At-A-Glance: Huntington Asterisk-Free Checking

Last month while we were reviewing the Huntington Voice Card, we came across a landing page for the bank’s Asterisk-Free Checking account. After taking a closer look, we were struck by a few interesting elements of the product and how it’s promoted.

What’s in a name?

What we liked right away about the product was the simplicity of the name and how it fit with the value proposition. Many other regional players also have checking products with names that immediately convey a benefit: Key Bank has Hassle-Free Checking, TD Bank has Convenience Checking and Union Bank of California has the customizable Banking By Design.

With Asterisk-Free Checking, Huntington seems to be taking this a step further, using the name both to convey a benefit and answer a common customer frustration. “Asterisk-free” implies simple and easy, but it also says “we’re not trying to trick you.” I’ve watched countless focus groups where a respondent has gone right to the fine print, determined to find “the catch.” Consumers are highly skeptical of banks, and many look to uncover the hidden trick in the offer. Huntington is getting that out of the way up front and saying that there is no trick: what you see is what you get.

The product name is further backed up by the features and benefits. There are no maintenance fees, no minimum balance and no requirement for a particular number of debit transactions. The bank also offers 24-Hour Grace which gives customers one business day to resolve an overdraft before they are hit with fees (this is similar to the Late Fee Grace offered on the bank’s Voice Card).

Online promotion

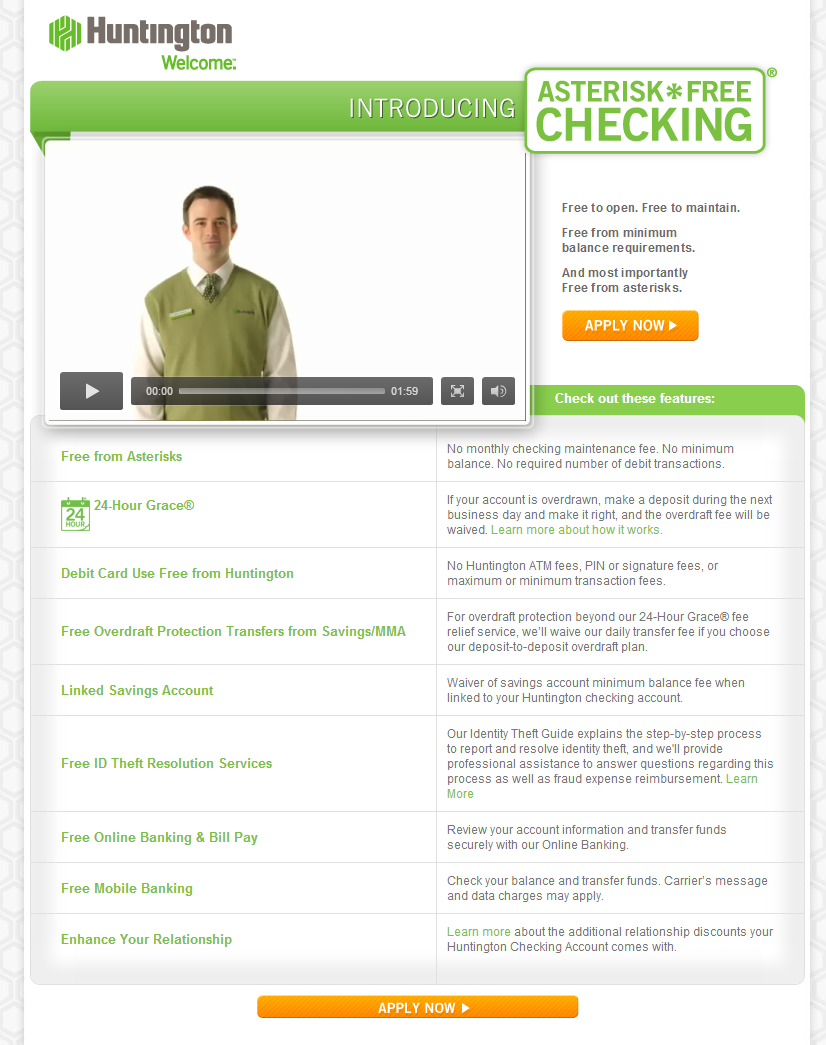

The Asterisk-Free Checking landing page immediately grabbed our attention. Its overall design is informative and robust without being overwhelming.

The layout is simple and clean, and use of a table to explain the features and benefits makes information easy to scan. The centerpiece of the page is a two-minute video that provides an overview of the product. The video style is a combination of an actor talking to the viewer and animation. The result is a video that’s both attention grabbing and informative. But it’s also very well integrated with the content on the page (the actor points at different page content to direct to viewers’ attention). Overall it’s a great example of the use of video on a landing page – keep it short, to the point, entertaining and visually stimulating.

For its search engine marketing efforts, Huntington seems to be using Asterisk-Free Checking as its lead product. When you search for “Huntington Bank” in Google, the paid search result looks like a general ad for the bank, but the link does not drive to the Huntington home page; instead, it goes to the product landing page. The bank likely sees this product as unique: a way to differentiate itself in a market crowded with other checking products.

Based on our quick reviews of their credit and checking products, it seems to us that Huntington is trying to carve out a unique position among regional banks. It has developed a product set that is innovative and helps the bank stand out. In addition, Huntington has smart marketing execution with a consistent look, tone and feel across products and channels. These factors will help Huntington differentiate and will make it a highly relevant choice in a market crowded with many “Big Bank” options.