Is Your Bank Branch an Expression of Your Bank Brand?

Bank branches that focus solely on the transactional nature of business conducted there are missing an opportunity to “make the branch visit a brand experience.” That’s the headline from a recent ABA Bank Marketing article by Raja Bose. It contains several lessons about the customer experience in-branch along with action items for how to elevate a “transactional visit” to an “immersive brand experience.”

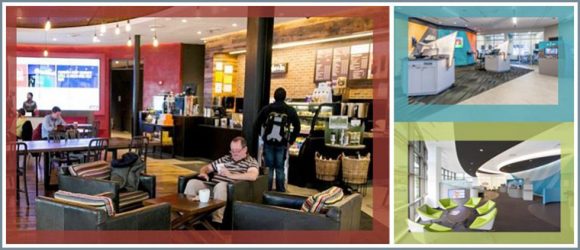

As is the case every time bank branches are discussed, there’s a need to acknowledge their changing role in the financial services ecosystem. Bose writes, “Amid the proliferation of physical and digital channels, the branch is no longer the only place to ‘bank.’ However, its impact as a visible and tangible expression of your bank’s brand is undeniable.”

He goes on to say, “[This is] an era when customers are as digitally driven as they are experience driven.” And we do know that banks and credit unions are working on both. In addition to working constantly to enhance their digital platforms, we showed in a recent post “how banks and credit Unions are using branches to build customer relationships.” That post provided 20 examples of activities that are part of the customer experience specific to branches and recommended that they stay “true to brand and in service to its customers/members.”

So what are some important steps to take to make sure these in-branch experiences also enhance the brand? Bose details five action items, which we paraphrased below:

- Integrate the digital experience into the branch by using technology to engage with customers.

- Think like a store (i.e., consider how you visually present products and services).

- Teach employees to be curators of the brand experience by helping them get excited about the brand and giving them the skills listen to customers and the tools to help.

- Provide services specific to each audience in the form of customized classes or access to relevant experts.

- Convey to customers that you “have their backs” by, as Bose says, “treating your interactions with them like relationships, not transactions,” and by incorporating customer input.

No matter how you get it done – the best approach will vary by bank/credit union – we believe making the branch a true expression of the brand is an important part of a smart marketing strategy. And Bose is on the mark with these tips; Media Logic often advises clients to do many of these same things.

We also agree with Bose when he says, “Rather than conduct a rote transaction, or push customers to buy a checking account, your marketing efforts can address customers’ needs and desires in entirely new ways, all the while underpinning the true value of your bank branch. You aren’t there just to offer a safe place for your customers’ money – you’re there to be their lifestyle enabler: to help them achieve their goals and aspirations.”

It’s no coincidence that this is the level of service customers cannot find online.