Get Ready for the Digital Advertising Boom

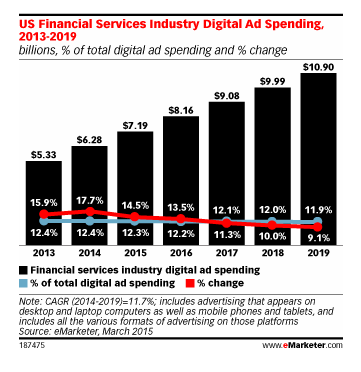

Financial services companies – banks, insurers, brokerages – invest a lot of money in direct response marketing: more than six out of 10 dollars (the latest estimate from eMarketer’s 2015 survey). And this year, digital ad spending by the category is expected to increase 14.5% to reach $7.19B (62% of the spend is categorized as direct and 38% as brand advertising).

The category investment in digital advertising is predicted to continue to grow by double digits. However, it is important to note that the category share of spend as a percent of total digital advertising spend across all categories is declining, creating increased competition for consumer mind share.

What else can we expect with the coming digital advertising boom, according to the report by eMarketer?

- Much of the growth in spending across categories will come from mobile advertising related to promoting mobile transaction platforms and customer service.

- The average consumer expects digital experiences and content across a full range of devices, including smart phones and tablets.

- For all industries – including financial services – video is and will continue to be among the fastest growing formats within digital advertising. The reason is simple: digital video is very engaging and allows a brand to tell a story.

- Digital direct marketing tactics, versus brand-related advertising, will account for the greatest percentage of overall spend. eMarketer observes display ads are now doing “double or triple duty … as the line between branding ads and direct ads is blurring.” The result: digital ads can build awareness and amplify a brand while also impacting the conversion funnel at various stages. Display ads are becoming more tightly integrated within a sequencing campaign where different formats are coupled with precision targeting to drive conversion.

- Programmatic buying will be an area of growth for financial services. This approach, aligned with how the category already relies on data driven marketing, uses an automated platform that considers multiple variables and adjusts campaign settings in real time. Marketers have the ability to display an ad on a specific website only if the correct target is browsing the site. The result: greater impressions with less spend and greater precision in targeting.

- Paid search has been an area of heavy spend and looks to keep growing.

If you are involved in marketing in the financial services category, you already know how important digital is within the mix of channels. With resources like eMarketer substantiating that digital advertising will continue to grow and take dollars from other areas, like direct mail, staying on top of digital strategies is more important than ever.

Source: “U.S. Financial Services Industry Digital Ad Spend Passes $7 Billion” (eMarketer, May 21, 2015), which cites Digital Ad Spending Benchmarks by Industry: The Complete eMarketer Series for 2015 (Executive Summary, May 2015).