Can Pinterest Showcase the Lighter Side of Financial Services?

Few things are more serious than financial transactions. All of them – from point of sale purchases to million dollar investments – involve sensitive, personal data and impact (positively or negatively) a person or company’s financial well-being. As a result, of course, financial services companies are strictly regulated: they bear heavy burdens, such as privacy and security.

Few things are more serious than financial transactions. All of them – from point of sale purchases to million dollar investments – involve sensitive, personal data and impact (positively or negatively) a person or company’s financial well-being. As a result, of course, financial services companies are strictly regulated: they bear heavy burdens, such as privacy and security.

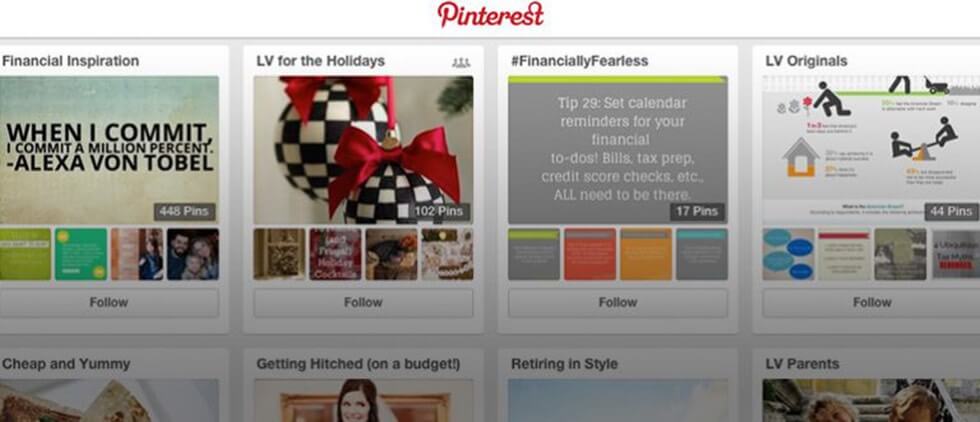

It seems to make sense, then, that banks, insurers and financial advisors have largely ignored Pinterest. Presumed to be one of the “fluffier” social media platforms, the site is best known as a social scrapbooking site where users trade recipes, craft projects, home décor tips and fashion statements. However, is this a missed opportunity? Can Pinterest showcase the lighter side of financial services? At least a few financial advisors are giving it a try, according to a recent article circulated by Reuters. Transition Financial Advisors Group, Betterment and LearnVest are on Pinterest, for example, with varying levels of success.

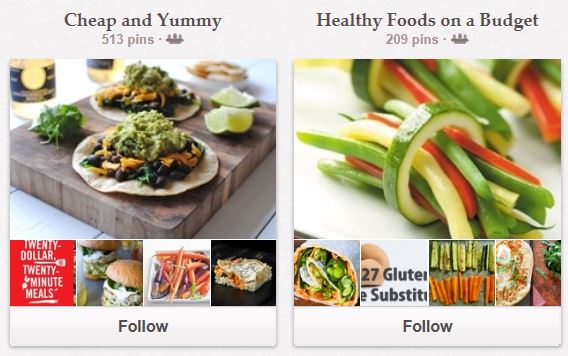

LearnVest, which is the most successful and has been on Pinterest longer than the others, has over 4,700 followers and 23 boards. Its secret? It stays true to Pinterest culture – sticking with inspiration for food, projects and personal style – but adding a financial spin where possible, as with its food boards: “Cheap and Yummy” and “Healthy Foods on a Budget.” Mixed in are a few boards on good financial health. These boards – “Live Richly” and “Financial Vision Board” – focus on inspiration, instead of advice. And for fun? LearnVest has a board dedicated to piggy banks.

So is there a role for Pinterest in financial services marketing? The lesson for financial services companies is to think beyond the nuts and bolts of products and services and consider the lifestyles of your customers. A platform like Pinterest is a lively, visual way to make a personal connection and associate your brand with some of the ways consumers can take charge of their pocketbooks… and get excited about their financial health.