7 Strategies to Refresh Entrenched Financial Services Products

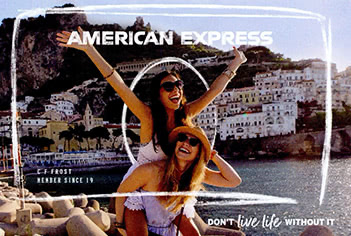

In October, Amex relaunched the American Express Green Card, a product it first introduced 50 years ago. Positioning this refresh as a “reimagining,” the brand changed the product name to “Green from Amex” and, as stated in a press release, updated its value proposition to “meet the evolving needs of Card Members and reward the areas they care about and regularly spend in – travel, transit and dining.”

It is well known that American Express marketing has played a central role in building the iconic brand. As a result, its product and brand campaigns draw a lot of attention in financial services and also from marketers in other industries, and the reboot of this well-established credit card product is no exception.

Based on our observations of the marketing for Green from Amex, we believe that Amex has executed a number of strategies that can be instructive to the relaunch of other entrenched financial services products. See our observations below or download a printable pdf.

Observations from Green from Amex

American Express is committed to refreshing products on a three-to five-year cycle.

In October 2019, they relaunched the new American Express® Green Card, going to market with a product better able to capture share and engage existing and new cardmembers through an improved exchange of value.

-

Identify high-value targets

Amex clearly targets the competitive set of Chase Sapphire Preferred/Reserve® and the beginner travel segment, allowing Amex to be laser-focused on a value proposition and benefit set to drive appeal and differentiation.

The effort benefits from Amex’s continued product stratification which matches segments to products within the suite of all cards they issue.

-

Amplify brand vision at the product level

Amex corporate is focused on “digital membership” and anchoring all products with digital enhancements.

Green from Amex aligns through the card app capabilities: in-app chatting feature and mobile assistant, “split the bill” with Venmo/PayPal, rewards management and travel planning and booking.

-

Scale “reimagination” to need

After fifty years and a few tweaks over the decades, the Green Card needed recrafting to remain competitive.

Amex delivered new positioning and branding, value proposition, benefit set, digital enhancements and new plastic design.

Amex found a good balance between the legacy assets and new assets.

-

Retain equity in assets

Amex retained elements of the iconic Green card such as the Membership Rewards® and the brand heritage of travel and lifestyle.

The brand then contemporized the assets aligned with the targeted segment including updated partnerships with LoungeBuddy, CLEAR® and Away.

-

Ensure consumer insights drive initiatives

The card is “designed for consumers who live for experiences – big and small.”

Amex identified three areas the target segment cares about and spends on – travel, transit, dining – upping the rewards earn to match the identified competition.

All communications – DM, social ads, digital ads – support the experiential promise.

-

Create and sustain value

The Green card launch offering is generous and sustainable circumventing any need to pull back as other brands were forced to do post-launch.

Amex matched the competitive earn rate but expanded what qualifies for rewards. Their transit category, for example, rewards transactions for campgrounds, ferries, tours, home shares and more.

-

Get ahead of perceived negative change

The higher annual fee presented Amex with a challenge for both existing cardmembers and pure prospects.

Rather than relying on consumers “doing the math,” Amex launch communications immediately asserted how the welcome offer and discounted perks more than made up for the increased annual fee.