Top 10 Financial Services Marketing Blog Posts of 2025

Explore Media Logic's top financial services marketing blog posts of 2025, including valuable commentary by group director, Nicole Johnson.

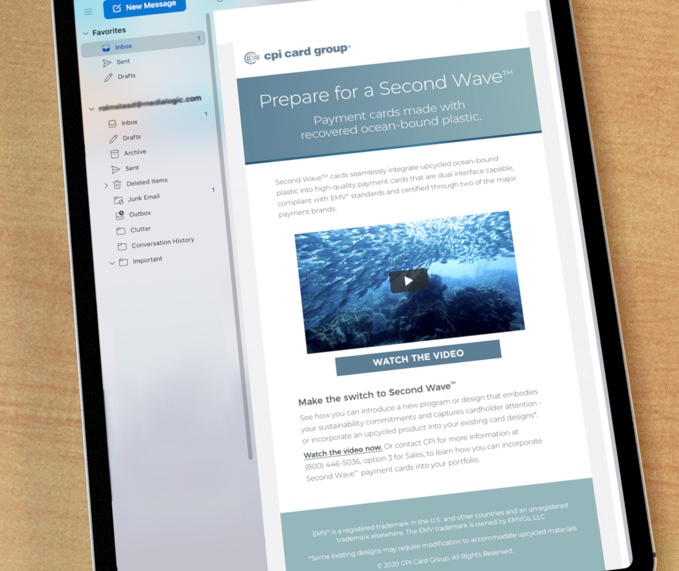

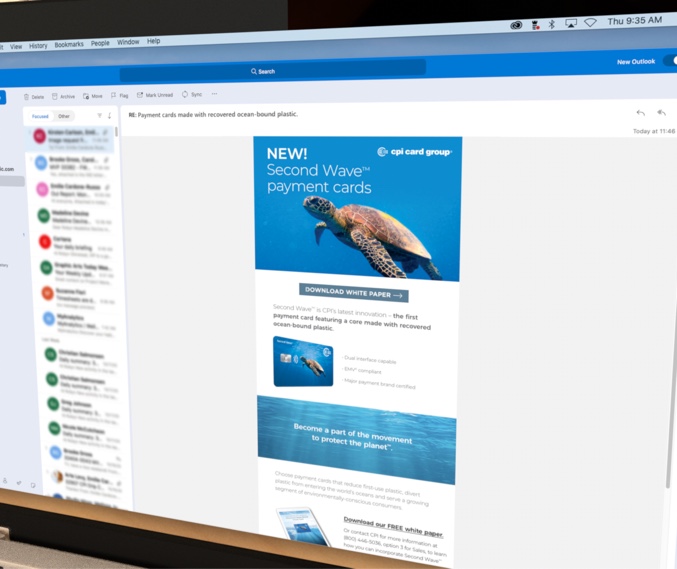

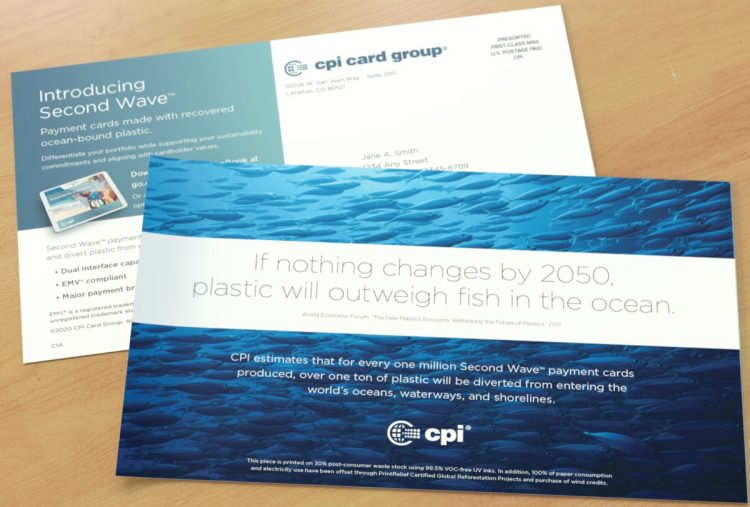

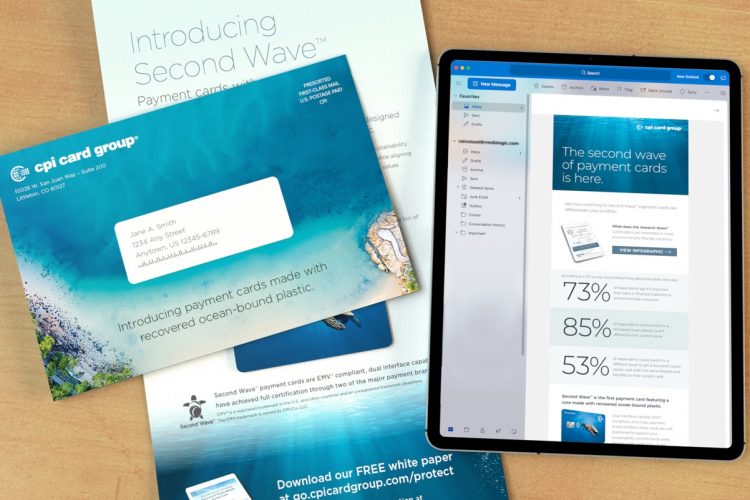

As part of payment card manufacturer CPI’s commitment to sustainability, they have developed Second Wave™ — a new type of payment card made with a core of recovered ocean-bound plastic.

CPI was looking to educate both prospects and customers about this new solution (and naturally, generate and nurture leads), so Media Logic developed the strategy, executed creative and managed printing and fulfillment for an integrated drip campaign. Driven by consumer preference expressed in research and a guided cadence of sequenced direct mail and email, the drip campaign directed recipients to unique landing pages. Each drop focused on a singular asset including low-lift resources like video and infographics, as well as a white paper, e-book and delivering a physical sample of the innovative card.

Recipients who didn’t respond were retargeted with reminders and new assets. Those who did demonstrate interest were connected directly with salespeople who then followed up personally to provide additional information.

Ready to find your edge?

Get smarter strategy and breakthrough creative. Backed by unmatched client support.

Explore Media Logic's top financial services marketing blog posts of 2025, including valuable commentary by group director, Nicole Johnson.

In this intriging Q&A session, Media Logic's resident expert, Nicole Johnson, Group Director and FS Practice Lead, shares her perspective on the Lower Midde Market segment honed by decades of commercial payments and retail banking marketing experience.

American consumers are currently facing a dramatic financial landscape. With recent data indicating that 70% of U.S. consumers face difficulty paying monthly bills, economic fragility is increasing (PYMNTS). As we approach the end of 2025, this increasing trend has many wallets taught, and the implications for financial services marketers are becoming clearer.