Wells Fargo Aims to Boost Cardholder Loyalty with Updated Rewards Program

Recently, Wells Fargo Bank (WFB) introduced Go Far™ Rewards – an enhanced rewards program that spans points and cash-based reward credit cards from WFB. The program allows cardholders to enroll and gain access to new rewards, perks and program functionality.

- Redeem rewards for cash at 13,000 Wells Fargo ATMs by using an ATM or debit card. (Wells Fargo was the first major U.S. financial services provider to introduce this functionality last year.)

- Use rewards towards qualifying Wells Fargo checking or savings accounts or apply to the principal balance of certain WFB loans/lines (mortgage, home equity, credit card, personal or auto loan).

- Redeem for travel, merchandise and gift cards.

- Combine consumer and small business card rewards.

- Redeem at auctions for merchandise, concerts, shows and sporting events.

Some of the enhancements clearly will appeal to Millennials – a segment most banks are working hard to attract and satisfy. WFB makes this appeal with tone and imagery both at the program’s microsite and in its social media streams:

However, WFB’s program structure ensures that the attraction for Millennials is more than cosmetic. As explained in this video, there are several rewards options likely designed with the Millennial audience in mind. For example:

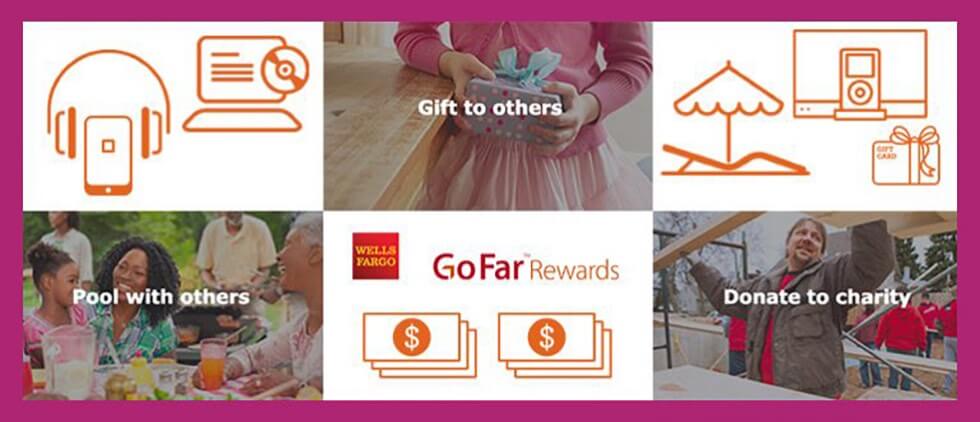

- Pool rewards with other Wells Fargo customers.

- Gift rewards to other customers.

- Donate rewards to charity via “CharityChoice” gift card.

- Redeem rewards for digital downloads of music, movies and e-books.

There are other program perks ranging from creating wish lists to earning rewards at 10,000 merchants via “Earn More Mall®” offers. Customers interested in travel rewards redeem them through an enhanced travel search engine that includes an interactive “How Far Can I Go” feature to see destination recommendations based on accumulated rewards. In addition, customers can easily access and use the site on their mobile devices, tablets or desktop computers and personalize their experience using the “Tailor Your Preferences” widget that allows them to “Love It” or “Leave It” with regard to certain categories.

Wells Fargo’s news feed suggests its perspective on the new program is that the program has been an evolution and, indeed, a good attempt at being relevant to their cardholder base. Here’s how Beverly Anderson, head of Consumer Financial Services for WFB, describes the change in a recent press release:

“Customers use their credit cards to pay for ordinary things they do every day, and we want the rewards they earn from doing that to feel extraordinary. With an emphasis on the flexibility and accessibility our customers told us they want, we spent the past few years updating our rewards program so significantly we felt it deserved a new name.”

Go Far Rewards received a grade of “A-” in the Rewards Redemption Options research conducted by Corporate Insight. This examined redemption options, flexibility, choice, site design and ease of use. Wells Fargo’s high grade is shared by only two other programs out of the 11 programs examined making the bank’s efforts look to be a smart enhancement that will pay off in loyalty.