The Everyman Loan from Goldman Sachs

Marcus, a new personal loan product, recently showed up on my personal Facebook feed. Two things immediately seemed at odds: 1) The offer was aimed at people with credit card debt (for the record, not me) and 2) the product was from – wait for it – Goldman Sachs.

And so, my experience was somewhat of a disconnect not only because of flawed Facebook targeting but also due to my general skepticism around the personal loan – positioning, marketing and name – being offered from a brand not generally interested in the hoi polloi.

Skepticism aside, I wanted to explore what Marcus is all about. Here’s what I learned:

- Goldman Sachs is investing heavily in marketing the lending platform using online and traditional direct mail. A recent American Banker article quoted Head of Digital Finance Harit Talwar as characterizing mail volumes as “millions of pieces of direct mail from Goldman Sachs.” (Sidebar: The Goldman Sachs’ representative himself admits “who would have thought Goldman Sachs?”)

- Online marketing for Marcus is heavy on Facebook and includes retargeting as part of a digital strategy. I’ve have been continually served up Marcus ads following my visit to goldmansachs.com for research.

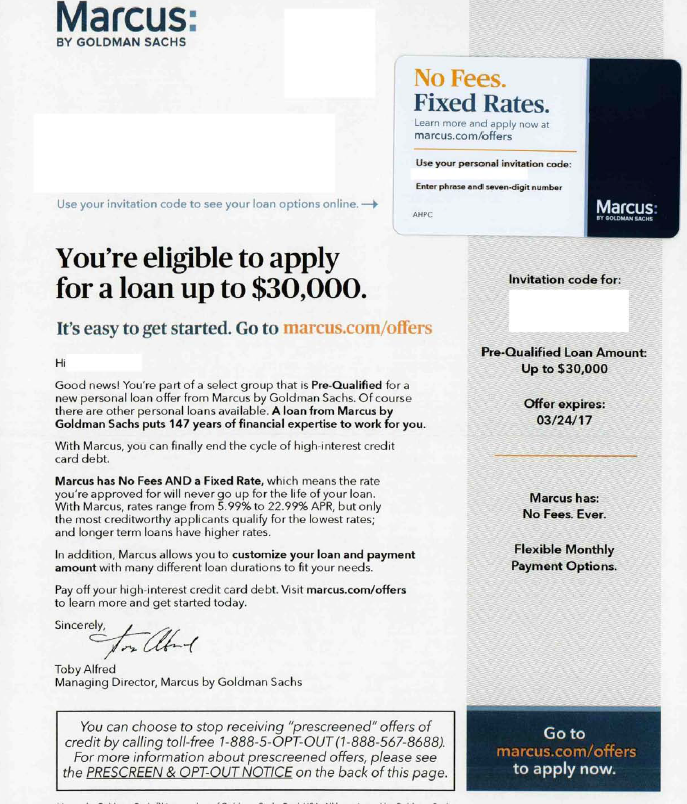

- Kudos to Goldman Sachs because the DM gets it right. The brand is using DM tradecraft – that, ironically, credit card marketers invented – to market the antidote to high credit card debt.

- DM is targeted to a pre-qualified audience (most, but not all prospects).

- DM best practices abound – scan-able, benefit driven, strong Johnson Box and call-to-action and personalized variable content. The letter also leverages a time-tested device, placing a tipped-on plastic card in the upper right hand corner, reiterating the offer and CTA.

- Goldman Sachs admits that it had to change up the culture and take on the mentality of a start-up in order to compete with the likes of Prosper and The Lending Club. Pin stripes have given way to “anything goes” to accommodate recruits from Facebook, Amazon and the like.

So how does Marcus stack up as a loan product from the customer point-of-view?

- It boasts “No fees. Ever.” No prepayment fees. No late fees.

- It offers fixed rate, 2- to 4-year loans ranging from $3,500-$30,000.

- It promises customer service without automated voice response and with agents who pick up in 10 seconds or less.

- Established borrowers (those who have made 12 consecutive payments on time) have the ability to defer one payment with no fee and no extra interest.

- The product name – inspired by Goldman Sachs’ founder Marcus Goldman – gives it a casual and accessible personality.

Applicants report approval in as little as 10 minutes or, more typically, somewhere between 24 hours to a few days, and the majority of those who provided commentary on Marcus self-report high FICO scores. The majority of product reviews were very positive, even when their approved Marcus loan came with a 16% APR. (Loans are promoted as anywhere between 5.99%-23.99%.)

The most negative reviews were typically from prospects with prequalified offers who clearly do not understand prequalified is not preapproved. In good faith, these prospects initiated an online application and were turned down, only to receive a hard hit to the credit bureau and negative impact to their FICO scores.

Bad reviews aside, Goldman Sachs is reaching out to the Everyman with vigor and with a very attractive product. Marcus is definitely coming to your mailbox and Facebook feed soon.