Game On, Discover!

Gamification as a marketing tactic is being put to use by financial services for brand amplification, to deepen customer engagement and to energize promotional campaigns. Discover is dabbling in game mechanics as part of its digital strategy to appeal to card prospects and customers by demonstrating product value for their rewards credit card.

It has moved away from the traditional way most banks communicate reward value: a static graphic telling consumers do X, earn Y and get Z. Loosely applying the Forrester definition of gamification – “The insertion of game dynamics and mechanics into non-game activity to drive a desired behavior” – Discover presents a good example of how to use elements of game theory to communicate and sell.

Here’s how Discover does it:

Show, don’t tell me

Cashback Bonus is all about earning cash for credit card spending and then applying the rebate towards all variations of rewards: merchandise, gift cards, statement credits and charitable donations. Evolving beyond traditional tactics, Discover found a neat way of selling the product’s value by not only telling prospects about easy, fast ways of earning and redeeming rewards but also demonstrating value through non-traditional techniques both creative and engaging.

Big bang theory

Big bang theory

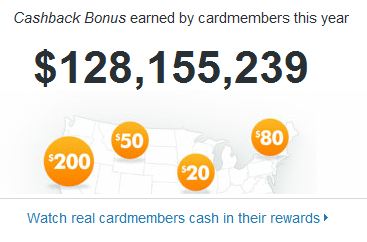

Through use of a real time digital display, consumers can see for themselves the dynamic, ever increasing amount of money returning to cardmembers via rebates in 2012. In an attention-grabbing way, Discover overtly makes the case that it gives back lots of cash via the aggregated rebate amount from millions of cardmembers. As Discover Cashback customers make qualifying purchases using their cards, they contribute rebate dollars to the digital display “pot.” Earnings grow by hundreds of dollars per second, giving the net impression of robust rewards and increasing the perceived value. The screen grab to the right represents only one moment in time, and Discover well knows the exponential factor works in their favor.

From earn to burn

The digital earnings board segues to showcase the second part of the rewards card conundrum by answering the fundamental questions: “What are these rewards worth?” and “Can I really use them?” A second gamified tracker invites you to “watch real cardmembers cash in their rewards” using an interactive U.S. map that is clever and fun. The map pulses with locations – from small towns to big cities – and flags activity of real cardholders redeeming their rewards for specific items. Throughout the experience, Discover intersperses light-hearted calls to action for me to apply for the card, link to Facebook/Twitter and, as a result of my longer-than-average viewing session, Discover charmingly messaged me, “You’ve been around so long, I feel like I’ve gotten to know you.”

The End Game

Discover has taken a fresh approach to a key challenge of selling value in a world of ubiquitous credit cards. Every element of Discover’s game supports the positioning expressed in their tagline, “Rewards your way:” earning cash is easy and fast, the range of reward options gives me choice and flexibility, I can cash in on small amounts or alarge amount, I get spiffed with a better than 1/1 reward value with merchant rewards and finally – everybody’s doing it.

Ultimately a game should be fun, right? Discover has found a way to make the fun factor greater than the effort required and put millions of Discover cardmembers to work in selling the card on their behalf. Game on, Discover!