B2B Check Utilization: Challenges Beyond COVID-19

We recently imagined a world without direct mail, inspired by a fictional account set in 2050 where mail is a relic of the past. Let’s now shift to the viability and potential demise of the paper check in business.

Prior to the pandemic, despite much effort to convince business to move from checks to other digital payments, checks were still the most popular way for businesses to pay each other. As Mercator Advisory Group indicates, paper checks accounted for 47% of B2B payments in 2018.

But now, amid COVID-19, have we reached the tipping point where displacing checks with digital solutions is almost universal? The answer leans towards “yes,” hastened not only by the pandemic but also by years of alternative payment providers actively working towards that goal.

Sign of the times: Deluxe Corporation

Surprisingly, the movement away from business checks includes a provider ahead of the no-checks trend – one that happens to be synonymous with checks themselves. Deluxe, one of the leaders in manufacturing and distributing paper checks, brought in a new CEO, Barry McCarthy from First Data, recognizing him as an “ideal leader to drive the next stage of their transformational growth,” in reference to his prior Fintech leadership and pioneering of technology.

The Deluxe 2019 Annual Report makes specific reference to the continuing “decline in check use over the past several years leading (Deluxe) to focus on opportunities to increase revenue and operating income and to diversify our revenue streams and customer base.” The company expects the decline in check use by business to continue due to “digitization of payments including debit cards, credit cards, direct deposit, wire transfers and other payment solutions, such as PayPal, Apple Pay, Square, Zelle and Zenmo.”

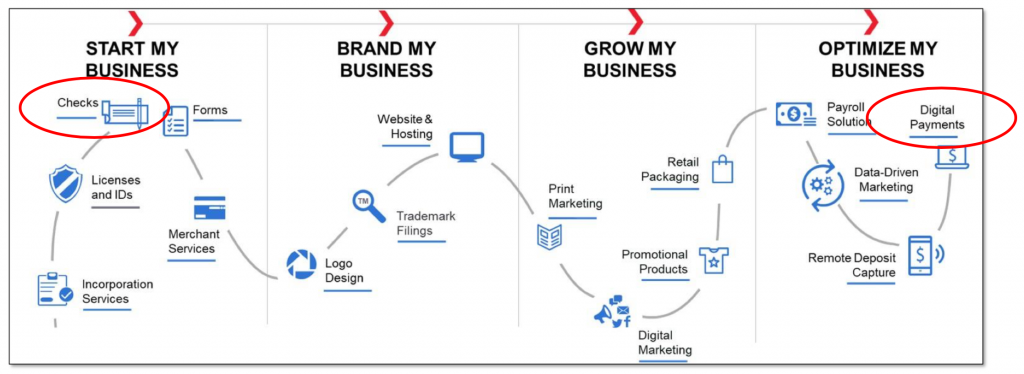

The recent Q1/2020 Deluxe Corporation Investor Presentation, released May 7, corroborates a focus on shifting the B2B segment from declining paper checks to digital payments through a lifecycle strategy where paper checks are appropriate to “start my business” but then evolving to digital payment and other services to “optimize my business.”

The pandemic and the need to work from home is accelerating the transformation, but as reported by PYMNTS, Deluxe believes even disruptions of this magnitude can’t eliminate the paper check in the B2B payments world all at once:

“Everyone has been saying that checks are going to go away for a very long time, so I don’t think there is a cliff edge that we’re running towards. Checks will be around for a while. They’re foundational, and there are a lot of people that still like using them,” says Michael Reed, Division President, Deluxe Corporation.

According to Deluxe, providers can’t force the move away from paper. Rather, they observe “by virtualizing the paper check and preserving many of the workflows that surround it, businesses can face far less friction in their payment digitization journeys.”

Taking aim at checks: Visa Direct and Mastercard Track

Along with the strategy of creating frictionless digital payments, payment networks continue to take aim at checks with new and improved alternative solutions.

Visa Direct, for example, is a single payment solution used by multiple applications including Venmo, Zelle and Square. For business, Visa Direct positively impacts cash flow by pushing payments to credit and debit cards simply and effectively – the payment rides on Visa debit rails. To make its case, Visa offers the example of a small business that typically uses Square, which often pays out via ACH, taking a few days. Using Visa Direct on Square instead, a small business can choose to pay a fee and vastly accelerate payment:

“With Visa Direct, it doesn’t matter what time it is. The way Visa rules read, once a bank receives the money for a Visa Direct transaction, they have to post and make available the funds within 30 minutes. We did some research and found that on average the money is posted in 18 seconds.”

Mastercard introduced its solution to the U.S. market in early May. Mastercard Track Business Payment Service supports both card-based payments and ACH, allowing businesses to pay their suppliers and identify their preferred payment method. It is flexible since it moves both dollars and data across multiple payment types. Experts regard it as a payment innovation that can make digital payment the preferred choice for B2B:

“The business world has accelerated, but the payments that enable it are stuck in neutral – paper checks and manual invoicing need to be scrapped, man-hours need to be applied to more strategic roles and back-offices need tools to help streamline operations.”

Are rumors of their death greatly exaggerated?

Despite what is a very logical argument by Deluxe regarding unlikely check abandonment, a Mercator analyst notes the significant impact of COVID-19 on B2B check payments. His opinion? Business owners are not likely to retreat back to check use and are now exponentially adopting alternative payments like virtual cards:

“The trend is that companies want to pay digitally because they are locked out of their facilities or have a mandate to do so. Everyone is being forced to work remotely and what they were doing manually can no longer be done in a [work from] home environment. Signups for virtual cards are up 2,000% in the last month.”

As business begins to fully reopen, moving back to physical locations, we believe the complete demise of the paper check is in the not-so-distant future. Businesses will navigate an “on again/off again” work from home situation driven by potential virus re-emergence cycles. The final elimination of paper checks will then accelerate as business owners must seek digital payment options to assist in their efforts to increase efficiency, lower costs and require less people resources.