Adweek Says Fewer People Than You Think Use Financial Services Apps

As part of its regular “Data Points” series, Adweek recently published “How Apps Are Changing the Way the World Banks and How They Aren’t,” an infographic based on a survey from Clarabridge, a leader in customer feedback management. The data captured by the infographic leads the Adweek author to conclude, “Fewer people use apps to handle their finances than one might think.”

Here are some findings from the Clarabridge survey:

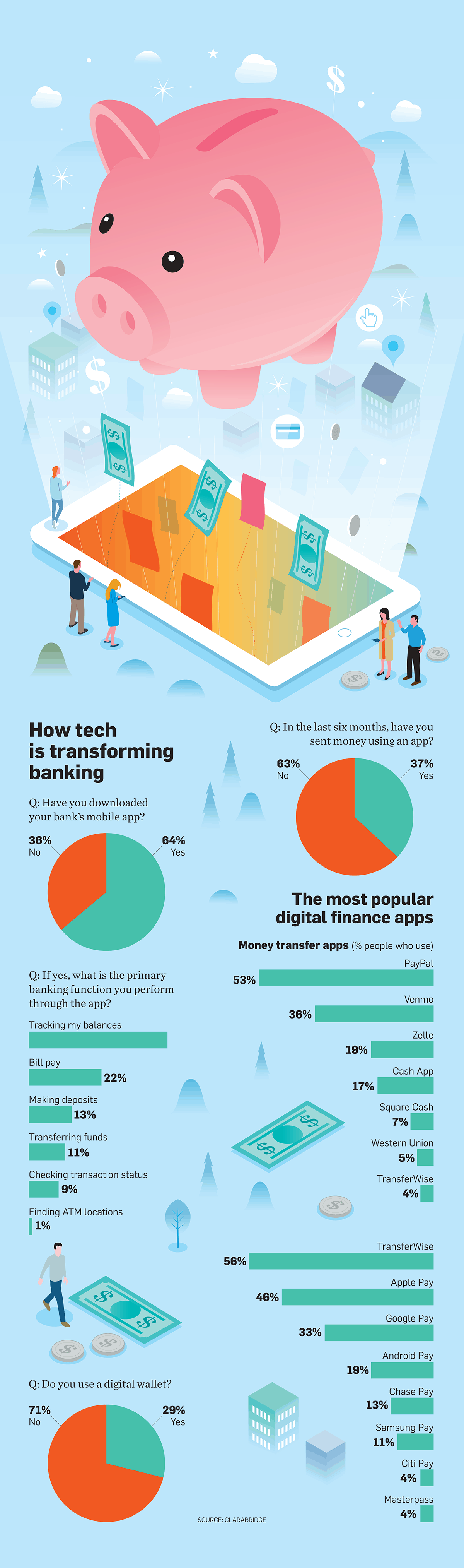

- 64% of respondents have downloaded their bank’s mobile app.

- 42% of those who have downloaded their bank’s app are using it to track balances, but only 9% are checking transaction status.

- Only 29% of those surveyed use a digital wallet. (TransferWise outranks Apple Pay, 56% versus 46%.)

- The most popular digital finance apps are PayPal (53%) and Venmo (36%) with Zelle coming in third (19%).