Affluent Spending Trends: Purchase Categories and Digital Habits

Ipsos recently released 2013 affluent survey results that included insights into affluent spending habits. The survey focused on affluent adults: those over age 18 living in households with at least $100K in annual income. By the Ipsos definition, there are 62 million U.S. affluents, a segment that’s grown by six percent since 2010. And compared to 2012, average income grew, as well – up 4.6 percent to $200k – while average net worth grew two percent to $1.01 million.

The survey also looked at overall purchasing behavior. Affluents spent $1.5 trillion in 2013, and 80 percent of those purchases fell into eight broad categories: automotive (18 percent of total), personal insurance (11 percent), home and garden (11 percent), education (10 percent), groceries, travel, apparel and electronic purchases.

Trending: Spend behavior through electronic devices

A good portion of purchasing dollars were spent by affluents through online payments – a trend that will continue to grow along with the increased penetration of smartphones and tablets.

Virtually all affluents use the internet (over 99 percent) and each week average 41.6 hours online. Millennial affluents averaged 52.7 hours online per week. Several categories of websites – entertainment, shopping, travel and social media – showed significant growth in affluent visitors.

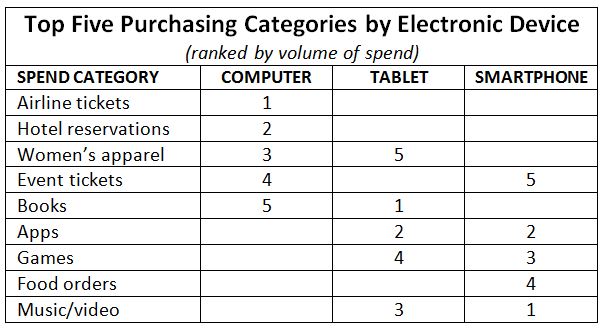

Ipsos took a deeper look into the types of purchases made with electronic devices:

Of course, these habits have implications for both merchants and payment providers:

- There will be increased competition among merchants due to the shift in the way affluents shop and purchase (as digital spending increases across platforms).

- E-commerce and m-commerce shopping will put additional pressure on card issuers to offer services that enhance online shopping with their credit and debit payment products… no matter what the digital interface.

- Issuers face the challenge of holding onto digital transactions versus having their customers turn to new entrants to the payment space or explore new ways of paying.

- Online security concerns will only increase. Issuers will need to not only heighten their secure shopping features and services but also figure out the best ways to communicate and differentiate their security features from other payment choices.

Data cited from the 2013 Ipsos Affluent Survey USA, September 2013.