Like a Good Neighbor, State Farm to Offer Health Insurance

State Farm’s marketing team has done an excellent job of conveying the brand identity via its messaging. In addition to easily recognizing the insurer’s jingle – “like a good neighbor, State Farm is there” – consumers identify the brand by its “discount double check” and the magical way agents can pop in and save the day. The takeaway messages there? State Farm is connected with the (very valuable) ideas of savings and protection. Based on materials already in-market, it looks like the brand will leverage both as it enters the healthcare industry via partnerships with Assurant and Blue Cross Blue Shield (BCBS).

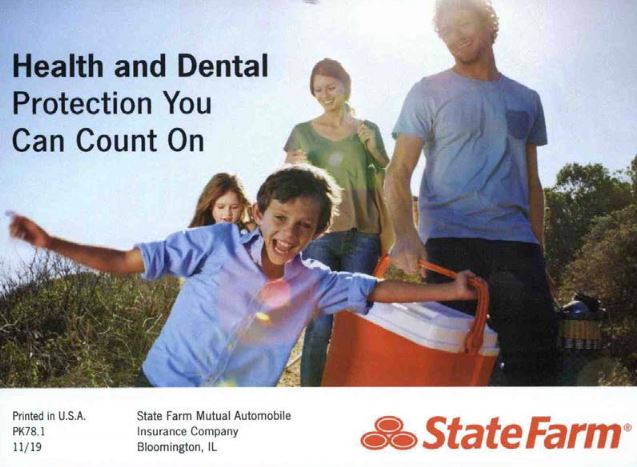

For example, this postcard captured by the market research firm Competiscan,* leads with “protection” on the card front and addresses “affordability” on the card back:

There’s no doubt State Farm knows how to market and sell insurance, but healthcare marketing and sales, by nature, involves greater emotion. And the stakes are higher: cars can be replaced; people can’t. Are consumers ready to buy health insurance products from the same company that covers their homes?

State Farm is betting they are. And it’s leading its effort not only with messaging about savings and protection, but also attempting to pitch to consumers that it makes sense for them to shop for all their insurance needs in one place. For example, State Farm’s health insurance web presence states prominently, “You buy health insurance plans for the same reason you buy other types of insurance – to protect your family.”

It could be also argued that State Farm agents will have to increase their expertise to be a credible sales force for something as complex as health insurance. While it’s a logical extension for State Farm (“You buy health insurance plans for the same reason you buy other types of insurance”), life and auto insurance are very different from health plans. And although you can be sure both State Farm and its health plan partners are providing appropriate training, that’s still a few steps removed from convincing consumers the company is the right source to manage their healthcare.

Either way, beginning with this open enrollment season, State Farm will be using its general sales agents to sell health insurance nationwide through Assurant, except in five states (Illinois, Montana, New Mexico, Oklahoma and Texas) where it will sell health plans exclusively through BCBS. According to the company’s press release, “State Farm agents will market health insurance both on and off the Affordable Care Act health insurance exchanges. Through exchanges, consumers who are eligible for financial assistance can shop and obtain help in paying premiums. … Plans will be available in every zip code of each state.”

In addition to commissions on individual and family products, State Farm stands to benefit from an expanded brand identity. With more and more individuals buying health insurance directly, State Farm wants to have products in its line-up that meet this need. From a State Farm agent, consumers can secure not only auto, home and life insurance products – which they purchase hoping never to need – but also products consumers rely on month to month and year to year such as financial products, like loans and checking accounts, and, now, healthcare. It changes how – and how often – consumers tap their local agent and storefront.

It may be those exact storefronts – and those agents already familiar to and trusted by consumers – that seem so attractive to health plans. For example, although Assurant is an $8.3B company, it is a relatively small player in the health insurance space, and it lacks consumer brand recognition – something it could gain by affiliation with State Farm.

Synergy exists also between State Farm and Health Care Services Corporation (HCSC), which operates BCBS plans in the five states where State Farm will be selling them. Jeff Welch, HCSC’s vice president of retail markets, told Crain’s Chicago Business that HCSC was “leveraging an agent field force … to broaden our reach into areas that we may not have gotten into before.” And in a piece in the Chicago Tribune, Welch also indicated that BCBS anticipates most initial health plan sales to be outside the marketplaces. “But as time goes on,” he says, “I expect we’ll start seeing more and more on-exchange members who are subsidy-eligible coming through because of the storefront perspective.”

Even though they may have hills to climb convincing healthcare consumers to shop with them, these partnerships and branding strategies are among many interesting evolutions happening in the healthcare industry. Last week, Walmart announced an agreement with DirectHealth.com, a health plan comparison website, to provide insurance agents in Walmart stores. And last month, of course, to better reflect its purpose of expanding into healthcare services, CVS launched its new brand identity: CVS Health.

And since we already know that last year’s enrollment was confusing for consumers and left them feeling anxious, the market is ripe for companies like State Farm and Walmart to step in and offer assistance with the process. “Relax,” urges the State Farm web page for individual medical insurance. “Talk to us,” it continues. And a few lines down the page, this: “State Farm …. offers … 175 years of quality service and products.”

Although Walmart may not enjoy the same reputation as State Farm (for example, at the same time its partnership with DirectHealth.com was in the news, headlines were also announcing the company’s plan to end health insurance for some of its part-time employees), both entrants represent an evolving distribution model for individual health insurance. And both signal greater competition for payers, which are getting more aggressive – and creative – with their approaches. As the field gets more and more crowded, not necessarily with new products but with new paths to purchase, payers have an opportunity to think of their own co-branding and co-marketing strategies.

*Competiscan is a full-service, competitive intelligence market research firm that enables clients to study marketing and loyalty strategies by industry, company, product or recipient demographic. Media channels tracked include direct mail, email, online display, social media and print.