Medicare Advantage Is Changing – And So Must the Marketing

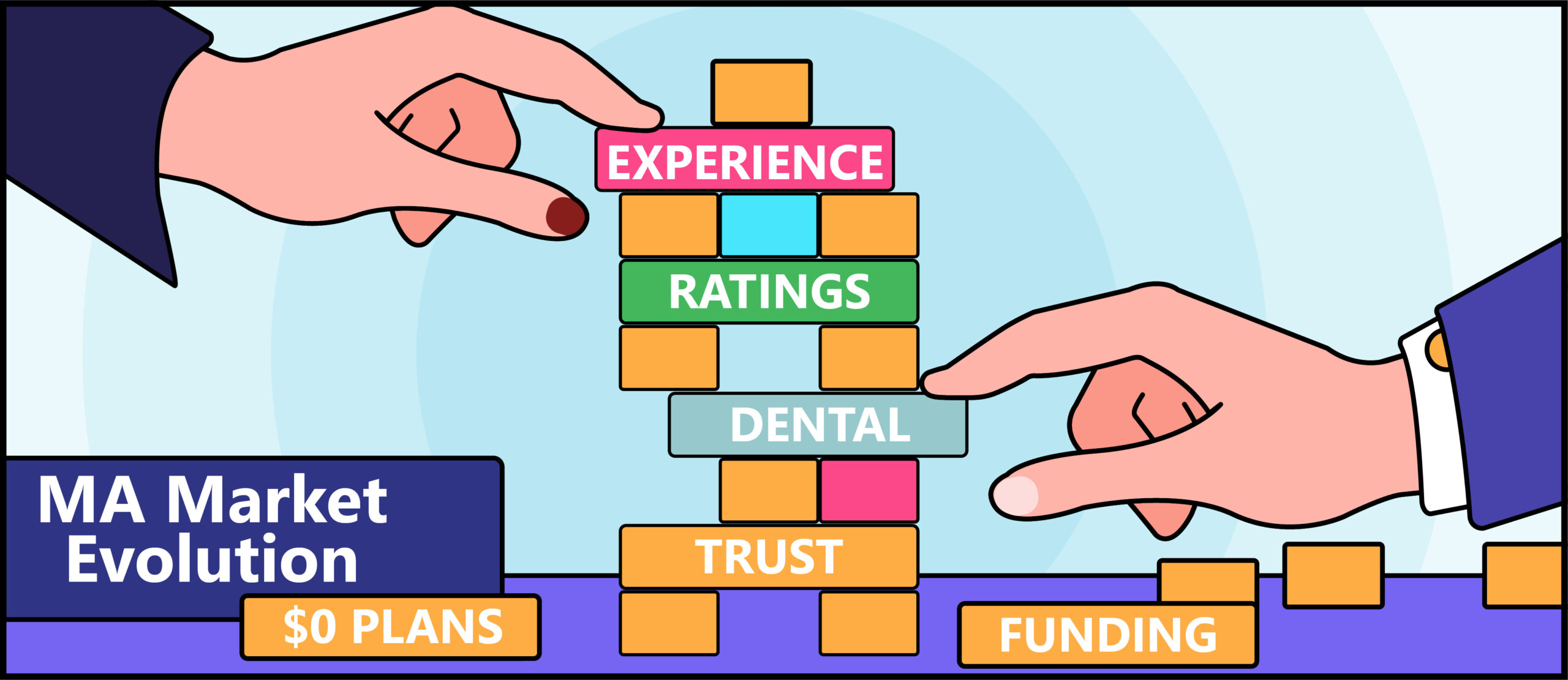

Over the past decade, the Medicare Advantage (MA) market has seen tremendous growth – not just in enrollment, but in the generosity of plan benefits. From expanded dental and vision coverage to over-the-counter allowances and fitness perks, health plans entered an arms race to offer more. But that era has come to a close. We’ve entered a new phase, defined not by expansion, but by disruption – one that will rewrite the health plan marketing playbook.

The Rise and Fall of Richer MA Plans

This former period of accelerated growth was triggered by a confluence of factors helping to enable richer MA benefits:

- Robust federal funding: MA reimbursement rates remained strong, with plans receiving bonuses tied to Star Ratings.

- Rising enrollment: With 50% of Medicare beneficiaries now in MA(KFF), scale advantages lowered per-member costs.

- Healthy economics: CMS rebate structures, growing enrollment scale, and bonus revenue from high Star Ratings gave plans the financial room to expand supplemental benefits year after year.

These favorable conditions allowed many insurers to pour resources into supplemental benefits, using them as a primary competitive lever. But that model hit turbulence in 2023 and 2024. Margin pressures began mounting due to:

- Rising medical loss ratios driven by increased utilization post-COVID and higher negotiated provider rates

- CMS risk adjustment and Star Rating methodology changes, which cut into bonus revenue

- Increased broker commissions, further eating into marketing and administrative budgets

- Macroeconomic pressures, including inflation and tighter regulatory scrutiny

Suddenly, the economics of “richer every year” became unsustainable.

Disruption Takes Hold

Last year’s AEP (Annual Election Period) marked the beginning of the MA Disruption Era. We saw:

- Plan exits and benefit rollbacks

- High-profile payor/provider contract disputes

- Consumer confusion, fueled by benefit reductions, plan exits, and shifting provider networks, which left many members uncertain about their options

As the 2026 AEP gets underway, we expect it to be even more volatile, with potentially a couple more years of disruption ahead. Eventually, most plans will settle into a new normal – one with fewer bells and whistles and less room for competitive differentiation on benefits alone. More of a commodity market, perhaps.

What This Means for Marketers

With the rich-benefits era fading, marketers must adapt. The next wave of Medicare Advantage growth will require smarter strategies focused on experience, efficiency, and long-term brand building.

1. New-to-Medicare Will Rise in Priority

If fewer people switch plans during AEP because plans are increasingly similar, new-to-Medicare prospects will become the main growth driver. That means shifting budget toward:

- Always-on, age-in targeting strategies

- Content that resonates with late retirees and those still working

- Lead nurture programs designed to educate and guide, not just convert

2. Brand Becomes a Differentiator

In more commoditized markets (think auto or property insurance), brand is the hook. Health plans should take cues from these sectors:

- Invest in brand awareness, regularly measuring impact and adjusting strategies as necessary

- Create emotionally resonant messaging focused on trust, advocacy, and ease

- Reinforce brand promises across all touchpoints, from digital to call center

3. Member Experience Drives Growth (and Retention)

As plan benefits become more similar, the experience of being a member will matter more. That means:

- Optimizing digital tools like member portals and mobile apps

- Streamlining service channels (chatbots, live reps, text reminders)

- Elevating member engagement – onboarding, wellness engagement, and annual touchpoints

A superior experience fuels retention – and creates organic referrals via word of mouth.

4. Web + Sales Journey Must Be Seamless

The website is the front door. It must:

- Deliver intuitive navigation and personalized recommendations

- Guide prospects based on life stage, health needs, and budget

- Connect smoothly to lead forms, call centers, and licensed agents

The sales experience – from nurture emails to one-on-one consults – should feel human, timely, and consultative, not transactional or overwhelming.

5. Segmentation and Personalization Will Be Critical

As the market matures, plans will need to understand their prospect universe at a deeper level. That means:

- Developing more sophisticated segmentation models that account for age, lifestyle, health status, and financial needs

- Delivering communications tailored to those segments in both tone and content

- Using personalization in digital journeys, lead nurture, and sales outreach to make every prospect feel understood

More relevant, personalized messaging will be key to winning attention in an increasingly crowded, commoditized market. However, this will also mean investment in strong Customer Development Platforms (CDPs) that will likely be an additional burden on marketing budgets and factor into ROI.

6. Efficiency Will Be the Watchword

With tighter margins, marketers must do more with less. Expect a greater focus on low-cost, high-impact digital channels. Media mix models and attribution tools to guide spend allocation will also become essential.

Looking Ahead to the 2026 AEP

The most successful marketers will be those who anticipate these changes – not react to them. While the disruption is real, it also presents an opportunity: to rethink what truly drives Medicare Advantage growth in the long term.