How Are Health Insurers Using Smart Speakers and Voice Assistants to Serve Members?

For the last few years, the Healthcare Team here at Media Logic – with help from our Emerging Media Team – has been monitoring smart speaker and voice assistant adoption trends, such as who has them, who uses them, how they’re already used and how they could be used. As such, the most recent edition of the Smart Audio Report caught our attention.

In the report, NPR and Edison Research indicate increased usage across several measures, including the frequency of use, the number of smart speakers owned and the number of devices where consumers use voice assistants. These trends present opportunities in healthcare, and some health insurers are already taking advantage of them as another means to engage members.

Smart speaker and voice assistant adoption in the U.S

First, let’s take a look at overall adoption of voice-operated devices and assistants. NPR and Edison Research report the following:

- 24% of U.S. adults own at least one smart speaker, equivalent to around 60 million people.

- 78% of smart speaker owners own an Amazon speaker, and 41% of smart speaker owners own a Google speaker.

- 63% of U.S. adults currently use a voice-operated personal assistant on any device.

- 46% of smart speaker owners who also own a smartphone say they are using the voice-operated personal assistant on their smartphone more since getting a smart speaker.

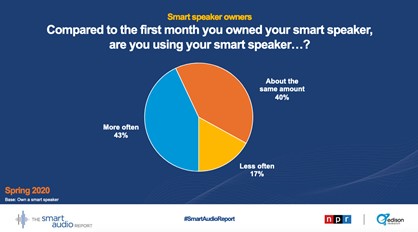

The data from NPR and Edison also show where and how adoption has increased since 2019. For example, ownership is up 13% (53 million to 60 million), and when comparing current frequency of use to the first month of ownership, 43% of respondents reported increased use.

Three examples of health plans integrating smart speakers and voice assistants

The Smart Audio Report also showed some interesting stats on the level of convenience consumers attribute to these tools: 68% say “using voice-operated personal assistants makes your life easier,” and 41% “wouldn’t want to go back to life without your voice-operated assistants.” According to the data, more and more households are finding ways to integrate smart speakers and voice assistants to make interaction with media, entertainment and brands more convenient.

As interest in the healthcare space also grows, we’re seeing exploration on both the medical side and the insurance side. Among the smart speaker innovations in medicine is the potential for health tracking, including detection of irregular heartbeats. And when it comes to health insurers, we’re seeing deployment of practical tools for granting member access to customer service and helpful information about their plans, like cost.

Here are three notable examples:

1. UPMC Health Plan launches a virtual concierge.

This goal of this new tool − available on both Amazon Alexa and Google Assistant-enabled devices − is to assist commercial plan members with some of their most frequently asked questions (FAQs) related to their benefits and coverage and how to access care and services through a verbal chatbot-style experience, reports Fierce Healthcare. They designed the tool based on a study the health plan conducted, which found that 40% of insured Pennsylvanians reported that a “smart speaker” voice assistant would better help them understand their healthcare benefits.

2. Humana announces a partnership with IBM Watson Health.

The partnership will create a solution using an AI-enabled virtual assistant connected to the IBM Watson Health. Goals of the solution are to provide accurate benefits, costs and provider information to agents, employers and plan members, reports HealthPayerIntelligence. The tool also hopes to help Humana leverage AI to reduce members’ spending by helping them predict their costs. By using historical claims data and other provider data, the tool can present a personalized healthcare cost projection for members. The service will be first available for Humana’s employer group medical and dental members.

3. Anthem launches an enhanced version of its Amazon Alexa voice assistant skill.

Anthem Skill, launched in 13 commercial markets, allows health plan members to ask Alexa for assistance with common requests. Members can schedule a call with customer service, order prescription refills or access information about their plan, including health savings account (HSA) balances and more, reports Fierce Healthcare. Anthem plans to enhance Anthem Skill based on consumer feedback.

Considerations for payers interested in launching voice assistants

Based on both consumer trends and current levels of adoption by health insurers, it’s not too soon for health insurers to start thinking about how smart speakers and voice assistants can enhance their member experience. Understanding that many insurers are new to how these tools can help them serve members, we put together four tasks you can consider as you get started.

1. Decide what you want to achieve

Smart speakers and voice assistants open up a world of possibilities to enhance member interactions with their health plans. For example, Alexa voice tools allow consumers to use the device to book urgent care appointments and to access personalized information like progress updates after surgery, prescription delivery notifications and locations of nearby urgent care centers. Our collection of Amazon Alexa Healthcare Skills can inspire some ideas.

2. Seek input from members

We know that payers are always looking for new ways to improve member engagement and make health insurance more personal. While tools like these may not be for every segment of the population within your service area, members and prospects could favor this service as a way to simplify their overall experience in navigating their coverage. The UPMC example was a good one because it showed how the plan gauged member interest in a virtual concierge service by conducting a survey of insureds in their region. Beyond member interest, ask them what type of skills they’d like a smart speaker or voice assistant to help with. Anthem continues to enhance their voice assistant skill based on consumer feedback.

3. Address member privacy concerns proactively

A survey conducted by the Pew Research Center found 54% of smart speaker users are very or somewhat concerned about the personal data collected by smart speakers. Of course, Amazon’s announcement about a HIPAA-compliant Alexa Skills Kit was a very significant milestone, making it so that developers can meet rules and requirements dictating how personal health information is shared and stored following HIPAA guidelines. In the Anthem example, their Alexa tool only pulls information from a member’s current Anthem plan, so there is no access to a backlog of data and prior coverage. The payer uses its own security options including voice ID and multifactor authentication. Given data privacy concerns and trends, as a payer considering rolling out a service like this, it’s a good idea to communicate to members the steps you are taking to protect their data.

4. Optimize for voice search

No matter what you decide, it’s important not to ignore voice search. According to PwC, 61% of adults ages 25-64 and 57% of adults ages 18-24 say they plan to use voice search more actively in the future. As more people purchase – and use – smart speakers and voice assistants, optimization becomes even more important! We recently wrote about a few best practices on optimizing for voice search. It’s a great place to start!

Want to learn more?

Medicare marketers and others looking for more data specific to older adults can watch for results from our annual Senior Media Habits Study, which is coming soon. We touch on smart speaker usage and many other topics including traditional media, digital media and social media.

If you have any questions about anything we’ve discussed, we’d love to connect! Contact Jim McDonald, head of strategic growth, at 518-940-4882.