How Did Financial Service Brands Fare at Super Bowl XLIX?

There’s been no shortage of Monday morning quarterbacking after this year’s Super Bowl. I mean, come on Pete Carroll… just have Wilson give the ball to Marshawn Lynch! But every year, no matter how the game turns out, ad critics across the country pick apart the winners and losers in the other “game” – namely the race to be among the best Super Bowl ads.

We joined in this annual ritual last year with a look at how financial service brands performed, so we thought, why not do it again? Last year, we observed that Super Bowl commercials tend to have either an epic or wacky approach. Both of those tactics are challenging for a financial services industry still working to regain consumer trust. And in 2014, the brands that ran ads found ways to thread the needle between those two camps by not pushing too hard in either direction.

But, oh what a difference a year makes! In 2015, financial services brands had a glass of wacky juice on the way to the big game.

Discover

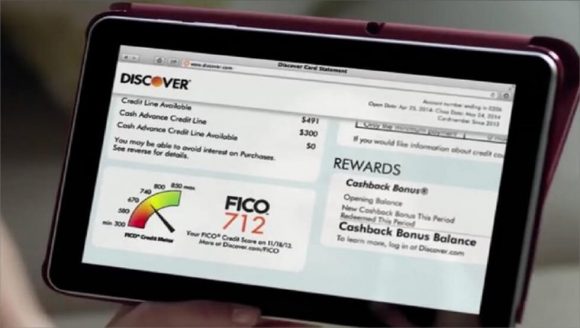

We’ve had our eyes on the Discover It card for a while and we’ve written about one of its key features: the free FICO score. For its Super Bowl ad, Discover chose to focus on that benefit, while adding a dash of “wacky” into the mix:

[This video is no longer available]

The creative is an extension of the campaign Discover has been running for It since the launch (cardholder calls Discover, talks to a duplicate of themselves and learns about a feature of their card). The new twist here is the goat.

Why a goat, Discover? And why did Sprint’s Super Bowl ad also have a screaming goat? Turns out “screaming goats” went viral a while back on that wacky Internet, with some videos approaching 8 million views. Maybe brands wanted in on the attention of that meme. But if you didn’t know screaming goats were a thing, it’s likely to cause some head scratching. I suppose one could argue anyway that FICO scores are dull and Super Bowl parties are loud, so why not throw in a screaming goat? If viewers miss the first half of the ad, but hear the screaming goat and look up, they still get the card benefit at the end.

Turbo Tax

Last year, the online tax filing giant asked consumers to look at the annual filing as a chance to look back on the year and all the things they did, personalizing and humanizing what is often an onerous task. This year they asked us to look back further and consider a historical “what if”:

Hmmm… [cue mock outrage]. So let me get this straight. Had the Colonial Americans been given free tax software by their British overloads they would have turned tail and given up on the revolution? I think not! It offends me as an American, a history buff and also a human being who realizes that the internet did not exist at the time of the Boston Tea Party in 1771. I am OUTRAGED!! (Not really). On the plus side, Turbo Tax gets points for a cheeky, original idea and for trying to be both epic and wacky at the same time. On the minus side, the ad didn’t make much sense. But hey, the brand got a product benefit in there: nothing beats free.

Esurance

The online insurance company had a big hit in 2014 with a post-Super Bowl ad that included a Twitter promotion and resulted in over 1.9 million Tweets. This year, Esurance ran two spots featuring famous faces. The one that scored higher on the USA Today Ad Meter was “Sorta Pharmacist,” where a woman goes to pick up a prescription expecting to see Greg, her regular pharmacist, but instead finds Walter White behind the counter. Why Walter White? He’s “sorta” like Greg because they have the same basic demographic information.

Personally, I laughed more at the second spot, “Sorta Mom,” in which Lindsay Lohan stood in for a tween-ager’s mother:

I get why the Breaking Bad tie-in got more public love than LiLo making fun of herself, but the mom spot actually made me laugh out loud. Either way, I got the point: who you are is more than just your age range and driving history, and Esurance knows that. Let’s note that these spots where also in the “wacky” camp.

Nationwide

Another insurance company, another celebrity. This time, comedian and sitcom star Mindy Kaling thinks that she is actually invisible and tries to use it to her advantage:

[This video is no longer available]

The spot was a perfect fit for Kaling and matched her comedic persona to a T. And the ad brings home the point that, to Nationwide, customers are not invisible. I thought it worked. Also, though… wacky.

But then there was one of the most divisive ads of the year. You know the one.

What the heck? Nothing says Super Bowl buzzkill like a cute kid saying “I’m dead.” The ad felt like a bait and switch: the tone of the first half was whimsical, then it turned dark and creepy. The ad was so divisive that before the game had ended, AdWeek published a post with 10 tweets showing what a downer it was.

Nationwide has since released a statement proclaiming that the ad raised awareness about childhood safety and “started a fierce conversation” which was its goal. OK, but guys… if you’ve lost Al Roker, you’ve lost America. The thing that confuses me most is that Nationwide had a longer, more uplifting take on the same issue in a two-minute video they posted on YouTube. Why not recut that into a 60-second spot and talk more about what you’re doing to help rather than just freaking people out? Very confusing.

So, how did financial services brands do? Once again we saw very solid efforts in the category. Creating a Super Bowl ad has to be one of the hardest things for brands and their agencies to do, so to some degree you have to give them all points for trying. Unfortunately for Nationwide, it stands a good chance of making the all-time “worst” list.