Spilling the Tea: Fintech and Bank Marketing Envy

As they develop, launch and market products and services, fintech and traditional financial services companies continue to look over their shoulders to see what the other is up to.

It makes sense: Banks and fintechs compete for the same users while working with different strengths. If, instead, they were to work together as partners as BAI suggests, they could tap into the “potential to create significant, positive change in the financial services industry. The only way to realize that full potential will be to partner strategically and rely on each other’s strengths.”

In the meantime, BAI Global gets to the heart of this fintech-vs.-bank/bank-vs.-fintech dynamic when observing, “Each has what the other needs.” We agree with BAI’s point of view and, as result, are aiming our lens at fintech marketing to identify strategies and tactics banks may want to emulate.

6 Marketing Lessons Banks Can Learn From Fintech in 2022

As one observer noted, fintechs “have made traditional financial institutions seem rigid and clunky, forcing them to digitize their services or risk not keeping up.” Here are six fintech practices for banks to consider, including best-in-class examples from unconventional marketing of retail bank, payment products and B2B services.

1. Go on the offensive

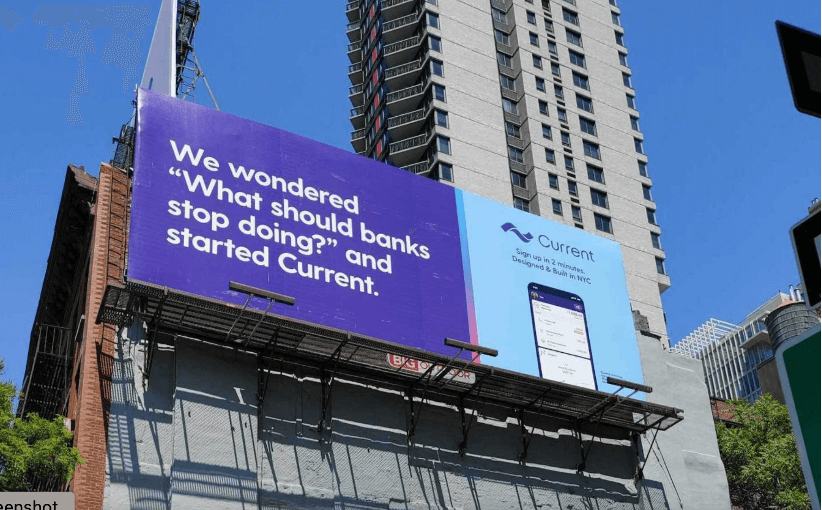

Branding and positioning may be easier for fintechs since, as “challengers,” they sit outside the norm. This may help bolster emotional connections to consumers and businesses seeking new and innovative solutions. Being disruptive, as in the examples below, takes not only “chutzpa” but also a cooperative legal department with an open mind and appetite for pushing marketing. More conservative bank infrastructures and strict regulations are barriers to assertive, ownable and provocative marketing. The result: traditional players are often reluctant to make competitive claims that may stir the pot. Working with cross-functional teams to understand and mitigate barriers is a first step for traditional players.

A good example of marketing by an outlier – Current Bank – uses an anti-bank position that is more charming than it is ugly. Current Bank’s above-the-line advertising campaign – “What do you think we are, a bank?” — is a great example of how to go on the offensive without being offensive. Traditionalists can find ways to capture the spirit of the outlier approach by infusing their marketing with a bit of attitude, too.

2. Take your cue from the customer

No doubt, you are familiar with Chime Bank, thanks to its heavy, on-repeat ad campaigns including the “Two Days Early” spot focusing on access to paychecks. (Eligible Chime DDA customers get paid up to two days early when their employer uses accelerated direct deposit.) In the spot, featured Chime customer “Dulce” declares that now, thanks to Chime, she gets paid two days before her co-workers.

We appreciate how Chime manages to take ownership of a product feature that is not at all unique to Chime. Its messaging leverages a consumer insight specific to Dulce’s age cohort, which likely manages paycheck to paycheck. The take-away: Chime’s marketing centers on an envy-provoking product feature and narrowly focuses on a very specific target with a singular, relevant message.

Chime’s strategy is successful as the challenger bank secured additional funding in 2021 and is seeing healthy growth.

3. Make beautiful connections between positioning and marketing

Petal – the fintech issuer of credit cards targeting the new-to-credit consumer – breaks out of the expected through online marketing that skillfully echoes the Visa card positioning – simple and spare – to engage new-to-credit prospects.

Petal is knowledgeable about its prospects and addresses the inexperienced card applicant with clear, concise marketing that showcases two Visa card options with different value propositions. The website is content “light,” providing relevant and essential information in a streamlined, highly visual way, while allowing for an optional, deeper content dive. (With a click, the visual content can be shifted to a comparative product “grid” view.)

The site layout draws attention to two key messages: There will be no hit to your credit score (applicants are likely sensitive to hard hits) and — for those who received a direct mail offer – it is super easy to bypass the page and apply for the card. We appreciate the visual, side-by-side presentation of the two physical cards – Petal 1 and Petal 2. As visitors scroll, each dynamically rotates to showcase the cards’ vertical card designs. Well done.

4. Add music to your words…or words to your music

Great partnerships make beautiful music together: Oscar and Hammerstein, Lennon and McCartney, Simon and Garfunkel. The same can be said about well established banks and sexy fintech providers who are finding ways to work together. Case in point: Amex acquired Kabbage to fill critical gaps and better serve small business customers (its key segment).

As it brings Kabbage and the entire Kabbage enterprise onboard (technology, people and products), Amex immediately benefits from the fintech’s digital banking platform. Amex can now offer “a broader set of cash flow management tools and working capital products to its millions of small business customers in the U.S.”

Amex is not unique in acquiring or partnering with a fintech to keep pace with more innovative and digitally delivered products. Banks, payment issuers and payment networks are beginning to think differently and embrace fintechs because immediate benefits are apparent. As noted in a recent Forbes column, “The contrast between perspectives is what makes partnerships so worthwhile. On the one hand, we have the dependability of established banking infrastructure, credibility with regulators and a customer base that still trusts banks; on the other, there’s the freedom to innovate and the agility to build tailored solutions for niche customer segments.”

5. Use traditional channels in nontraditional ways

Jasper defines itself as a fintech credit company innovating to give customers what they actually want: more cash back and tools to maintain a financially healthy lifestyle. (Sidebar: We encourage you to read Jasper’s rebranding story, a detailed, authentic – warts and all – recap about how and why it rebranded and the circuitous route it took in transforming CreditStacks to Jasper.)

We noticed Jasper’s use of direct mail, a foundational acquisition channel for FIs but not one all fintechs utilize. As noted below, Jasper’s direct mail approach does not follow convention:

- The acquisition “letter” is not a letter. There is the requisite address block but no expected letter components (salutation, body copy, signature, postscript, etc.).

- The letter resembles an infographic and uses a “module-like” layout to cover key product attributes in an organized but non-linear way.

- There’s a large amount of space dedicated to cash back earned from friend referrals, which is clearly a lever to drive card acceptance. (Traditionalists leave the friend-get-friend efforts to later in cardmember lifecycle.) This makes sense as Jasper’s bonusing of referrals is an intrinsic part of the card value prop. Each approved referral contributes an additional 1% in cash back for 12 months on top of the standard 1% cash back earned for card spend. So, cash back from referrals is an essential component of the value proposition touted as “up to 6%” cash back.

- App screen shots, a strong CTA driving to web to accept the offer and cardmember testimonials (important to their targeted cohort) are some of the best practices, Jasper manages to pack into this DM piece.

6. Make ownable content a mission

Wealthsimple is an investment management service targeting next generation investors. The brand describes itself as a resource that gives everyone access to the tools they need to make smart financial choices. Services Wealthsimple provides include investing, high interest savings accounts, commission-free trading via a stable of financial advisors and tax filing.

Our focus here is on the brand’s best-in-class commitment to content, which is fresh, relevant to their audience, comprehensive and delivered in multiple ways through its branded magazine, podcasts and tutorials (including video bootcamps that breakdown big topics into digestible lessons.)

What is distinctive is that Wealthsimple Magazine is an “independent publication created by award-winning writers and artists with experience from places like the New York Times Magazine, Slate and GQ.” As a result, the end product is superior to some of the best-in-category FS category blogs, which are not as creative in their approach, struggle to be engaging and have less-ambitious publishing schedules. Scanning recent issues proves just how far ranging the content is, while showcasing an ownable Look, Tone, Feel and demonstrating how in touch (very!) it is with its readership.

There are many other ways fintechs put a fresh spin on marketing strategies and tactics including personalization, viral marketing, unique branded language, use of influencers and affiliate marketing. Many of these are also used by traditional players, but we’ll be taking a look at how fintech put a spin on these marketing tactics in a future post.