Chase Freedom Mobile App Offers Rewards Redemption at Point of Sale

At Media Logic, we’re credit card rewards program junkies. We love watching card issuers roll out new ways to structure and promote their rewards.

Here are a couple of past examples from our blog: Citi’s Double Cash Card and the Orbitz Rewards Visa. For its Double Cash Card, Citi changed the rewards structure; customers earned points not only on purchases but also on payments toward their card balances. And in terms of promoting rewards programs, the co-branded Orbitz card used a rewards calculator to pitch prospects its card over competitor cards by asking them about travel expenses. When prospects entered their estimates in the calculator, the brand showed them its rewards compared to other programs.

But as much as we enjoy reward structure and promotion, one of our favorite things is seeing how card issuers use technology to make reward redemption easier and more fun for their customers. Of course one of the biggest developments came in 2014 when American Express moved redemption toward instant gratification – the physical point of sale – allowing cardholders to pay in the moment for everyday transactions (like Uber rides) with their rewards.

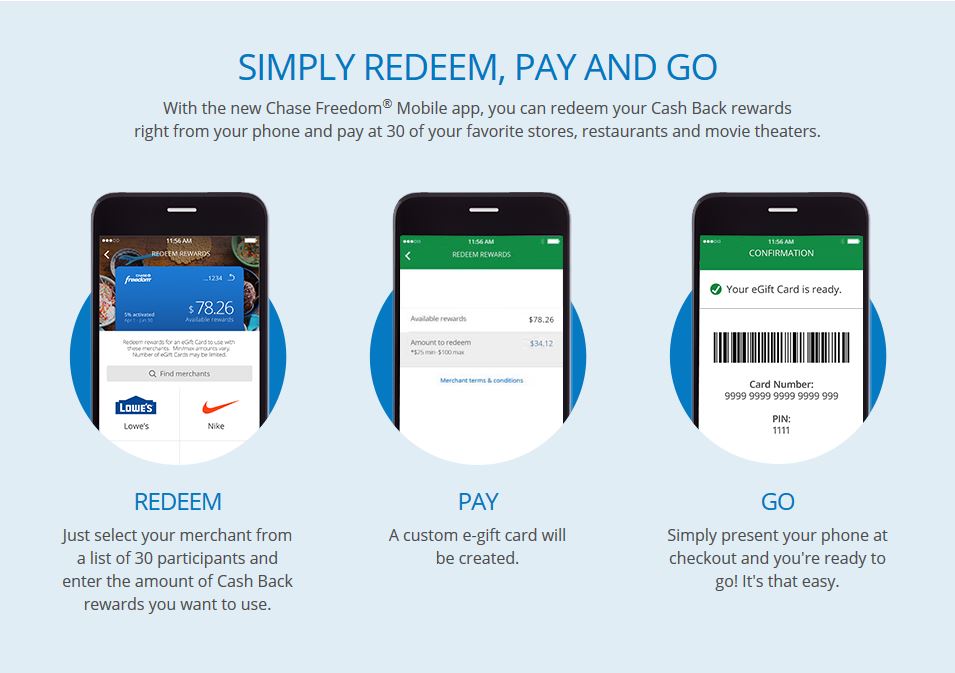

Via its Chase Freedom mobile app, Chase has joined Amex in the instant gratification realm. Chase Freedom mobile app users simply go shopping with a participating retailer, log into the mobile app, select “redeem rewards” and indicate how many rewards they’d like to use. The app generates a bar code (mobile e-card) specific to that merchant for the customer to use at check-out.

Here’s how Chase depicts the process on a landing page about “on the go” cash back:

Chase (along with Amex) is onto something here. The redemption of rewards is easily the most important part of any loyalty program. Earning rewards can be passive, but redeeming them is a point of engagement between customers and brand. And when the process is satisfying for customers? It’s proven to be the best way to sustain interest in the rewards program… and the card.

Banks used to be interested in the short-term payoff of breakage, but they have since learned that breakage also represents lack of interest. Therefore, anything that makes redemption more enticing (right now this means “easier,” “automatic” and “top-of-mind”) has a better, long-term payoff. Happy, engaged customers are more likely to stick with their current cards and not be tempted by competitors’ rewards programs.

*Shout-out to Bank Innovation where we first learned about Chase mobile e-card reward redemption.