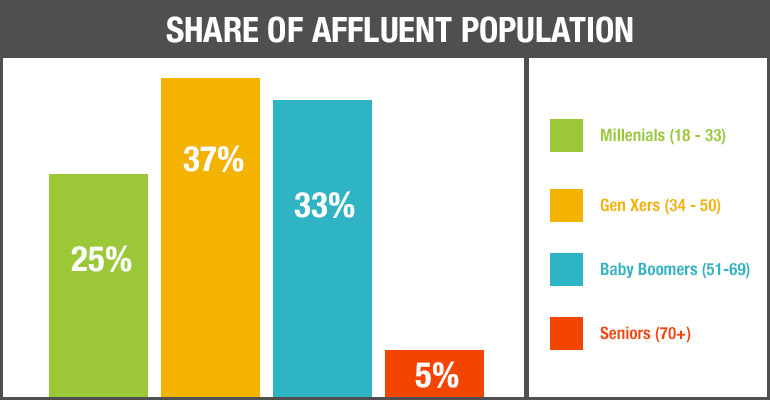

Affluent Trends: Gen Xers Outnumber Baby Boomers

According to the 2015 Ipsos Affluent Survey USA, the affluent population of the United States has more Generation Xers (those with birthdates ranging from the early 1960s to the early 1980s) than Baby Boomers for the first time ever. For its research, Ipsos defines “affluents” as adults living in households with at least $100K in annual household income. It discovered that 37% of affluents are Gen Xers, 33% are Boomers, 25% are Millennials and 5% are seniors.

Ipsos says these numbers “signal a generational changing of the guard,” and from a marketing standpoint, we believe that’s true. Since most financial services brands already expertly target audience segments by age, life stage and household income, this kind of shift becomes important. In addition to noting a change in the age composition of their affluent segment, marketers will also want to adjust positioning for part of their Gen X segment.

Ipsos Chief Insights Officer Dr. Stephen Kraus remarks that Gen Xers have been “long over-looked and under-estimated,” and we concur. Last year, when Pew Research dubbed Generation X the “neglected middle child,” Media Logic cited Census data (via MediaPost) and insisted that Gen X is a target-worthy segment. The Ipsos data confirms affluent status of this generation that for so long seemed “stuck in the middle” between two generations often deemed more desirable: Baby Boomers and Millennials.

But the rise of Gen Xers among affluents isn’t the only trend noted by Ipsos. Its data also shows that affluents are particularly likely to live in urban areas and that they prefer to consume media via magazines, television, websites, social media, mobile apps, radio and podcasts versus brands’ core platforms.

SOURCE: Ipsos press release dated September 18, 2015