Parting the Sea of Sameness for Medicare Audiences

Year after year, Medicare marketers focus key messaging on price and network options. And while these are the Medicare audience’s primary criteria for shopping around, it’s important not to overlook the value that comes with offering and marketing unique plan add-ons. In a competitive market, exploring ways to deliver added savings, engage with members and leverage partnerships is a practical approach for enriching your plan’s value and making your product stand out from the crowd.

We took a look through this year’s Medicare AEP creative captured by Competiscan to compile a list of this year’s more unique product offerings and add-ons. Here’s what we found:

Member Discounts and Rewards

Some of the most notable features offered by health insurers included discounts, rebates and allowances on premiums, copays and pharmacy expenses.

- AARP/UnitedHealthcare: $2 off monthly premium with autopay from bank account

- AARP/UnitedHealthcare: 30% discount on supplemental premiums for the first year (with additional annual savings over 10-year discount period)

- Alignment Health Plan: $50 rebate each month on Medicare Part B premiums

- Humana: $50 OTC quarterly medication allowance for mail order pharmacy

- Independence: $0 copays on diabetes test strips

Access Add-Ons

For the Medicare audience, options that simplify access to necessary appointments and services are an effective way to address the target audience’s needs. These insurers acknowledged that and offered innovative features that support those needs and reduce barriers to access:

- Blue Care Network of Michigan: Transportation to medical appointments

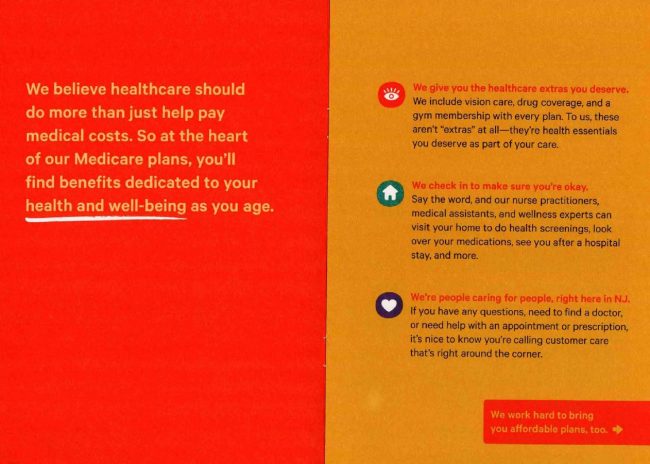

- Clover: In-home health screenings, post-hospital stay check-ins and more from nurse practitioners, medical assistants and wellness experts

- Humana: Meal delivery after hospital stays

Price and network will continue to be the primary criteria consumers will use to shop for Medicare plans. However, these unique product add-ons offer compelling messaging opportunities, a way to grab the attention of consumers in a sea of sameness. Keeping your target audience and their needs in minds by infusing plans with relevant benefits, features and rewards can lend to increased brand affinity and loyalty.

*Direct mail communications (screenshots) sourced from Competiscan, a full-service, competitive intelligence market research firm. Competiscan enables clients to study marketing and loyalty strategies by industry, company, product or recipient demographic. Media channels tracked include direct mail, email, online display, social media and print. Competiscan clients utilize a web-based search facility to understand what consumers, business owners, financial advisors and insurance producers are viewing in the marketplace.