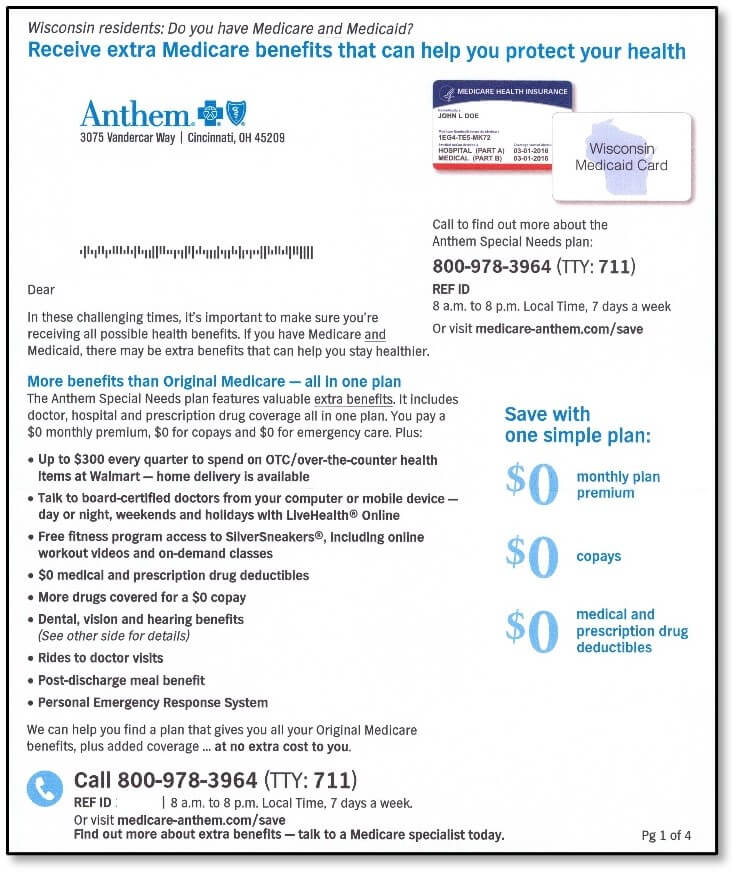

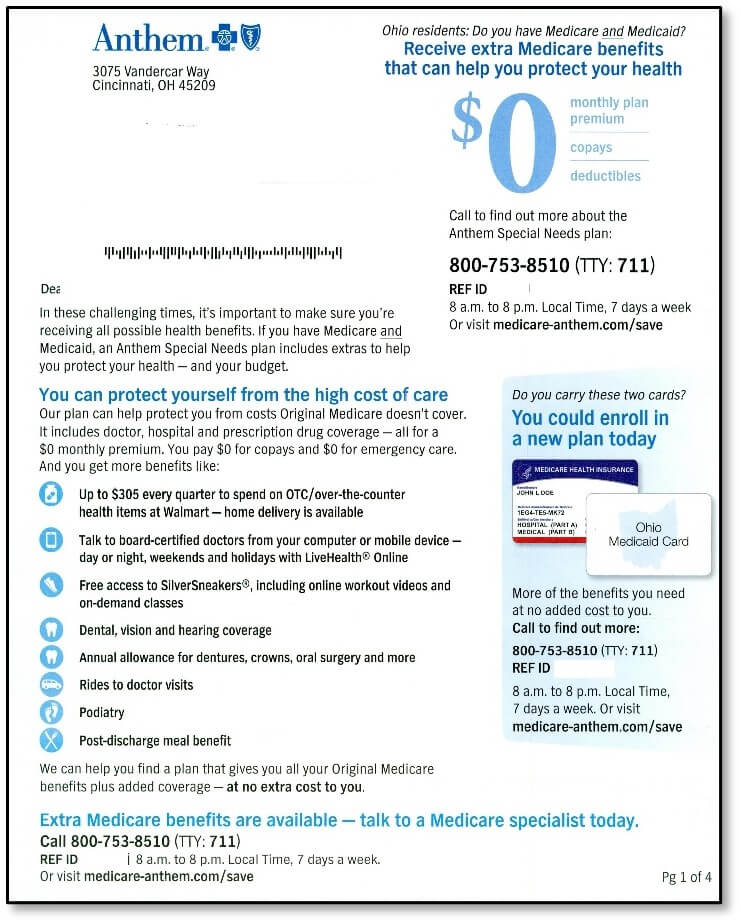

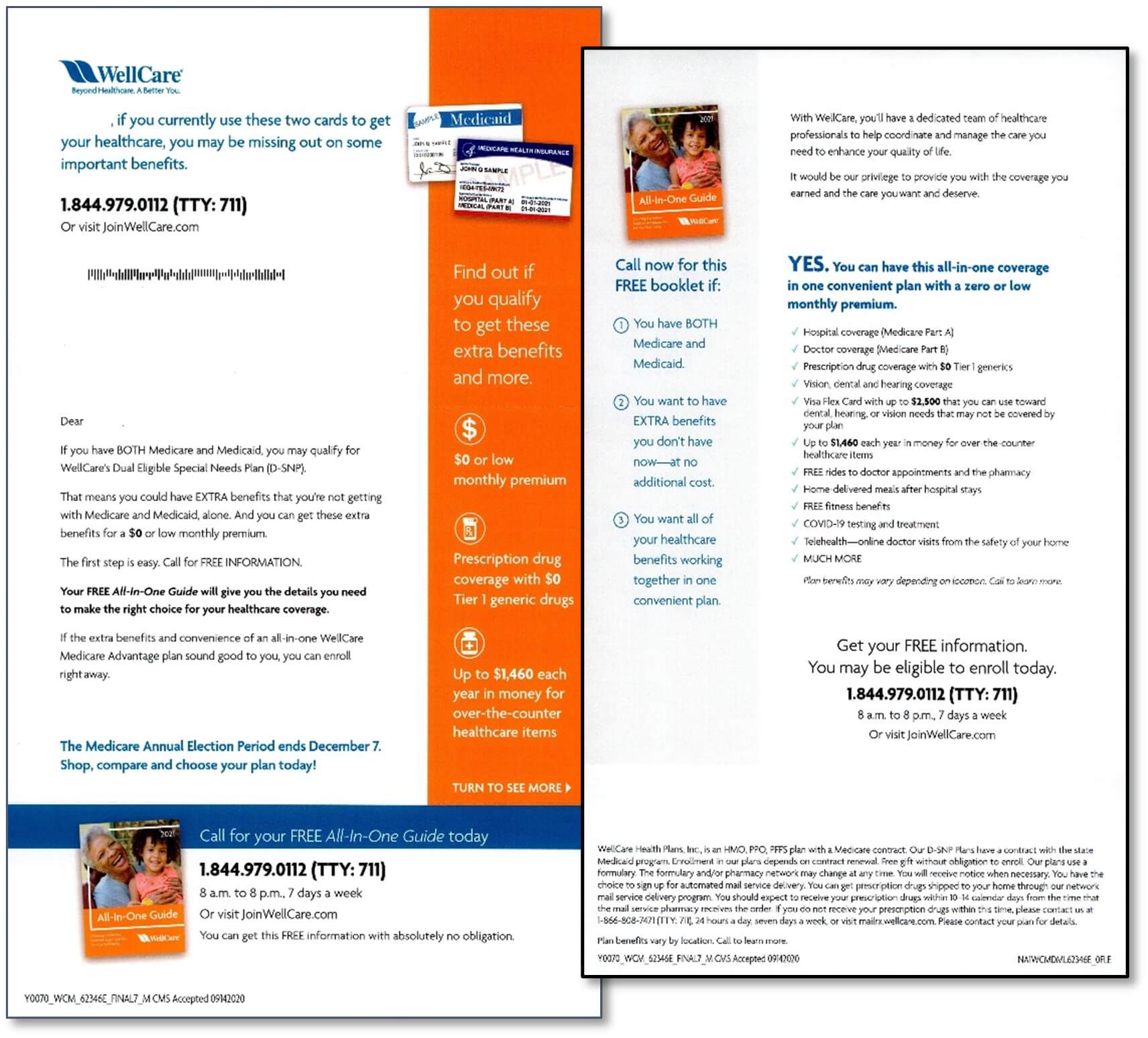

4. Focus on $0 offerings and cost savings

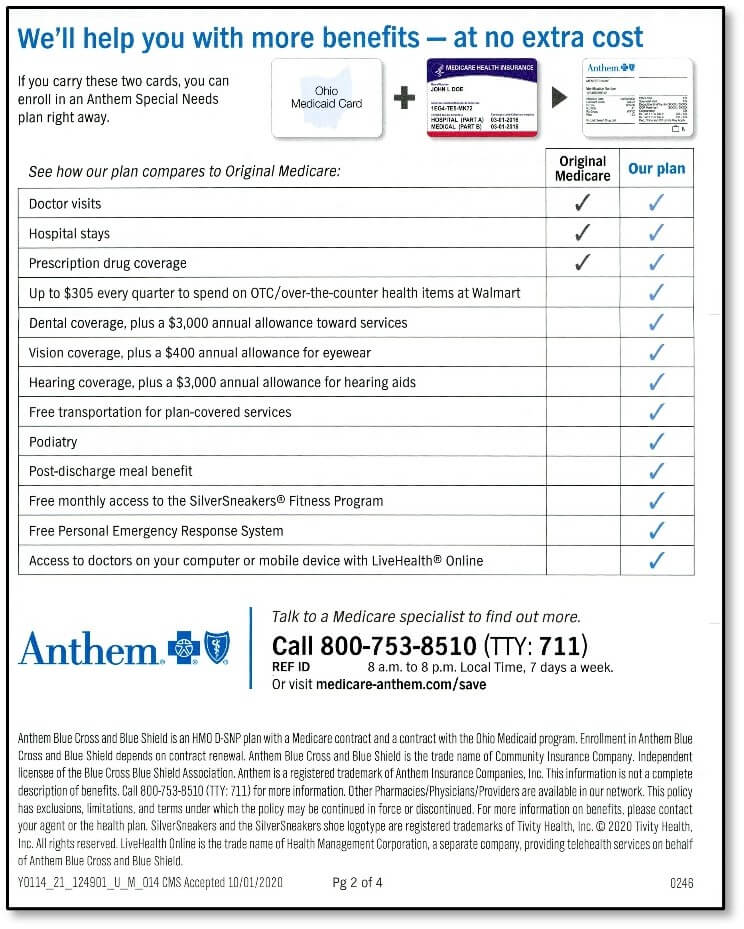

Due to increased financial challenges over the past year, there seems to be a greater emphasis on the $0 cost of a D-SNP plan. Some mailings such as the one below from Anthem Blue Cross and Blue Shield feature large $0s throughout mailing. Other mailings make a point of coupling “extra benefits” with “at no extra cost.”

5. Acknowledgement of challenging times

The past year triggered many challenges for seniors, including financial hardship – and the D-SNP audience is likely to have been hit especially hard. To show empathy and gain trust, some payers acknowledged this past year and used it as an example of why a D-SNP plan is a smart move. Something as little as starting a paragraph with “In these challenging times, it’s important to make sure you are receiving all the health benefits available” is a great way to frame the value of a D-SNP program and we were surprised more payers did not use it.

6. Getting more benefits

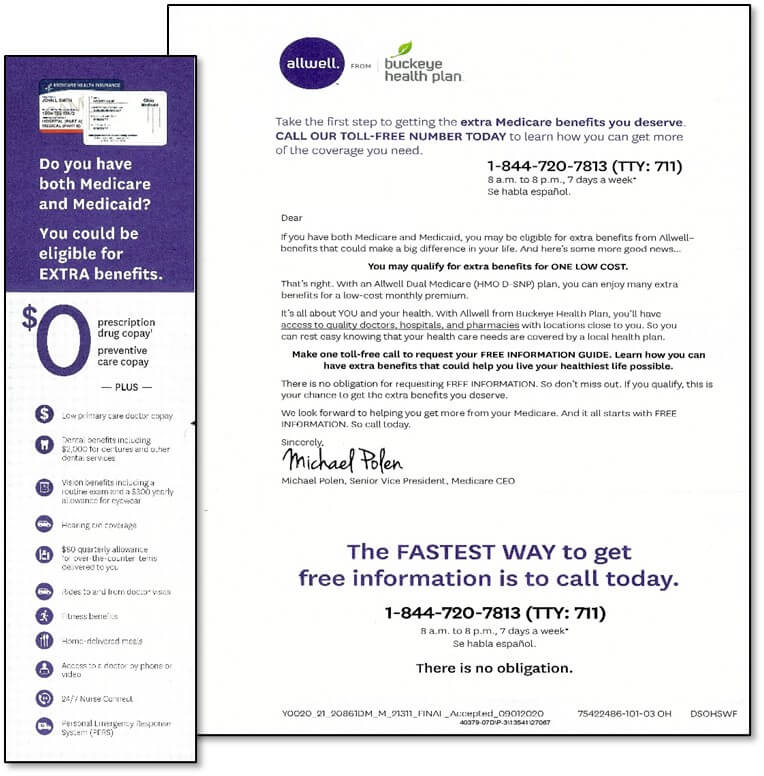

Payers continue to see the benefit of educating prospects in the value of a D-SNP plan to get more benefits. Almost every communication we looked at compared the benefits of a D-SNP plan to Original Medicare.

Sometimes a direct mail package would focus on the extra benefits D-SNP plans offered, such as the one from AllWell below.

Some packages would directly compare Original Medicare benefits to D-SNP benefits such as the one from Anthem Blue Cross and Blue Shield.

SNPs continue to gain traction in the Medicare Advantage market. If you’re an insurer looking to launch (or grow) a D-SNP plan, let’s connect. Contact Jim McDonald, Head of Strategic Growth at 518-940-4882.

*Direct mail communications (screenshots) sourced from Mintel – a leading market intelligence agency.

+While marketing elements play a part in each brand’s enrollment growth, we acknowledge that there are many non-marketing factors that contribute to plan growth.