The Financial Services Product Revolution You Can’t Ignore

Have you ever felt that customers don’t fully accept the fees and charges associated with your financial institution‘s products and services? Is it that they don’t value your offerings? Or are they perhaps frustrated that they know exactly what they want — but aren’t getting it?

In some new business models, the consumer is gaining power in the form of “individually designed” relationships. It is now practical – and profitable – for some financial institutions to forsake offering “a universal product” to a large audience in favor of something potentially more lucrative and valuable: a product the customer personalizes to his or her needs, lifestyle, technology usage and interests. We decided to investigate one of these products to see how it could change the consumer’s perspective of one of the industry’s most stalwart products – the online checking account.

Green Dot Bank listened to Gen Y and Millennials in its creation of its customizable GoBank product. In the process, it entirely eliminated what it promotes as some of the “most derided aspects of traditional banks,” including minimum balance requirements, overdraft/penalty fees and complicated disclosure forms.

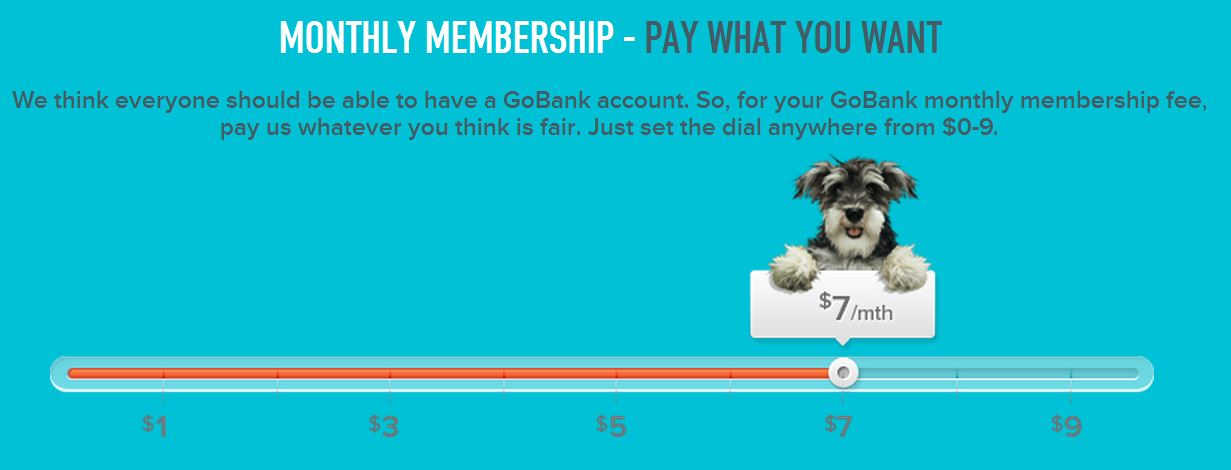

So how does GoBank make money beyond non-fee revenue? The truth is that GoBank does charge fees – and successfully does so by changing up the value proposition for the customer. It has created what is arguably the most inimitable aspect of the GoBank relationship: the optional, monthly, pay-what-it’s-worth “membership fee.”

Based on a sliding range of nothing to $9 a month, members voluntarily pay any amount they think is fair. The customer-determined fee (in terms stated by GoBank) “gives the customer the power to punish or reward GoBank based on how they feel about the product… providing an emotional benefit for the member because it puts them in control of their bank.” Moreover, it does appear to work. GoBank’s product research indicates that most GoBank members contribute monthly. If they “like” the product, they pay. That’s a true loyalty play, and GoBank has responded with some creative product enhancements:

- a no-cost Visa debit card and free cash access via Elan’s MoneyPass network of 42,000+ ATMs (a high-quality, customized Visa debit card depicting a user-provided image is available for $9);

- easy-to-set account alerts, notifying accountholders of direct deposits being posted, purchases over a user-set amount, withdrawals, daily balance, budget reminders and balance warnings;

- Smartphone app with a convenient “swipe to view balance feature” that is accessible without logging in (a nice touch);

- free mobile check-scan deposits;

- free money transfer (similar to PayPal or Popmoney);

- free physical checks mailed from an online checkbook to recipients who don’t accept e-payments;

- a “Money Vault” to store and protect money from being inadvertently spent; and

- interactive online and app-based budgeting tools.

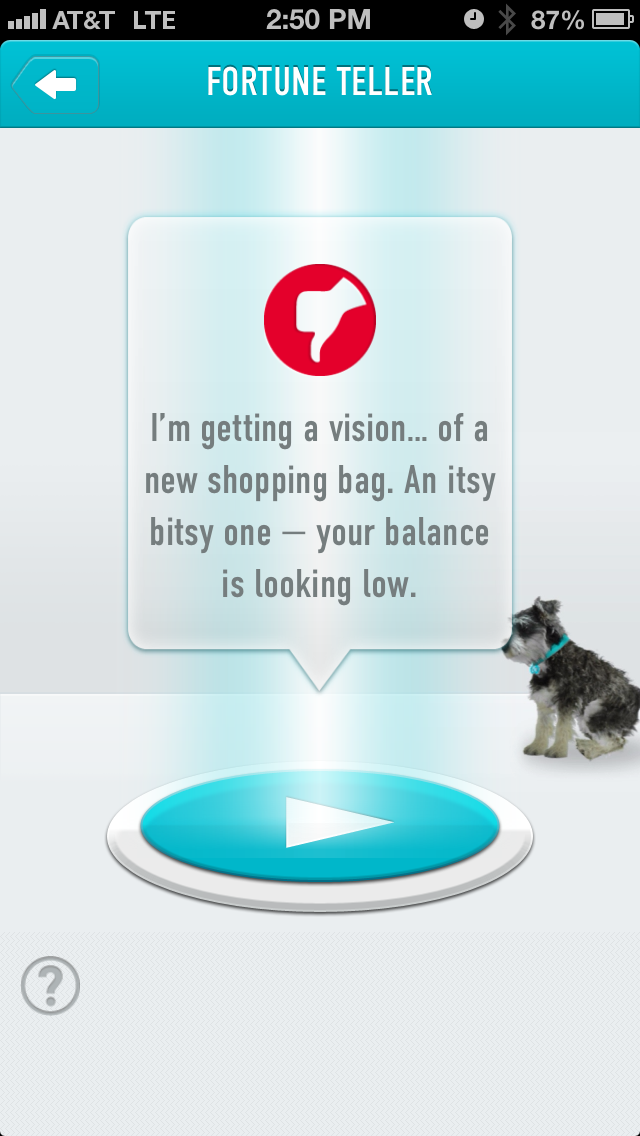

The budgeting tool even includes a “Fortune Teller” who goes so far as to mystically flag a potential purchase and offer somewhat sarcastic, irreverent and entertaining advice if the purchase is not aligned with the accountholder’s balance and income. (“Remember that time you won the lottery? I don’t either.”)

The budgeting tool even includes a “Fortune Teller” who goes so far as to mystically flag a potential purchase and offer somewhat sarcastic, irreverent and entertaining advice if the purchase is not aligned with the accountholder’s balance and income. (“Remember that time you won the lottery? I don’t either.”)

The only costs to customers are foreign transaction fees of 3 percent, $2.50 ATM surcharges for out-of-network withdrawals and $1 ATM balance inquiries.

The process of opening a GoBank account is typical of most online banks, but with a clear investment in the consumer onboarding experience. Numerous forms handle data collection. A battery of challenge questions and personal data proves accountholder identity. Trial deposits and withdrawals link accounts. The process is fun, engaging and allows the new accountholder to take ownership of the GoBank brand.

Positioning itself with the tagline, “It’s About Time,” GoBank has entered the online banking fray as “the first bank account to be opened and accessed from a smartphone.” The software investment is highly apparent. With its iPhone and Android apps and a slick companion website, GoBank is attempting to redefine banking for a new smartphone-literate customer and has certainly issued a formidable challenge among online banks. Do you think it will be successful?

Note: GoBank is currently invitation-only or via a waiting period after signup until they get all of the kinks worked out. It took us six weeks for our invitation to be processed, and new accounts are not currently immediately available. That should change over the coming weeks.