Will Merchant-Funded Offers Trump Generic Deal Sites and Apps?

Consumers like to save money. And while the coupon culture — including discount codes and social promotions — has been surging over the last couple of years, some fairly significant frustrations continue to limit the appeal of the deals: they’re either a hassle to redeem or they simply aren’t relevant. Deal sites and mobile apps have tried to capture consumer preferences and tap relevance (with data points like location, for example), but often the offer and its utility remain disconnected… which can mean the transaction never takes place.

Consumers like to save money. And while the coupon culture — including discount codes and social promotions — has been surging over the last couple of years, some fairly significant frustrations continue to limit the appeal of the deals: they’re either a hassle to redeem or they simply aren’t relevant. Deal sites and mobile apps have tried to capture consumer preferences and tap relevance (with data points like location, for example), but often the offer and its utility remain disconnected… which can mean the transaction never takes place.

This failure represents an area of opportunity for banks and financial institutions, who have access to volumes of valuable – and very personal – data, along with years of experience with customer loyalty programs, like rewards. For these financial services companies, evolving technologies not only help them improve their own rewards programs but also position them as potential competitors to leaders in the deals space… even versus the big guys, like Groupon.

For financial services companies, consumer demand for convenient (this can mean “instant” or “nearly zero effort required”) deals couldn’t come at a better time. Restrictions on interchange fees charged to merchants for debit card swipes create losses in the billions for card providers. Forced to switch strategies in an effort to recoup some of the revenue, card issuers are developing new product constructs and beefing up rewards programs, including merchant-funded offers.

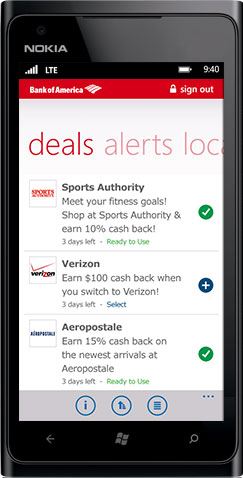

Bank of America partners with a vendor, Cardlytics, on BankAmeriDeals. Other issuers have similar partnerships; for example, Citi works with Truaxis to provide its personalized deals. To bolster its merchant-funded offers, J.P. Morgan purchased Bloomspot, a daily deals competitor to Groupon.

For consumers, these merchant-funded offers mimic familiar reward programs they’re used to receiving from their credit card companies or digital deals they’re used to seeing online or via mobile apps. But what’s in it for merchants? In traditional reward programs, the credit card issuer funded the perks and anticipated (and counted on) “breakage:” the percentage of consumers who would not take advantage of the offer.

In the new merchant-funded model, the merchant foots the bill for the discounts, and the goal is for the consumer to cash-in, not ignore, the offer. Since banks and credit card companies know where consumers shop and what they buy, they are uniquely positioned to personalize offers.

This contributes relevance for consumers and adds value for merchants because prospects can be highly targeted: the more likely a consumer is to access an offer, the more likely the merchant is to earn a transaction and gain (or retain) a customer. And although the merchant funds the offer, it is so targeted that its efficiency and cost-effectiveness is tough to beat through other marketing vehicles.

Will These Merchant-Funded Offers Trump Generic Deal Sites and Apps?

If issuers win because they recoup some losses from reduced interchange fees, and merchants win because they have highly focused marketing opportunities, and consumers win because the offers are a breeze to redeem, are there any losers? Perhaps the daily deals sites and mobile apps. It’s difficult for them to compete with banks because they lack the scale of customers and have considerably less spending data.

The big advantage banks have is frequent usage, along with the ability to see spend in all merchant categories (merchants only see their own transactional data). Customers habitually log-in to banking sites or bank apps to check balances and pay bills, and every log-in gives the bank an opportunity to promote a merchant deal. Compare that with Groupon where customers have only one reason to log-in or use the app. If they forget or are uninterested in the limited offer, they quickly move on.

Daily deal sites introduced a new way to think about discounts and rewards, but the issuers have the best opportunity to use the approach to reach a much broader audience with more relevant offers.