How Co-Brand Travel Cards Can Navigate the COVID-19 Downturn

The dramatic and sudden downturn in the U.S. economy has inevitably led to less spending on credit cards. While consumers still need the essentials like groceries (including toilet paper), most will be refraining from “leisure” purchases for some time. In late April, as Discover’s CEO reported, “Everyday sales are down 14%… discretionary spend is down 33% driven by the travel category, which… is down 99%.”

This puts marketers of co-brand travel credit cards in a very difficult situation. The economy is in recession, discretionary spending is down and the travel industry is effectively on ice. (Flight cancellations are up, and hotel bookings are down.) Adding to that, we’ve noted the (pre-COVID-19) industry trend toward “general purpose” travel cards not tied to any one co-brand.

These travel brands and their issuing partners need to think broadly about how to sustain spending on co-brand travel cards during COVID and add new cardholders. We’ve already seen some new solutions from these brands and observed some interesting promotions from non-co-brand cards that these marketers could apply.

Focus on portfolio first

It’s a truism no matter what the situation: it is easier and less expensive to keep an existing customer than to bring on a new one. And so it make sense to focus on these customers first.

Many co-brand travel cards have spent the last few years revising their value propositions to offer bonus points for everyday spending. For example, Hyatt, Hilton, IHG, Delta, American Airlines and United have all recently added bonus points/mile on restaurant and/or grocery stores as part of their core value props. It may be worth reminding existing cardholders about these bonuses, because many get the card for the bonus offer and may not think of an airline or hotel card as the one to reach for at the grocery store.

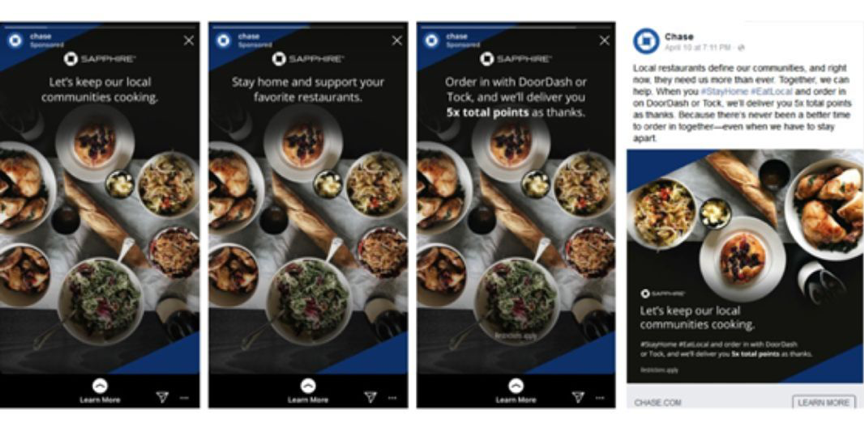

Marketers of co-brand travel cards can also consider “spend and get” offers in spending categories that are more relevant during the COVID-19 pandemic. Chase, for instance, is promoting bonus points for spending on food delivery and streaming services.1

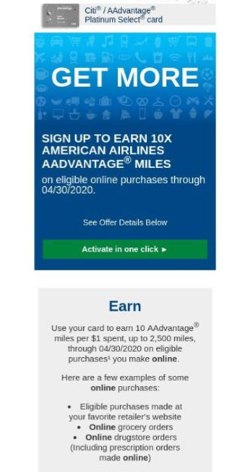

Citi is offering 10X points for online purchases (with specific mention of online grocery stores).1

And while this example from the World of Hyatt Card likely pre-dates the pandemic based on the categories highlighted (home improvements and sporting equipment are likely not top of mind these days), the messaging speaks to future travel planning, instead of immediate use.2

Don’t forget about acquisition

Although we have not seen hard data yet, it’s highly likely that there will be a drop off in direct mail volume in the coming months. A quick review of creative samples from Mintel leads us to believe that travel co-brand cards had already planned drops for March and April. We could not find DM creative examples that mentioned the crisis during this time, which makes sense as DM is planned and printed well in advance of being mailed.

But what about the new cardholders who applied just before the crisis hit?

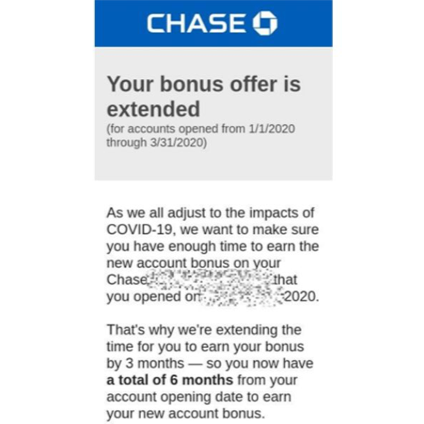

American Express and Chase are already extending the timing on bonus point offers. And while we’re not sure that this applies to co-brand travel cards, is a good bet that they are doing it for all customers.1

Co-brand travel cards should also acknowledge and embrace that these are not normal times. A quick review of credit card landing pages for major airlines and hotels in early May shows that only one, Delta SkyMiles, actually mentions the situation. It’s worth noting that Delta very recently relaunched the SkyMiles cards, so it is in the midst of a crisis while trying to mount a launch acquisition plan.

While direct mail campaigns take time to impact, email acquisition has a much faster turnaround. This acquisition email from Southwest Airlines appears to promote their control offer, but contains a mention of COVID-19 and a subject line that explicitly encourages saving bonus points.

And this Hilton email moves that message into to email itself.

Hilton also has an email that make a more forceful rate play.2

It’s true that co-brand cards do not always tout a 0% APR on purchases, but it may be appealing to an audience that needs a temporary reprieve due to unemployment and furloughs.

This is an evolving landscape, and co-brand travel card marketers will need to test and learn what works in the new environment. One advantage they have is data on existing customers and even prospects. Targeting will be a key factor of ensuring that these marketers connect with the right audience at the right time.

///

1 Credit Cards Step Up Their COVID-19 Response. Comperemedia. April 2020.

2 Mintel Comperemedia, April 2020