Credit Card Selectors: How Citi’s “Lifestyle” Quiz Tops the Competition

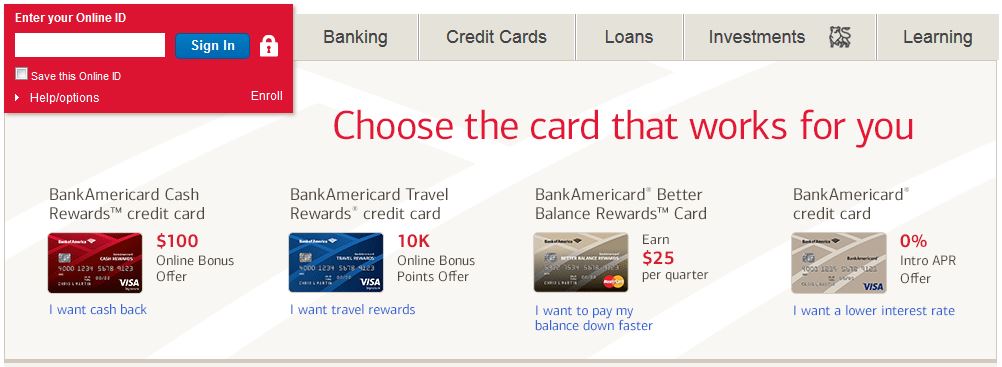

Online credit card selectors are very common among card issuers, and they almost always focus on product benefits and features, like this one from Bank of America:

In addition, they’re typically marketed in the same fashion, with a version of “We have the perfect card for you.” Here are some current examples:

- Pick the card that benefits you (Bank of America).

- Which card suits your business best (American Express)?

- Find the credit card that’s right for you (Mastercard).

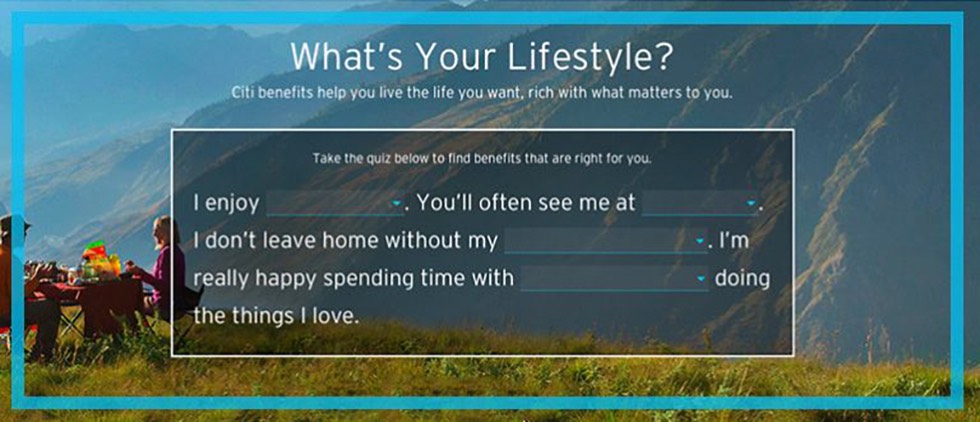

However, we noticed something quite different happening at Citibank. Here’s how it promotes its online card (and banking services) selector:

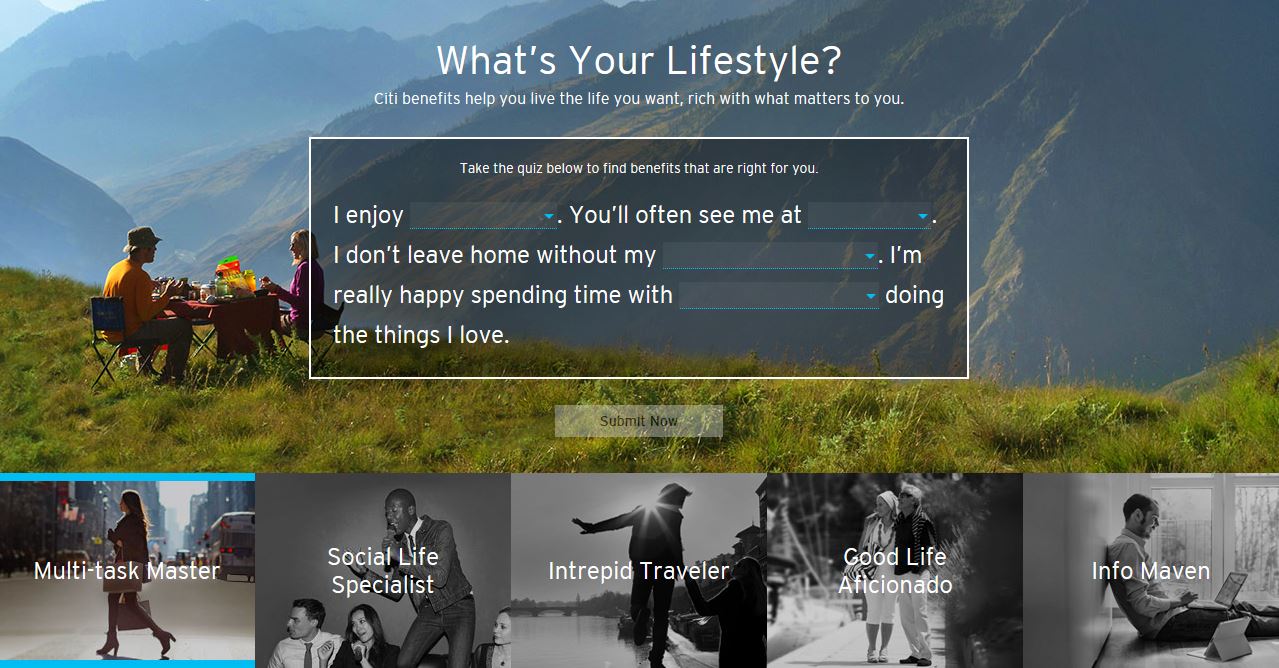

The “learn more” link in the Twitter card above takes users to Citi’s card selector – “What’s your lifestyle?” – a tool that leads with personality instead of card features. As a result, instead of appearing like a standard card selector tool from a financial institution, Citi’s approach feels like the memes and quizzes that are so popular on social media:

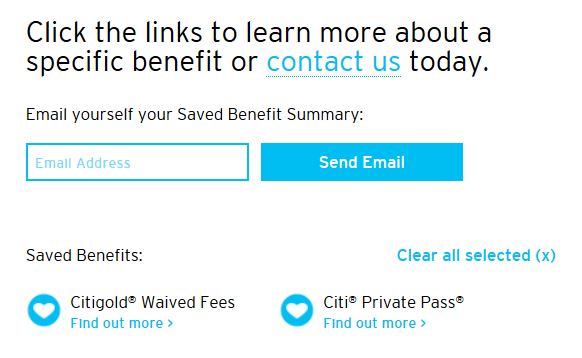

As you can see above, Citi invites prospects to fill out a lifestyle quiz, which leads to the exploration of five individual personas. From there, the tool suggests card and banking benefits that match each persona. Prospects can add desired benefits into a personalized summary and use a form at the bottom of the page to email themselves the summaries.

While each issuer’s card selector is interactive in a way (users click/select a number of options and receive a list of results), the Citibank effort is significantly more playful.

This is evident not only in its visual appeal, but also in its language: to reset the lifestyle quiz, users click “play again,” and instead of drop-down menus offering card features, users select from options, such as “I don’t leave home with my…

- trusty travel guide,

- to-do list,

- reading material,

- social media or

- designer sunglasses.”

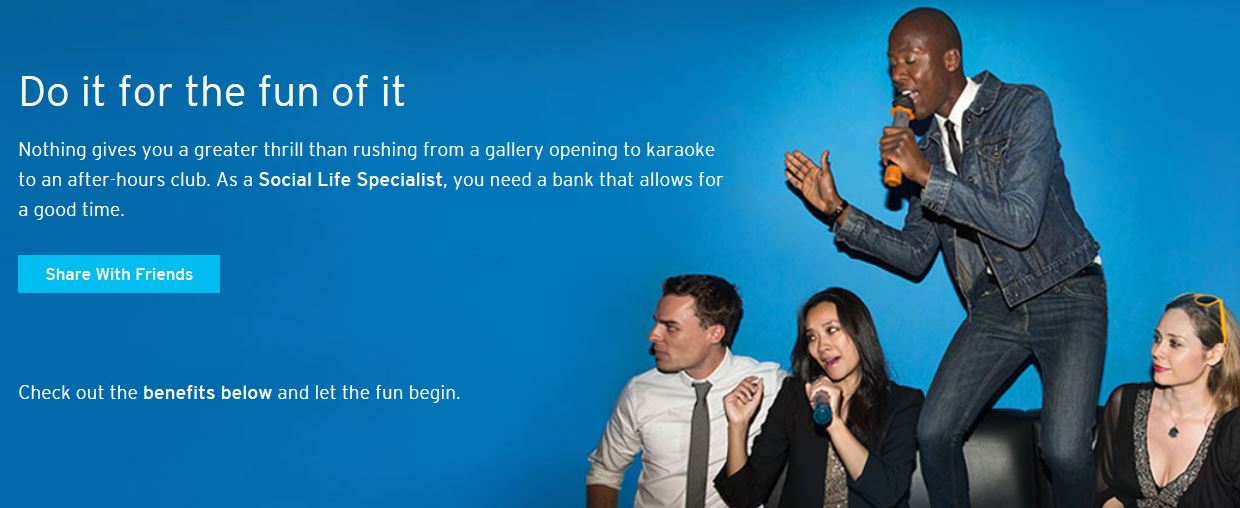

And instead of matching users with a card product (right away, anyway), Citi shows prospects a “lifestyle” persona that reflects their interests, for example: “Multi-task Master,” “Social Life Specialist” or “Good Life Aficionado.”

While users explore the personality profile, Citi serves up tiles with credit card and banking features that fit the lifestyle:

In all, there are 20 benefits organized into tiles. Users can skip the lifestyle quiz and start by exploring the benefits, if they want. This flexibility, along with the site’s many layers, deepens opportunities for engagement.

Takeaways

Of course, what Citi has done is to “re-skin” the traditional card selector by adding a lifestyle layer to the standard criteria for choosing credit cards and banking services. Still, there’s a lot we like about it: it’s creative, it’s engaging and it stands out from its competitors.

Our primary reservation about it is that it only includes five lifestyle personas, and we’re not sure that qualifies each as “unique”:

However, to get the attention of prospects, today’s card issuers must exceed consumer expectations when it comes to product fit, including how they market the “right” card for everyone. We think Citi’s effort achieves this. “What’s your lifestyle?” is an admirable reimagining of a traditional (and previously not so inviting or exciting) financial services tool.