Marketing the GM BuyPower Card

General Motors (GM) has issued a credit card since the early 1990s, morphing across the decades as the portfolio was sold from financial institution to financial institution. In 2012, Capital One acquired the GM consumer portfolio* and, in late 2013, the product was enhanced – making it more attractive to those with an affinity to American automobile brands Chevrolet, Buick, GMC and Cadillac.

Our focus is on how the BuyPower Card from Capital One is being marketed in partnership with GM, Capital One and agency MCC McCann Detroit (McCann’s client roster includes General Motors and MasterCard so there’s an existing partnership already in play). Basic strategies and tactics worth emulating when marketing a co-branded credit card include:

Ownable nomenclature

Capital One’s GM World Elite MasterCard – its most visibly marketed GM card – has been renamed the BuyPower CardTM, working to reinforce the enhanced value proposition of rewards earn and redemption towards a GM automobile with no earning cap or expiration. There’s strength in the name, particularly when combined with card visual and tagline, Your card is the keyTM .

Custom/branded card design

The plastic is vertically oriented – still relatively unique – with five available designs featuring an individual brand (Chevrolet, Buick, GMC, Cadillac) or the default all-brand card, making the card appeal to loyalists.

Comprehensive, integrated digital marketing

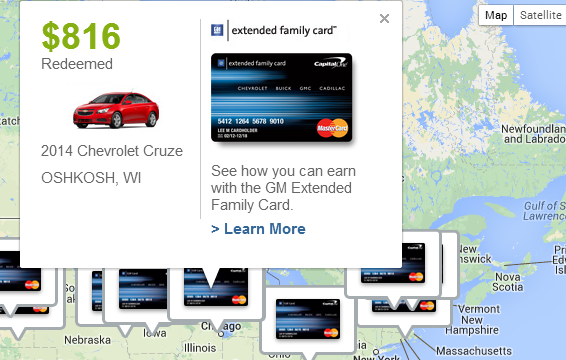

Whether you land on the GM or Capital One product pages for the BuyPower Card, you’re in for a consistent and positive experience from a branding and content perspective, while there’s strong continuity between issuer and co-brand versus the disjointed experience of many co-brands. Robust web content comes courtesy of GM’s product pages, with features like a card calculator that underscores how purchases add up to rewards towards new vehicles, a credibility-building widget that aggregates the total number of vehicle redemptions (the daily update was 7.1 million when we last visited), plus an interactive U.S. map used to call out specific reward redemptions, for example in Oshkosh, WI a cardmember redeemed $816 towards a 2014 Chevy Cruze (note that both consumer cards are represented).

Prospects and cardmembers can find product content related to World Elite MasterCard benefits, access TV ads and read cardmember stories about personal GM rewards redemptions.

Logical targeting/custom content

Mail stream review indicates car purchase data from GM dealerships is being leveraged by Capital One to target those most likely to acquire the BuyPower Card. The acquisition efforts include custom content specific to recently purchased car brands and reinforcement that the new car buyer is pre-qualified for the card. If the acquisition target purchase a Chevy Tahoe, for example, the letter content mentions the specific car purchase, reinforces the pre-qual status and features the specific Chevy branded card art.

On the flip side, efforts also indicate large mail volumes outside of recent GM purchase activity (no recent purchase and prequalification status). Most likely the targeted universe may come from GM data showing aging automobile purchase/lease of a GM car, assuming GM loyalists will soon be thinking about a new automobile and will therefore (hopefully) apply for the BuyPower card earning rewards toward a new car.

Engaging social streams

BuyPower Card has a presence on GM Rewards Cards’ Facebook page, which serves the family of cards. The mission – to “help you put your dreams in drive” – is strongly tied to the value proposition and the new rewards program changes. Regular posts and Facebook content include a recent trivia contest, a product promotion video and cardmember stories showcasing successful rewards-to-purchase testimonials.

Historically, the GM co-brand portfolio is regarded as a success among co-brand card programs. With a huge, fresh database of prospects with an affinity for the brand, card marketing could have simply stayed the course. With new partner Capital One and GM Rewards program improvements (no earn/redemption limit, no rewards expiration, additional World Elite benefits) the marketing has renewed energy, focus and a high level of integration which other co-brands could emulate.

*GM currently offers several credit cards: two business cards are issued by Chase; three consumer cards are issued by Capital One.