Citibank “Reimagines” Customer Experience at the ATM

Financial services companies always look for ways to enhance their customers’ experience of their brands, and in the case of banks, this requires ongoing upgrades to branches and ATMs. Last year, we wrote about Chase’s next-generation ATMs designed to better serve that bank’s affluent customers. And now, Citibank has developed new ATMs with a number of new – and sometimes customizable – options.

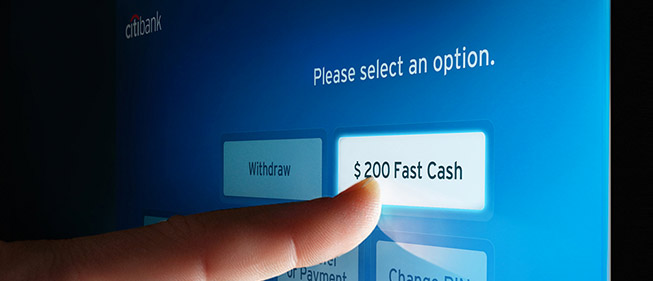

As reported in BusinessWire, Citibank’s new ATMS will “remember customer preferences and reduce the time customers spend to check balances, make deposits and withdraw cash.” The new machines will roll out by the end of February, and according to direct mail sourced from Competiscan, the “new ATMs at Citibank branches will feature time-savers and easy options.” These include:

- customizable – and savable – transaction options;

- language preference;

- “one-touch” balances available without leaving the screen;

- the ability to transfer money to other Citibank accounts in the U.S. and abroad (20 countries);

- bill-pay for credit cards, mortgages and other loans; and

- the choice to receive the receipt via email.

BusinessWire quotes Citi’s Consumer and Commercial Banking President Cece Stewart as saying, “We have reimagined the ATM experience.” In a marketplace with great competition not only from other financial institutions but also a barrage of alternative payment methods, the customer experience must be enough (fast enough, easy enough, effective enough, etc.) to encourage brand loyalty at every front… including the ATM.

When Citibank first introduced ATMs in the 1970s, it was enough that the machines dispensed cash 24/7. Then it was the big, new thing and fulfilled the brand’s slogan: “The Citi never sleeps.” But today, as cash becomes less necessary in daily transactions, financial services companies are smart to provide additional services at their ATMs.

Branches and ATMs remain important points of customer contact for banks, and Citi’s reputation for innovation comes from initiatives just like this one. Citibank’s flagship branch in Union Square, for example, has been called an “Apple-like store.” With Union Square and other “Smart Banking” locations, Citi attempted to infuse the banking environment with a retail-like experience. And now they are extending that retail-like experience to their ATMs with features like emailed receipts, an option many retailers offer at POS today.

Citibank’s new ATM concept also seems to bring together some of the best online and mobile conveniences. The effort demonstrates that the bank continues to improve its customer experience with successful practices from many facets of the service world, whether it’s brick-and-mortar retail environments or virtual/digital work flows.