Five Random Acts of Bank Innovation

Media Logic surveyed the financial services marketing landscape to find examples of innovative ideas from banks. Noting several interesting developments, our team has highlighted a few that represent how the sector is striving to come up with unique and differentiating solutions and products. We’ve also made note of how some innovations are more successful than others.

#1: U.S. Bank’s Contactless Payments with VITAband

In 2011, U.S. Bank launched the MasterCard® PayPass™ VITAband – a light-weight, durable wristband that combined contactless payment technology with emergency contact and medical data to bypass carrying cash and identification. VITAband met criticism from folks who didn’t see the value, were not impressed by its visual design or were wary of security issues. (Yes, in the wrong hands you could lose money out of your account, but that’s what Zero Liability is for.)

In 2011, U.S. Bank launched the MasterCard® PayPass™ VITAband – a light-weight, durable wristband that combined contactless payment technology with emergency contact and medical data to bypass carrying cash and identification. VITAband met criticism from folks who didn’t see the value, were not impressed by its visual design or were wary of security issues. (Yes, in the wrong hands you could lose money out of your account, but that’s what Zero Liability is for.)

Perhaps the next generation product design could take a more subtle branding approach and ensure messaging takes security concerns off the table. We appreciate the hands-free utility and believe athletes, moms, night-clubbers and others who want to travel light should like this, too. U.S. Bank is the first big bank to embrace VITAband, a move that may successfully encourage more consumers to embrace non-traditional payment.

#2: Barclaycard’s Rollercoaster Extreme App

We won’t debate the merits of a bank touting a free iPhone® game. We will, however, point out that the game is buried on the bank’s website and unlikely to be found by those who might appreciate it. According to the bank, the game “sees you riding the rails of eight individual rollercoaster tracks in the suburbs of New York City.” It has multiple player functionality via Bluetooth and “ghost racing that pits you against our best Rollercoaster Extreme track times.”

We won’t debate the merits of a bank touting a free iPhone® game. We will, however, point out that the game is buried on the bank’s website and unlikely to be found by those who might appreciate it. According to the bank, the game “sees you riding the rails of eight individual rollercoaster tracks in the suburbs of New York City.” It has multiple player functionality via Bluetooth and “ghost racing that pits you against our best Rollercoaster Extreme track times.”

We stopped scratching our heads only after we realized the game had been inspired by the bank’s TV ads so there is a “reason to be.” Unfortunately, the sparse iTunes® customer reviews – the majority of which are negative – suggest that Barclaycard would be better served by developing apps more strongly tied to personal finance or a timely promotion, like its recent push to sell its contactless payment product. At Media Logic we’re all for gamification and advise clients to deploy them strategically… towards products or promotions that amplify core business.

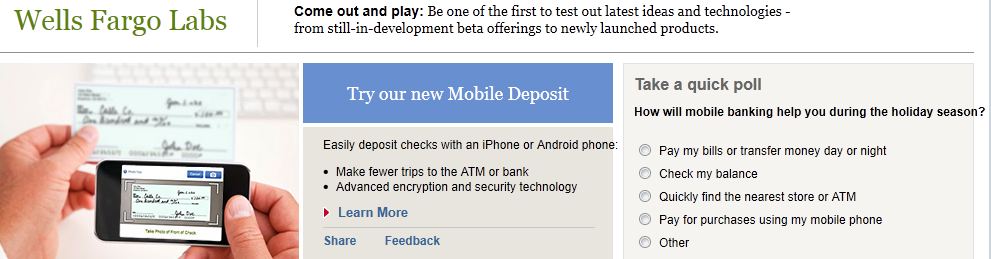

#3: Wells Fargo Labs

Sharing bank innovations with customers is not new. Amex has used a Web page to communicate beta-stage feature developments (our recent search indicates that’s sadly disappeared), and Citibank explores ideas in an Innovation Center located under a mid-town Manhattan building.

Now, Wells Fargo Bank has been inviting customers to “come out and play” at Wells Fargo Labs, a web page with a range of content allowing a customer to self-select and test new products and services, answer a poll or participate in the Wells Fargo Community. It feels inclusive and is an effective portal that gives customers the chance to be early adopters.

*

#4: Bank Audi’s Card Design Break-Throughs

The Financial Brand, an excellent website to learn about bank and credit union marketing, regularly showcases banks that are pushing the envelope. Recently, we read about Bank Audi’s Card Artist which allows for personalized card design beyond the usual options of 2×2 photo choice via a “super slick” microsite.

The Financial Brand, an excellent website to learn about bank and credit union marketing, regularly showcases banks that are pushing the envelope. Recently, we read about Bank Audi’s Card Artist which allows for personalized card design beyond the usual options of 2×2 photo choice via a “super slick” microsite.

Our recent review of Bank Audi leads us to believe that “thinking outside of the box” is part of its product development culture. The Shine MasterCard – clearly targeting women with shopping deals and beauty discounts – has a dual purpose: credit card functionality plus a handy mirror for quick touch-ups. We might dismiss this design as gimmicky except research validates that, when it comes to card design, consumers embrace off-beat and interruptive ideas. At the very least, the card design “reflects” the value proposition.

#5: Covestor’s Non-traditional Investment Model

Investment start-up Covestor allows consumers to select portfolio managers and mimic their investment moves to get the same results. It is a simple and brilliant idea that will make you say, “Why didn’t I think of that?”

Using Covestor, “You search for the Model Manager who’s best suited for your goals – we make it easy by giving you a fully-transparent window into their personal portfolios and performance. If you choose to covest with one (or more) Covestor sets up a mirroring account for you that automatically re-creates their portfolio, trade for trade. So when they make money for themselves, they make it for you too.”

Covestor is a great example of how technology is breaking down barriers. Money managers who were once only accessible to those with large investment potential are easily found online and willing to open their portfolios to the general public. You may be tempted to take a free “test drive” with $100,000 virtual dollars and 15 days of a mirroring account to see if this new model works for you.