The State of Credit Card Acquisition: Top Rewards, Offers and Sources, Plus BNPL Competition

What started out as a straightforward look at the current state of credit card applications has turned out to be more complex, as 2021 set the stage for increasing acquisition volume, many new product launches and changing consumer card dynamics – all within a challenging economy.

An overview of credit card acquisitions from 2021 to 2022 reveals three trends, as noted in Insider Intelligence:

- An uptick in credit use – While still behind debit use, credit use is growing and forcing issuers to make new and existing credit cards more compelling.

- Renewed card application activity – Over a quarter of all U.S. consumers applied for a new credit card between October 2020 and October 2021 (+15.7% over prior year).

- Growth in perks and products– To leverage increased usage and applications, issuers are focusing on expanding perks and adding new cards.

As a result, we are witnessing record-breaking numbers of credit card launches. In fact, Competiscan reports that it observed over 40 card launches in 2021.

Rewards as a driver of credit card applications

Most new product launches, according to Competiscan, followed one of two paths: targeting a specific niche or offering more well-rounded rewards. For example, cards were introduced to reward pet lovers and cryptocurrency enthusiasts, among others. What’s clear is that rewards are here to stay.

Insider Intelligence shares observations on key categories:

- Post-pandemic reward value propositions have returned to prior constructs, with accelerated reward earning in categories like travel and lifestyle.

- At the same time, continued rewarding of e-commerce transactions – post-pandemic and now habituated – remains in play.

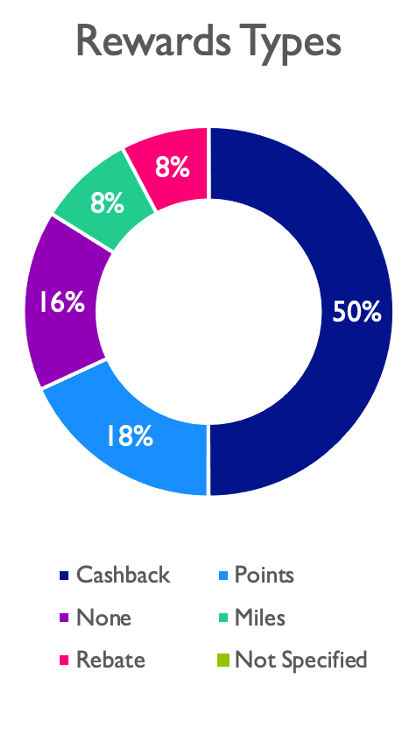

Turning to Comperemedia’s monthly survey1 of 3,000 individuals, we can validate the ongoing appeal of rewards by assessing credit card applications by type of card. According to the survey, cashback offers were the most prevalent in terms of attractiveness. They accounted for 50% of all cards applied for in Q4 2021.

Redesigned credit card rewards

Redesigned card products include cashback cards with simplified value propositions, such as automatically adjusted rewards for top spend categories requiring no action by the cardmember.

In addition, there’s increasing emphasis on rewards targeting the credit-building segment. Insights from Competiscan show that the sub-prime audience had typically been offered basic cards with low lines of credit and higher APRs. But Competiscan now observes, “A handful of top marketed credit-building cards offer cashback rewards in an effort to build deeper loyalty and to combat the runoff of cardholders to other card brands once they have established the proper credit to qualify for a rewards product.”

Evolution of non-rewards credit cards

In an interview with The Financial Brand, Mintel Chief Insights Officer Andrew Davidson points to a “pivot towards plain vanilla non-rewards card products” targeting revolvers. Due to the economy, he says, “The acquisition battle is back on” (not quite at pre-pandemic levels but growing). This includes credit-building or low-rate/balance-transfer products (no rewards), where issuers will have to get creative to differentiate themselves and deliver value. Competiscan believes standard APRs and promotional APRs are “key areas of opportunity where issuers will focus. We have observed issuers rewarding cardholders with discounted APRs or extended promotional pricing terms based on proper card use.”

Renewed focus on APR

Davidson also points out that consumers have rediscovered interest rates. They are very aware of the rising prices of goods/services and, indirectly, the purchases they are putting on credit cards. In its exchange with Davidson, The Financial Brand says, “Consumers find themselves at the intersection of two trends” – higher prices (spend they may be putting on credit cards) and likely increases in credit card APRs tied to rising interest rates.

Currently, low rates are giving way to higher rates, and experts believe that overall, rates are likely to be more important than in the past. “From a marketing perspective,” says Davidson, “We’re seeing more of an emphasis on rate and more innovation around products designed to help consumers with rates.”

As issuers continue to extend credit – and Davidson says they’re taking advantage of the window of opportunity and extending more credit, not less – issuers also push for balance transfers (BT) and encourage debt consolidation. Media Logic is noticing the rise of these BT offers as more and more issuers dedicate valuable onboarding bandwidth to solo, repetitive BT offers across the first 90 days of new cardmember initiatives.

New risk acceptance and new audiences

Insider Intelligence predicts issuers will continue to launch cards and services geared towards audiences like the new-to-credit segment, targeting 53M U.S. adults who “lack traditional credit scores or [have] subprime scores that exclude them.” Other segments are being addressed by U.S. Bank and Wells Fargo Bank, among others, who have returned to marketing secured cards to offer risky cardmembers a credit solution and a way to build a credit history. And several issuers, says Insider Intelligence, imitate Amex’s deal with Nova Credit through partnerships aimed at an invisible but creditworthy segment – immigrants.

Changing sources for credit card offers

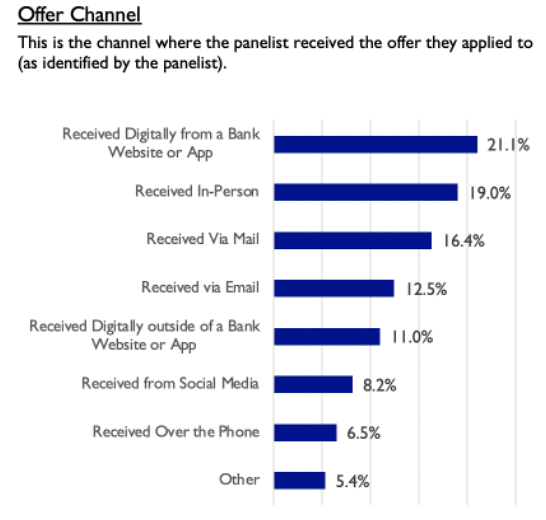

The latest Comperemedia data1 about how consumers find and respond to credit card offers indicate three top channels: issuer websites, in-person and direct mail.

In addition, Comperemedia’s panel survey uncovered key nuances in offer sources:

- Affiliate offers were up. Share of affiliate offers increased to 11%, the highest level since Q1 2020, with Capital One, American Express and Citibank as the primary drivers. These offers are more likely to be cashback or non-rewards cards.

- In-person offers also rose, increasing for the third consecutive quarter to about 19%, with Bank of America and Chase leading the way. These offers are more likely to be for points or miles cards. (In-person is Chase’s top application source at 27.5% during the time period. Let’s not forget: Chase has the largest branch infrastructure among all issuers.)

- Direct mail offers decreased from the #1 offer channel to the #3 channel in Q4 2021. Capital One’s share of email-driven card applications increased to 19% in Q4 2021, its highest point in the past two years. (Previously, Capital One has relied heavily on direct mail.) Although Discover’s direct mail volume plummeted in 2020, Q4 2021 indicates the issuer’s direct mail applications are beginning to rebound.

- Owned social platforms were used for card acquisition. Increasing to 14.4% in Q4 2021, Bank of America (BAC) is outpacing other top issuers in “share of applications originating on social media.” BAC also added 162.6K audience members to its combined social channels – Facebook, Instagram, Twitter and YouTube – in 13 months (January 2021 – February 2022).For perspective, Chase lost social media audience (-24.4K). Amex, Citi and Capital One gained audience, but nowhere near BAC’s increase.

Alignment of response channels and offer sources

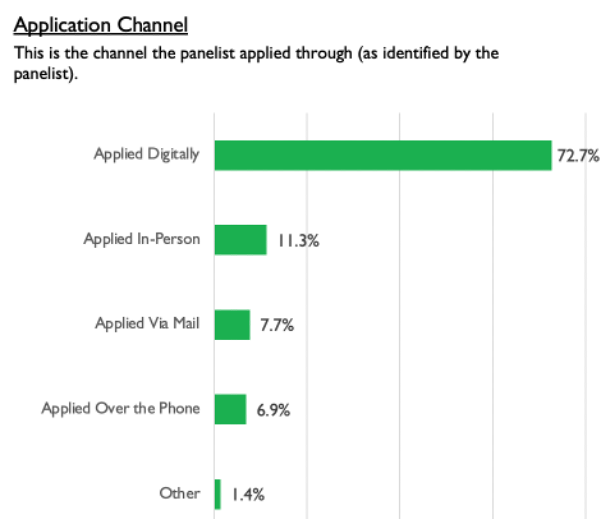

The Comperemedia panel survey1 points out, as might be expected, the source of the offer and the response channel used are closely aligned, e.g., a digitally sourced offer was responded to in the same channel. The data shows the bulk of applicants used digital applications (almost 73%), followed by in-person (11.3%), direct mail (7.7%) and phone (6.9%).

BNPL’s influence on credit card acquisition

Perhaps not of immediate concern to traditional FIs – but certainly one for the not-so-distant future – Buy Now, Pay Later (BNPL) is a credit card acquisition tool, says Forbes.

For now, Amex’s CEO has opined, “BNPL is not really a competitive threat to us. It’s targeted at debit card issuers. As a customer acquisition vehicle, it’s not the game we’re playing.” Current BNPL users may not be attractive candidates for issuers like Amex or any issuer marketing a premium credit card. However, when the BNPL users’ credit scores do become attractive to issuers like Amex, Forbes predicts that BNPL providers will already have a “deep history of their purchase and repayment activity, making it easier for them to offer credit cards with the right pricing and features.”

Forbes says this is the real threat to traditional players. It warns that BNPL companies may be positioned to displace established card providers: “BNPL is like training wheels for credit cards. It gives its users entry levels of credit. When BNPL customers demonstrate the need for more credit—and ability to repay—BNPL providers may be there with traditional card offers.”

To protect acquisition investments, issuers need to tackle these challenges

For the remainder of 2022 and into the near future, these variables are in play for financial brands as they try to acquire new cardmembers. Media Logic is helping many issuers of all sizes tackle these acquisition challenges through audits to realistically assess the competitive landscape, refresh value propositions/benefits and inform strategic acquisition marketing plans that respond to the current environment. The cost to acquire a new cardmember, always pricey and likely increasing, becomes more challenging to optimize with these evolving variables in play.

1. Comperemedia, Credit Application Behavior Report, Q4 2021.