Marketing American Express Business Checking and Platinum Card as a Bundle

Perhaps no single payment brand is as highly identified with small- to mid-size businesses (SMBs) as is Amex. The brand is focused on maintaining its small business dominance as it faces disruptors like Capital One, Sofi and Chase. One of these competitors (Chase) has found success using a “flywheel” strategy, whereby all channels, including huge branch infrastructures and digital self-serve products, support one another.

It was not unexpected in 2021 when Amex launched a new Business Checking account and debit card. Despite the lack of a branch network traditionally favored by SMBs, the way for an Amex expansion beyond payment solutions had been paved by the rise of fintechs attracting SMBs and the brand’s acquisition of partners like Kabbage. In addition, Amex business product attributes and positioning were already “fintech-like” – emphasizing digital solutions, high-yield interest and generous rewards (notably Amex Membership Rewards).

Amex initially rolled out and promoted the new Business Checking through cross-sell campaigns using targeted emails and direct mail to reach Amex cardmembers and business loan customers – a logical strategy to expand upon existing relationships.

Research supports why Amex could confidently focus on their digital onboarding experience. Based on a survey by Aite-Novarica Group of a highly desired SMB segment, The Financial Brand reports, “Digital account opening is critical to onboarding new customers and keeping their business … 86% of Millennial-run small businesses say digital/online account opening is required, very important or important for their bank to keep their business as a customer.”

And what about the absence of brick-and-mortar infrastructure traditionally important to the segment? American Express leans on convenience instead. As noted in Amex’s launch press release, Business Checking has a fast-onboarding process: “Apply and get a decision in as little as 10 minutes – all without needing to step foot into a bank branch.”

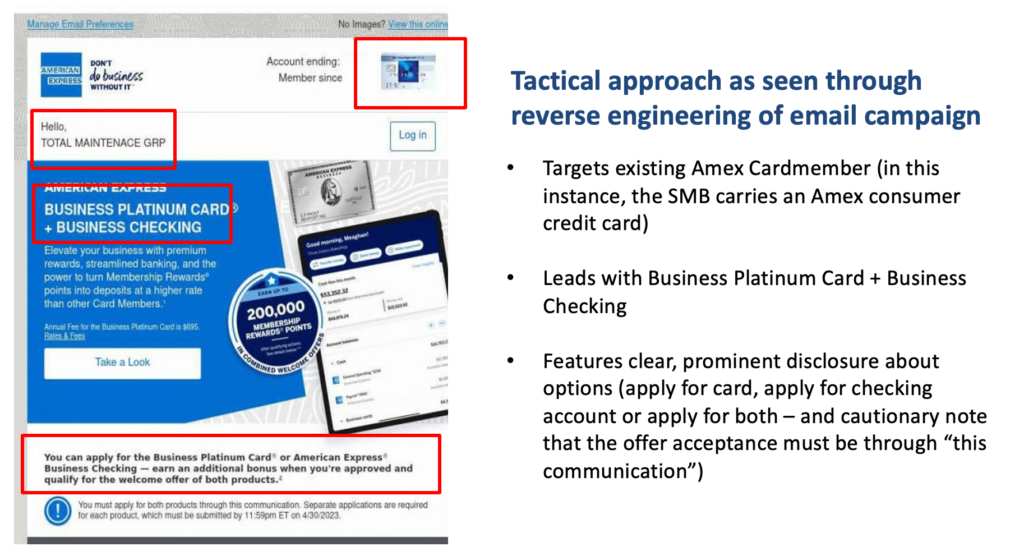

As the checking campaign matured, Amex began promoting Business Checking using a “bundled” offer, promoting Business Checking and Business Platinum Card together. Comperemedia, the service that tracks and analyzes marketing communications, captured marketing for the bundle in an email – the first one the service received – sent in March 2023. It also notes that this type of offer is unusual.

Media Logic’s desktop research uncovered that Amex started the bundled campaign approach as early as November 2022 with an even richer offer of 230,000 Membership Rewards for successfully applying for Business Platinum and Business Checking then meeting all qualifying activities. We expect to see continued testing of offers as Amex targets more resistant SMBs.

Reverse Engineering the Strategies and Tactics of the Amex Offer

The tactics in this bundled approach include:

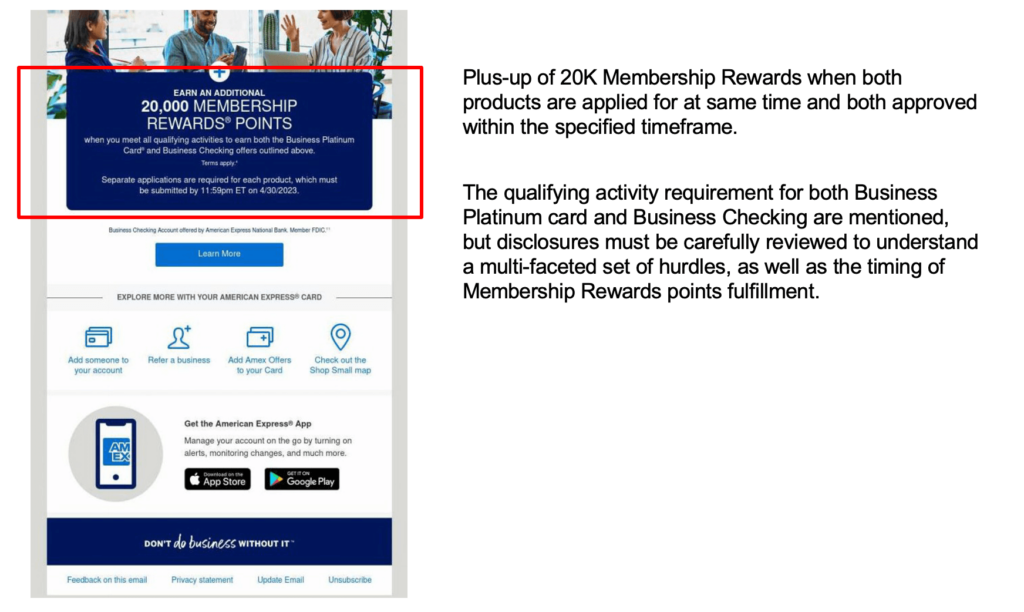

- Offering a substantial Membership Rewards bonus – richer than each product bonus acquired individually. This cumulative offer – up to 200K Membership Rewards points – is worth $2,000.

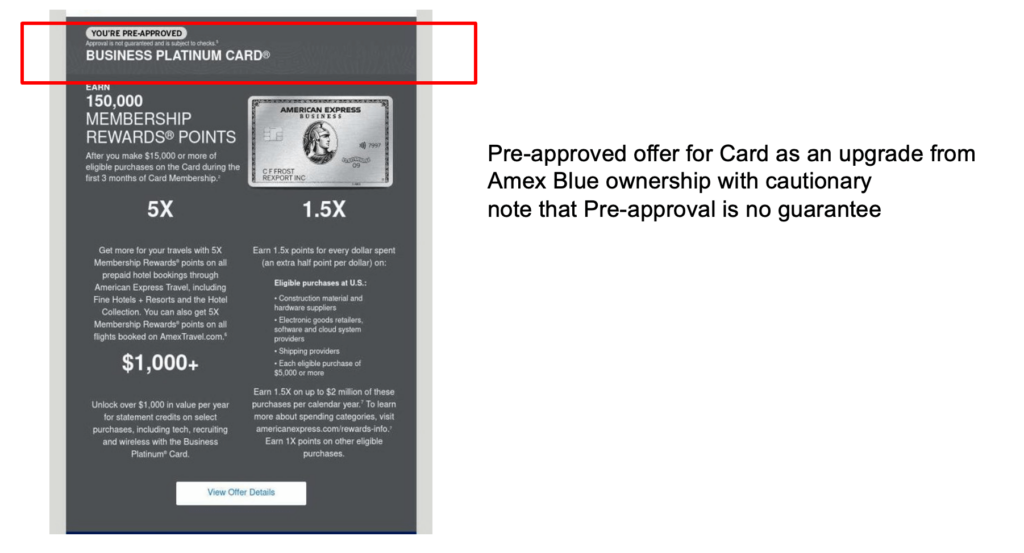

- Targeting existing SMB customers who are Amex consumer cardmembers. This helps extend the pre-approved Platinum card offer based on Amex-owned behavior data; mitigates declining the card applicant and a negative customer experience; and targets business with consumer cards without cannibalizing Amex business credit card portfolios. It will will likely lead to deeper engagement.

- Leveraging the cachet and over-the-top benefits/features of Business Platinum versus alternative Amex card brands.

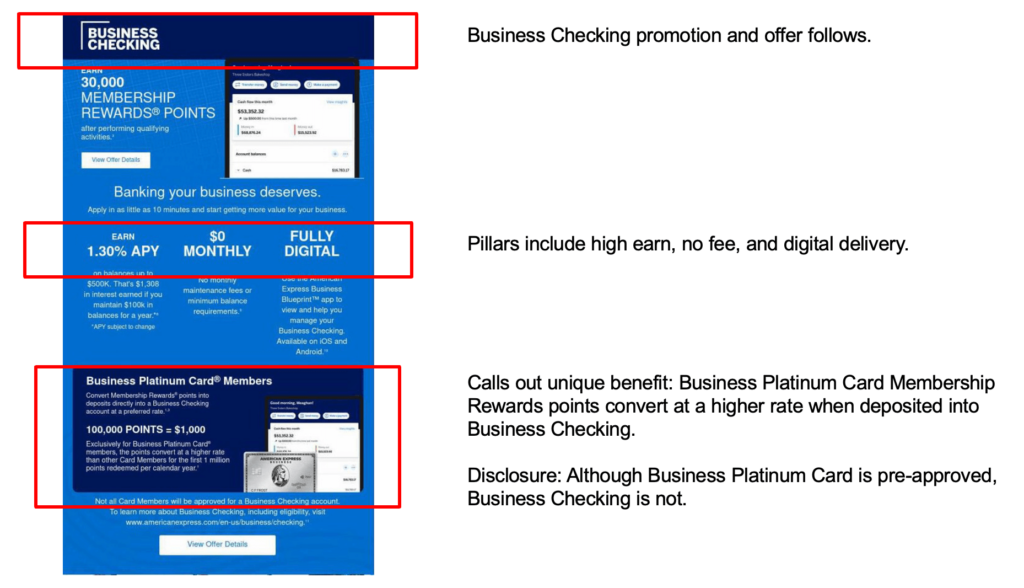

- Earning a higher rate of conversion when Membership Rewards points earned from Business Platinum are deposited into the Business Checking account.

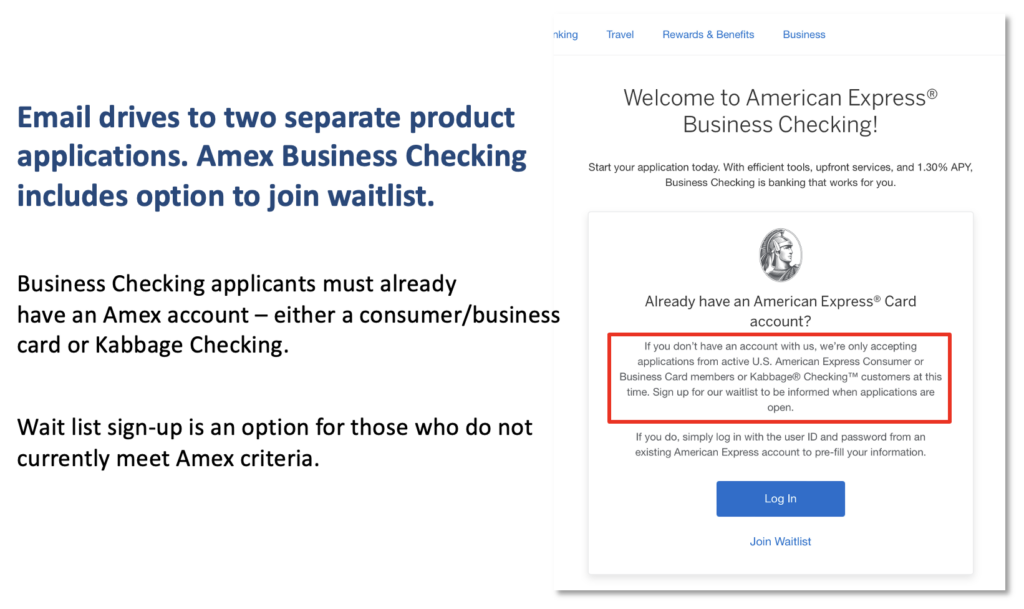

- Using the email channel to efficiently drive two separate product applications. Both apps must be submitted through the email offer by the specified date.

The link to apply drives to a landing page screen that discloses only those with an Amex card or Kabbage loan will be considered for Amex Business Checking. For SMBs not meeting the criteria, Amex provides an option to join the Business Checking wait list.

That’s all positive for Amex but there are some details to be ironed out:

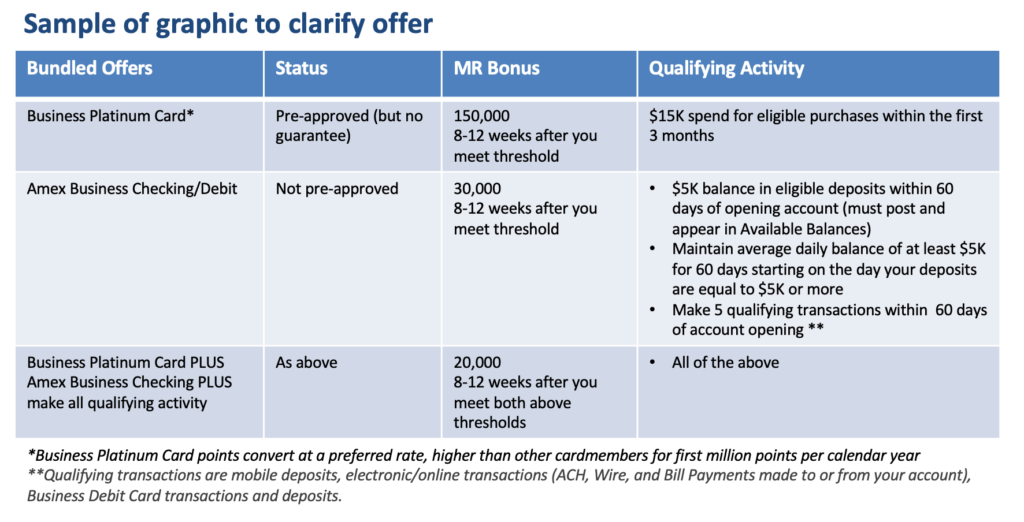

- Although “bundled” into one offer, each product is separately applied for, separately decisioned and separately bonused with no guarantee of successfully getting both products and their bonuses, plus the cumulative bonus to add to 200K Membership Rewards points. This presents a communication challenge.

- There are qualifiers for earning the bonuses – both deposits and spend requirements – and the qualifying activity hurdles required for Business Checking and Business Platinum could benefit from visual support and “do the math” help towards better understanding the 200,000 rewards points bonus.

The SMB applicant experience and satisfaction with Amex may suffer to some extent. Small business blogs promoting the bundled offer received negative reader comments about the logistics. There is feedback from approved applicants having to wait a long time to receive the Membership Rewards points deposited to their account – sometimes taking over 12 weeks after the hurdles are complete. In fact, comments referred to completing qualifying activities and “waiting way past 12 weeks.” One Amex customer advised, “Be prepared to make repeated calls” to Amex to troubleshoot missing Membership Rewards points well after qualifying activities were completed.