Landing Now with U.S. Credit Card Issuers: Chip Technology

EMV chip technology – the standard payment technology in many countries worldwide – has come to U.S. credit card issuers slowly, primarily beginning with high-end travel and entertainment cards that attract international travelers. But now that chip is gaining awareness among U.S. consumers, domestic issuers are beginning to offer it more broadly.

Because this payment technology can be confusing to consumers, it is imperative that communications about the technology and its benefits are clear. We’ve been keeping our eye on how financial institutions convey this information, and two recent examples caught our attention.

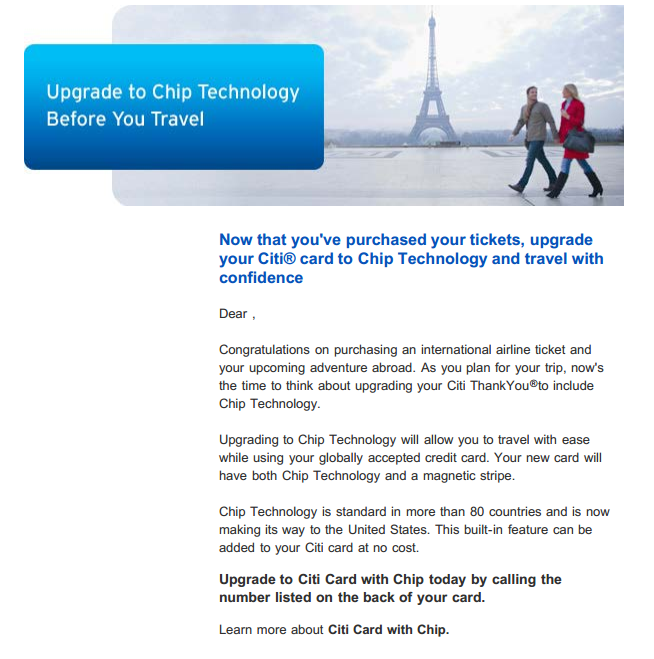

EMAIL FROM CITI

While unassuming in nature, we stopped to notice this email sent from Citi on the topic of chip:

What this communication does right:

1 – Smart targeting. When cardholders purchased an international airline ticket, Citi delivered the email offering an “upgrade to a chip technology…” a relevant feature offered at an opportune time.

2 – Gradual deployment. By offering chip to international travelers first, the issuer gives itself the ability to resolve issues gradually, as they occur, in order to prepare for what may come when it offers chip more broadly.

3 – Clear, simple, benefit-driven messaging. Explanations about the technology itself can be confusing, so it is important to describe its functionality and end benefit: to travel with confidence and ease.

4 – Details offered only if desired. The last link in the email presumably drives to this web page, which covers in greater detail what chip is, the history and technology behind it and what it means to the customer.

What could be improved:

Not much! The communication is focused on delivering one message, and we think it does so clearly and concisely.

DIRECT MAIL FROM U.S. BANK

U.S. Bank provided this brochure, which introduces chip, to its card customers:

What this communication does right:

1 – The interior headline. It’s benefit-driven and easy to understand: “More convenient. More secure. More widely accepted.”

2 – FAQs. The brochure’s copy preemptively addresses anticipated questions. This seems to be a popular way to go about disseminating the technical yet important information among a lot of issuers.

3 – Visuals! The image of the card reader builds recognition at the point of sale, and the credit card image with the call-outs are both easy to understand and helpful to those who won’t take time to read all the copy.

4 – Reinforcement of value proposition. U.S. Bank reinforces the FlexPerks value proposition toward the end of the brochure. It even reminds cardmembers of the FlexPerks Traveler photo promotion.

What could be improved:

U.S. Bank could have streamlined copy to offer more digestible – equally informative, but less overwhelming – content. Additionally, imagery could work harder to reflect the romance of travel given the communication targets travelers.

Citi E-mail sourced from Competiscan’s “This week in Credit Cards” (for the week of 4/22/13). U.S. Bank Direct Mail sourced from Competiscan.