U.S. Bank Rewards SBOs for the Swipes They Make and Take

Credit card rewards tailored to small business owners are nothing new. Many issuers have small business payment products that include usage incentives to encourage spend on the cards. But we recently noticed that one major issuer is now offering incentives for businesses to accept credit cards from their customers.

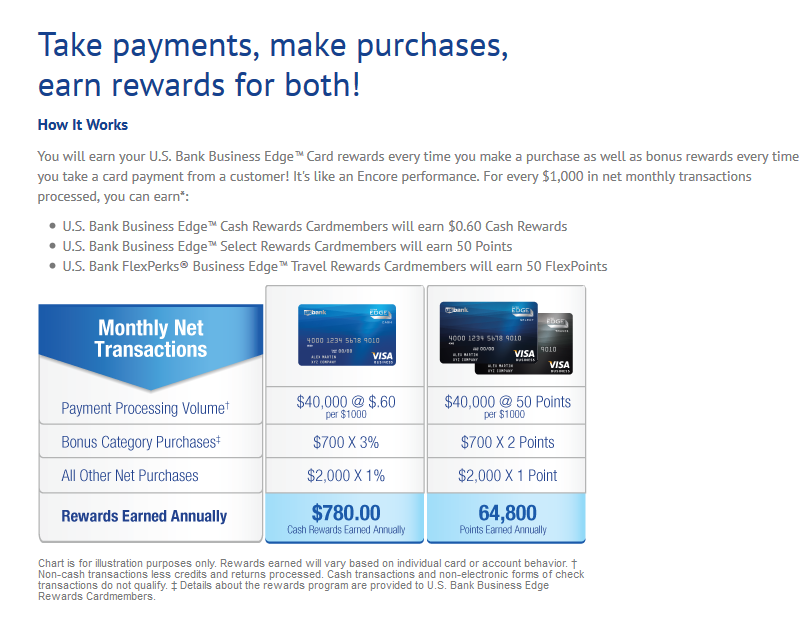

Earlier this year U.S. Bank launched a line of payment products for small business owners called Edge. The Edge products include both points-based and cashback rewards credit cards that give SBOs something back when they use their cards. And now U.S. Bank has rolled out Encore, which also rewards SBOs for the payments they receive from customers. Here’s how it works:

- business owners earn rewards every time a customer makes a purchase with an eligible Edge card;

- they also receive bonus rewards every time they process a card payment from a customer;

- for every $1,000 in net monthly transactions processed, they earn either $0.60 back or 50 points; and

- those rewards are added to their points or cashback earned when they use their card.

Why would U.S. Bank give incentives to merchants who not only use their card, but also accept cards from their customers? We can think of three good reasons:

1. Capture part of a wide-open market

According to a 2012 survey by Intuit, 55 percent of the nation’s 27 million small businesses do not accept credit card payments. Intuit estimated that these businesses were missing out on $100 billion in annual sales. Even a small percentage of a number that big could have a large impact on the bottom line, so why not give SBOs an incentive to make the switch and start accepting cards?

2. Compete with mobile readers

New players like Square, Intuit and even Amazon have entered the card processing market with mobile payment readers that circumvent the need to for a “traditional” countertop card reader. And as we observed last year, some FIs have rolled out mobile readers of their own to stake a claim in mobile processing. While the mobile readers have different fee structures, and some (like Capital One Spark Pay) offer sign-up incentives, none have ongoing rewards programs. This gives U.S. Bank an opening to compete with these emerging systems.

3.Combat merchant resistance

So why is it that 55 percent of small businesses don’t accept cards? Some don’t want the hassle, preferring to stay cash only, and others have a perception that they will be bogged down with high fees. By offering a rewards incentive, U.S. Bank is putting some skin in the game and showing SBOs that they aren’t just out for the interchange — they are also giving something back.

Encore is very new, so it’s hard to know what the longer-term impact of this product will be. Other issuers may jump in and develop similar products, or some of the mobile reader options could add rewards to provide an additional incentive.

There is one very obvious impact for U.S. Bank in the near-term: they now have a very strong product bundle to offer SBOs. It will be interesting to see how Encore is marketed in the next few weeks. The obvious first step is for U.S. Bank to cross-sell Encore to their existing Edge cardholders and possibly cross-sell the bundled of products to their business banking customers. The bank has a huge opportunity to show SBOs that they have a complete suite of business products to meet their needs.