Driving awareness of a service to expand usage—even where cards aren’t accepted.

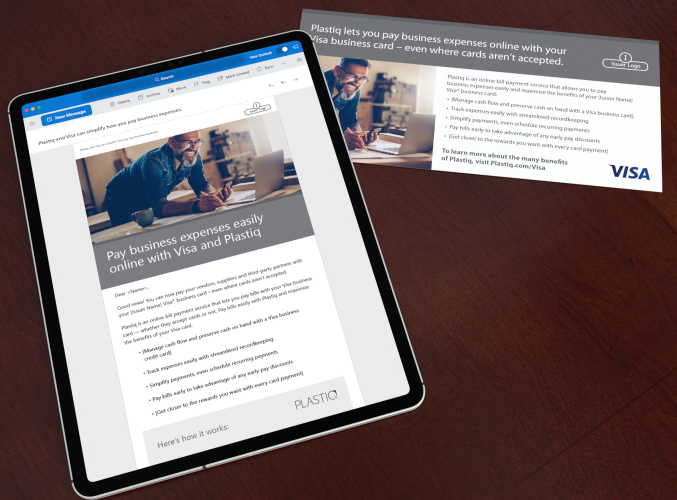

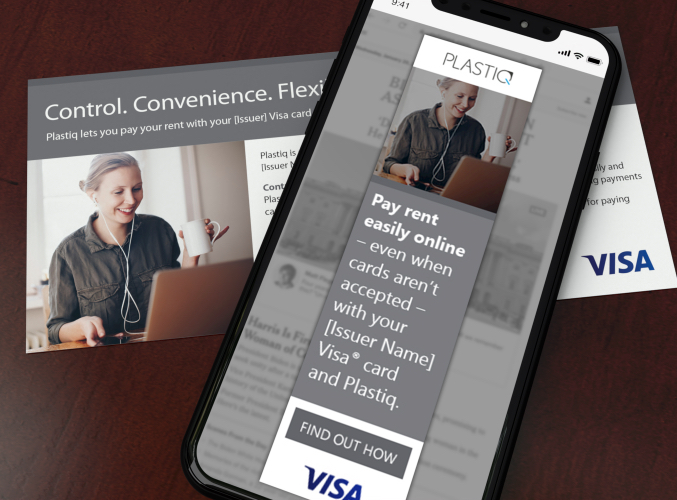

While research indicates both consumers and small businesses prefer paying bills online with a credit or debit card, there are still many billers that don’t accept cards. With Plastiq, an online bill payment service, users can pay bills online with their debit or credit card, even when cards aren’t accepted.

To help capture this previously untapped market, Visa wanted to help Issuers raise awareness of the Plastiq service among their consumer and small business cardholders. Media Logic developed a comprehensive marketing toolkit to do just that.

The toolkit featured a detailed Marketing and Messaging Guide with copy and design recommendations, as well as turnkey, market-ready assets, including emails, statement inserts and digital banners.

To ensure the messages were as relevant as possible to key audiences, the market-ready materials were not only versioned for both consumer and small business cardholders, but also for specific bill categories such as utilities and rent.