Positioning for the New Wells Fargo Bank Propel 365 American Express Credit Card

We have been following Wells Fargo Bank’s announcement of its new credit card issuing partnership with American Express for a few months now – waiting to see what the first card product looked like. Wells Fargo Bank’s pilot program began just a few weeks ago, and the first card solicitation materials are beginning to show up in market, with the promise of a national roll-out by mid-2014. The messaging and value proposition makes it clear that the new card is a relationship-based product that incrementally rewards cardholders based on the depth of their Wells Fargo Bank relationship.

The card, named Propel 365, is invitation only for now, targeting an “exclusive group of Wells Fargo customers.” With it, Wells Fargo Bank appears to be looking to build immediate cardholder loyalty and capture primary spend by awarding favorable annual relationship bonuses of 10 percent (with a DDA or savings account), 25 percent (with Wells Fargo’s’ PMA® Package) or up to 50 percent (with PMA and qualifying relationship balance of $250,000+) over the typical industry standard for reward point earning levels. It’s clear that Wells Fargo Bank is using this card product and its new partnership with American Express to dive deeper into relationships with its customers, connect, and build loyalty.

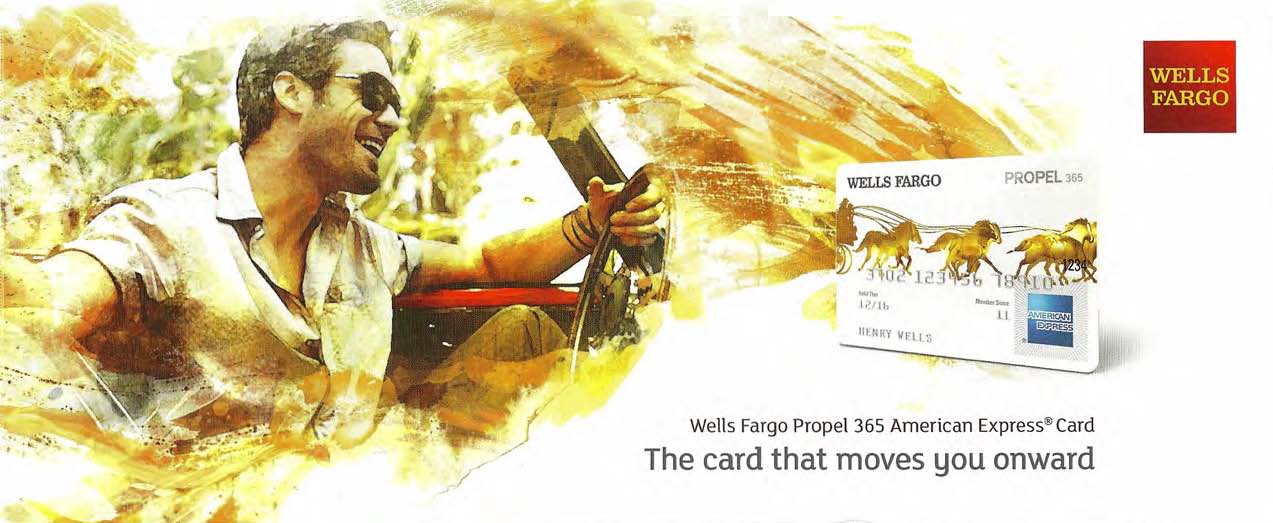

In terms of branding, bold, youthful graphics, contemporary masculine design and aspirational copy define the product and promote Propel 365 as “the card that moves you onward” to your next adventure.

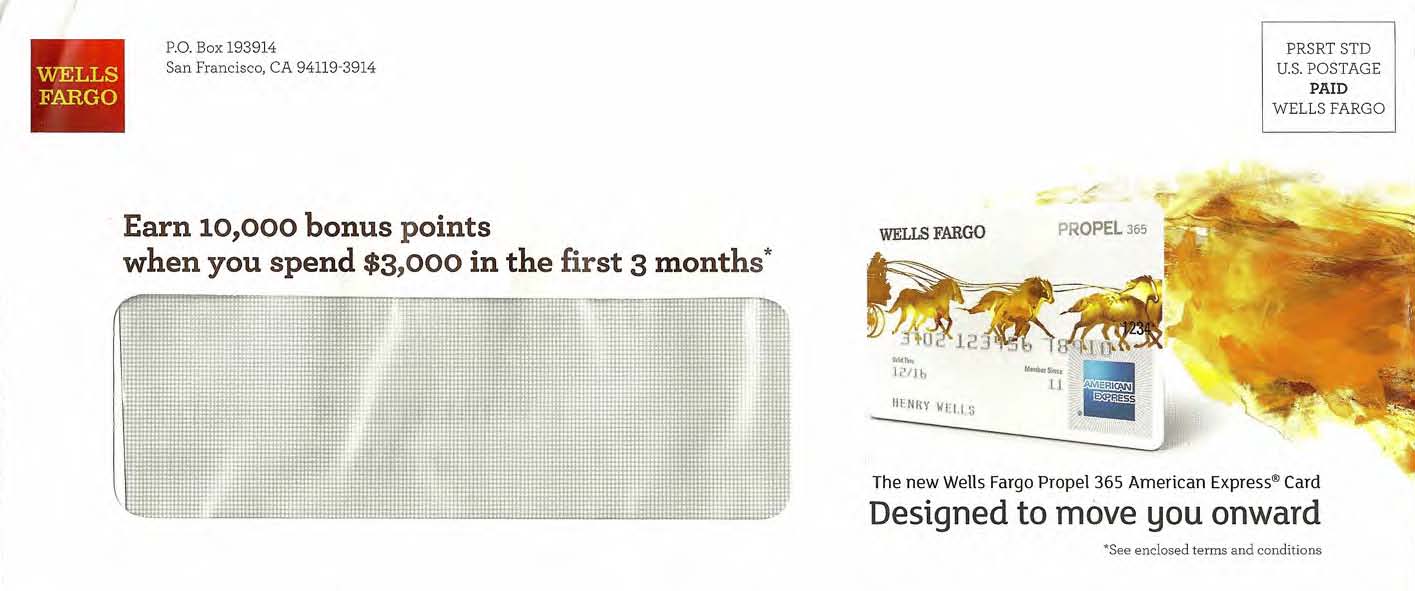

That adventure may be limited, however, given the acquisition offer’s modest initial acquisition bonus of 10,000 points (requiring a $3,000 spend within the first three months as a cardholder) and a basic earning premise of one point for each dollar spent.

While the acquisition offer is not rich, Wells Fargo Bank offers point-earning potential with accelerated earn for fuel (3x) and restaurant (2x) purchases, a 24/7 concierge, no foreign currency conversion fees… and that tasty 10, 25 or 50 percent annual relationship bonus that skews higher earning rewards toward mass affluent and affluent audiences. An annual fee of $45 kicks in after the first year. Point earning potential is unlimited, and points never expire.

Propel 365 comes with the attractive reward and travel benefits one expects from American Express, including special experiences, travel offers, event ticket pre-sale, insurance protections and redemption options (travel without blackout dates, brand-name merchandise and gift cards). Also offered is Sync from American Express, allowing Propel 365 cardholders to use their Facebook, Foursquare, TripAdvisor and Twitter accounts to link and load their cards with personalized and local offers at the places they frequent.

[Direct mail imagery sourced via Competiscan, 12/4/2013]