Cashiers Are the Key to an Effective EMV Chip Card Transition

If you were unfortunate enough to have taken part in holiday shopping this past November and December, you probably encountered longer lines as customers were introduced to the new EMV chip reading machines.

While the long-awaited transition to EMV chip cards is taking shape, one thing is immediately clear: customers are not aware how to use their new chip-enabled cards in the new readers, and it is falling on the cashiers to educate them.

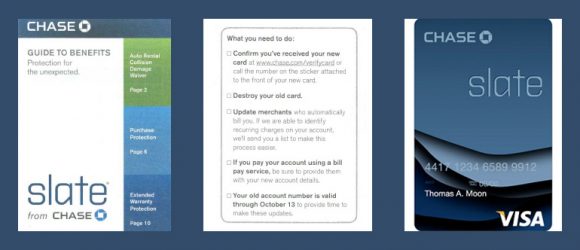

While many financial institutions issued educational pieces along with the new EMV chip cards, most customers didn’t read them. This is evidenced by a recent survey conducted by Stax, Inc., which found only 15% of customers felt their education came through their banks. Instead, 33% were taught by retailers and 28% were “self-taught.”

In many ways, this makes perfect sense. There isn’t a one-size-fits-all tutorial for using chip-enabled cards at checkout. Different retailers have different types of card readers. Target, Walgreens and Costco, for example, have readers that require chip + PIN while some retailers require chip + signature. Still others have the machines installed, but the EMV readers are not active.

As a result, the introduction of a new payment method has fallen squarely on the shoulders of the cashier. They must be trained to identify EMV chip cards and then teach already rushed customers how to use them. For many retail employees, this is a set of skills that goes beyond their typical job descriptions, particularly if they are seasonal employees. But the training effort is worth it. The better educated and prepared cashiers are, the more pleasant and seamless the transition to chip-enabled readers will be for the customer. And happy customers become repeat customers.

From personal experience, I can say Target cashiers have been very effectively trained. They patiently explain how the chip-reader works, how to insert the card and how to wait for a prompt before removing the card. They also are adept at explaining to frustrated customers the benefits of using the chip-reader. Standing in line, I saw many customers struggle with their first time, but not a single transaction ended badly.

Even more importantly, later trips to Target (I probably shop at Target too much) revealed that customers were using the new machines easily and without a single prompt from the cashier.

According to the research, 75% of consumers surveyed believe that EMV chip cards are more secure than both mobile payments and magnetic strip transactions. And 64% think that the transition to EMV chip-readers is a good thing in the long run.

The key is the cashier. This makes educating retailers at this level an important priority and one that financial services should see as a huge opportunity.