10 Tips for Early Month on Book (EMOB) Marketing

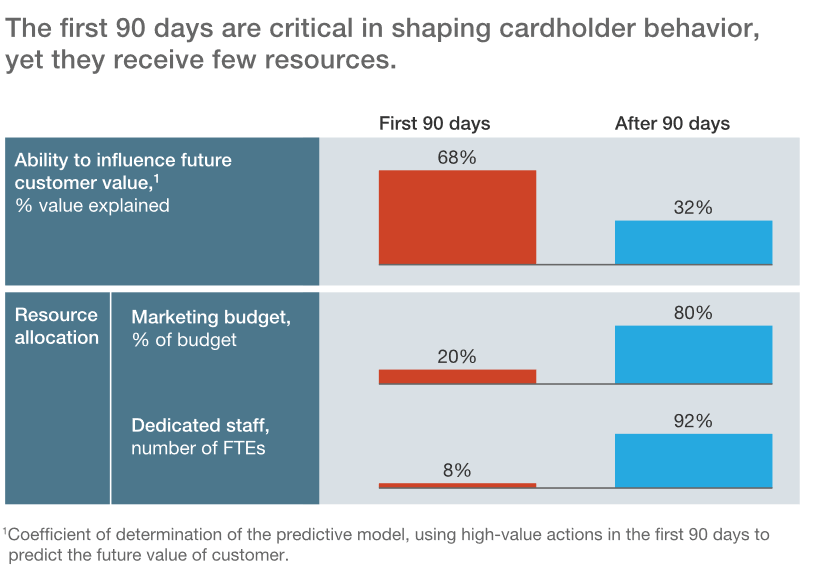

The actions cardholders take within the first three months on book set the stage for how they will behave (use their card) in the future, making it critical to get in front of new cardholders early and often to try to drive immediate activation and usage.

Still, we find that our clients – whether they are among the largest FIs or smaller credit unions – don’t have budget reserved for Early Month on Book (EMOB) marketing. Not surprisingly, a McKinsey analysis indicates that many issuers allocate only about a fifth of their marketing budgets to the first 90-day onboarding period.

Considering that the cost to acquire new cardholders is often steep, it’s worth the investment needed to turn as many new cardholders as possible into active, profitable ones. According to TMG Financial Services, cardmembers who were targeted with a 90-day EMOB messaging stream averaged 22% higher balances after the first statement cycle.

If you are an issuer without an EMOB plan and don’t know where to begin, the following are tried-and-true best practices to guide onboarding communications and get the most out of new cardholders:

- Engage early and often.

- Set a positive, welcoming tone from Day 1: Don’t skip out on a welcome message!

- For mass audiences, use email and other digital channels to keep costs down.

- For premium cards, consider a more robust welcome package with high-end production value.

- Narrowly focus content on the product’s value prop to remind cardholders why they got the card in the first place.

- Make it EASY to activate – include phone number and web site for activation multiple times so they can’t be missed.

- Use a single-focused CTA to drive card activation first and foremost.

- Save the push for sticky behaviors (sign up for online banking, add card to digital wallet, set up recurring bill pay, etc.) for future communications once the cardholder has activated.

- Don’t offer activation incentives too early. Wait for cardholders to activate voluntarily and save incentives for motivating those who don’t take immediate action on their own.

- Use a mix of channels to ensure reaching cardholders where they are and where they will pay attention.

- Use low-cost channels (i.e., email, digital) for those who are behaving as desired and invest in more expensive channels (i.e., outbound calls) to reach those who are harder to motivate.

- Continually mine data in an effort to:

- Identify inactives of high value to prioritize efforts against.

- Segment those who have activated and established early spend behavior and move them into targeted usage campaigns.

- Identify those cardholders who are not engaging and suppress.

Of course, as with any marketing effort, EMOB marketing messages and channels should be tested and refined to determine what works best for specific portfolios, demographics, etc. With a carefully crafted, strategic EMOB plan, issuers stand a better chance of becoming top of wallet with a highly engaged cardholder base. Without an EMOB plan, issuers can expect a portfolio that underperforms.