Can Bank Branches Continue to Deliver Value to Financial Services Customers?

It’s been a long time since the ATM did its part in disrupting the bank branch, and it’s been quite a while since online banking took its shot. We’re now well into the era of mobile banking, and yes, as a direct result, the role of the traditional retail branch continues to be a hot topic for discussion. You’ve heard the proclamations: They’re opening. They’re closing. They’re evolving. They’re relics that are soon to be extinct!

Whatever your assessment, branches – for the moment at least – still perform important functions as part of financial institutions’ marketing and customer service efforts. It’s also true that nearly all banks are engaged in ongoing soul-searching (we mean strategizing, of course) about what value their branches can deliver to their customers… and to the banks’ bottom lines.

Community Bank Insight (CBInsight) published an article recently that asked, “How do branches maintain their relevance in an increasingly technological age?” The author, John Hyche, then positioned the future bank branch as part of a “hub-and-spoke relationship.”

Although the majority of new banking relationships begin at the branch, service preferences vary after that. Driven by convenience, customers utilize the banks’ channels – physical, automated and virtual – in a combination that works for them. The bank must ensure a “flexible, consistent customer experience,” says Hyche, and the branch “establishes customer expectations and represents the institution’s image in the market.” Specifically,

Ultimately, the branch will serve as a location for financial education and advice. The branch must emphasize personal service, and delivery methods will emphasize connection with customers. Community bank personnel will literally be a handshake away from their customers. Further, the environment must communicate the products, services and benefits offered by the institution. It also will showcase a variety of technologies so that once a customer is on-boarded, they will have a great understanding of the variety of ways they can interact with their community bank.

Hyche predicts that the format of the branches themselves will respond to customer habits, while still meeting the business and branding goals of the financial institution. They’ll utilize flagship stores in some markets (what he calls “cornerstone” branches) to make a statement. Then, based on traffic and need, satellite branches will be sized accordingly: “community branches,” similar to cornerstones only smaller; “micro branches,” transaction-specific and technology heavy; and “self-service branches,” which are fully-automated.

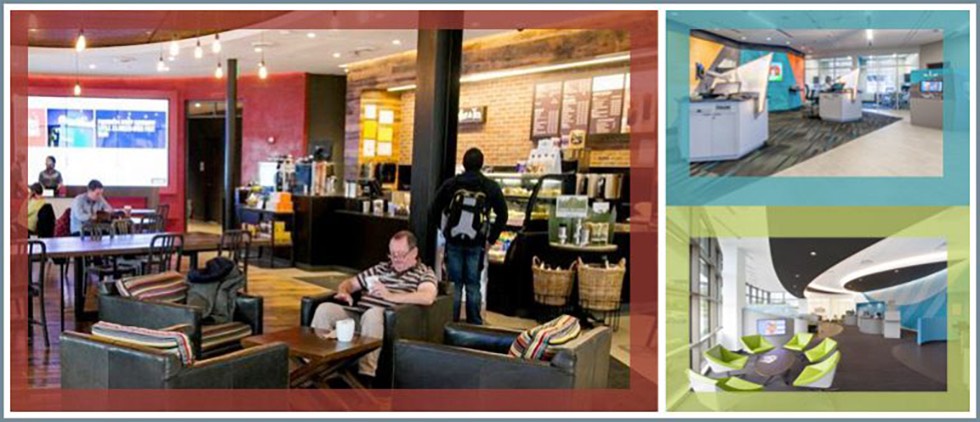

This is already happening, of course. Referring to a new branch format from Capital One, a recent Wall Street Journal article asks, “Is This a Coffee Shop or a Bank?” The new Capital One branch format is a café with free Wi-Fi… but no tellers. Capital One staff on site only answer customer questions (or direct them to the proper online resources), but they won’t open accounts or service loans. According to the article, Bank of America, JPMorgan Chase and PNC are moving in similar directions with some of their branch-based staff. Bank of America refers to staff members in this new role as “relationship bankers.”

We’re long past the question, should there be branches? Customers derive value from – and want – physical locations. And financial institutions want them, too. Take, for example, those Capital One cafés. Did you know that some of them were originally ING Direct cafés? ING Direct was an online only bank, but it realized it could benefit from branded physical locations, and so it opened café-style storefronts. When Capital One acquired ING Direct it embraced many aspects of the ING brand, including the cafés, and now Capital One has found a place for them in its own evolving strategy.

So the real challenge isn’t to figure out if there’s a future for branches. The challenge is how best to blend high-touch with high-tech in practical ways. Our experience indicates the toughest deliverable still remains the human touch, and despite rethought roles and new titles, only education, motivation and a service mentality will fulfill the expectation.