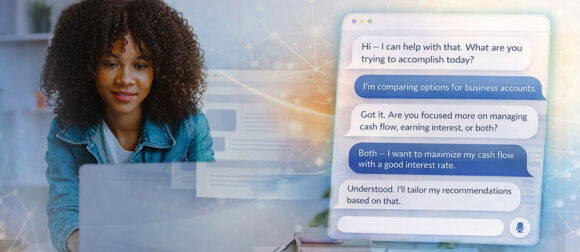

How LLMs Can Turn Static Websites into Interactive Conversations

Large Language Models (LLMs) are poised to transform websites from static digital readouts into dynamic, conversational experiences that adapt to each visitor's needs in real time. By enabling truly personalized 1:1 journey instead of predetermined segment paths, LLMs allow brands to deliver tailored responses through natural dialogue while maintaining strategic control over messaging and user engagement.