Is 2014 the Year of the Credit Card Comeback?

According to the most recent Senior Loan Officer Opinion Survey, issued in April by the Federal Reserve, things are looking up for financial institutions and their credit card marketing programs. Survey respondents looked back on 2013 as “constrained” and cited consumer concern for debt as continuing to negatively impact credit card growth. Other factors – including specific implications from the 2009 CARD Act – also contributed to the constraints on growth:

- inability to raise interest rates on existing card balances;

- credit card fee restrictions;

- requirements to apply payments to the highest interest rate balance; and

- requirements to have adult co-signers on card applications by consumers under 21 years of age.

And while new regulations have limited credit card account growth overall, application volume from two key segments – prime and subprime – did increase during 2013.

The outlook for 2014, especially for the prime and subprime segments, seems to be a bit more positive. Respondents expect to see higher growth in both segments of the credit card market relative to volume of credit card loan balances.

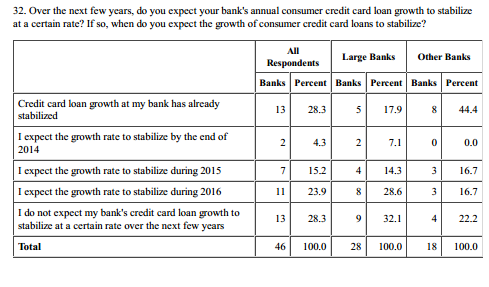

Most respondents either have seen or expect to see credit card growth to stabilize at a “new normal.” However, the degree of stabilization and the timing varies among respondents:

Just under half the respondents feel that growth has either already stabilized or they expect to see stabilization coming this year or next year.

We look at those numbers and wonder what impact they might have on one of the most steady acquisition channels for credit cards: direct mail. According to estimates from Mintel (as cited by the DMA Statistical Fact Book), credit card mail volume increased about 20 percent from 2012 to 2013. And Competiscan’s estimated mail volume for the same time shows an increase of 27 percent.

So if financial institutions are increasing mail volume and many expect to see a turnaround coming soon, it’s possible that 2014 could be the year that credit cards, like the broader economy, finally hit their stride.

SOURCES: The Federal Reserve Board: The April 2014 Senior Loan Officer Opinion Survey on Bank Lending Practices; 2014 Direct Marketing Statistical Handbook, DMA; Competiscan Credit Card Estimated Mail Volume (EMV) YE2013.

Competiscan is a full-service, competitive intelligence market research firm. It enables clients to study marketing and loyalty strategies by industry, company, product or recipient demographic. Media channels tracked include direct mail, email, online display, social media and print. Competiscan clients utilize our web-based search facility to understand what consumers, business owners, financial advisors and insurance producers are viewing in the marketplace.