J.D. Power’s 2014 Studies Validate Two Important Financial Services Trends

In a recent review of J.D. Power’s Banking Blog, we came across two posts – along with supporting data from its 2014 credit card and retail banking studies – that we found relevant to our work and to the business goals of our financial services clients. We thought they were worth sharing.

Competition for credit card “share-of-spend”

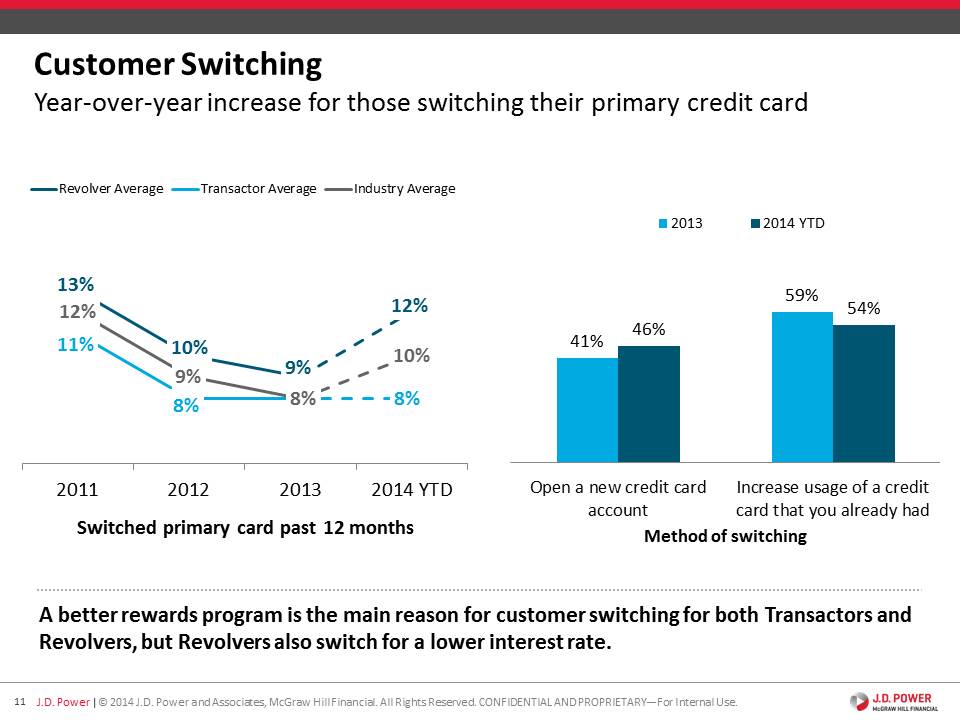

“The 2014 J.D. Power Credit Card Satisfaction StudySM finds that the percentage of credit card customers ‘switching’ their primary card has increased significantly over the past year. More specifically, there is a significant increase in the percentage of customers opening a new credit card account (46 percent vs. 41 percent in 2013).” [Source: “Competition for credit card ‘share-of-spend’,” J.D. Power Banking Blog.]

Implication: J.D. Power suggests that issuers must create successful rewards programs, provide strong offers and market them effectively to entice competitive customers to switch and, in turn, improve their acquisition metrics.

That is not to say, however, that creating a new rewards program is the answer to every issuer’s switch (and spend) problems. Equally important to the strength of the program is the development of lifecycle marketing strategies that continually highlight the rewards program value proposition. In many cases, we see strong rewards programs in the market that are not reinforced through consistent lifecycle marketing. Some issuers have perfectly rich and competitive rewards programs, but they fail to educate their existing cardholders on the value of their rewards program, thereby missing opportunities to create long-time, loyal cardholders (particularly among transactors who are not necessarily looking to switch for the best rate deal).

Investing at “banks” – A potential risk for investment-only institutions?

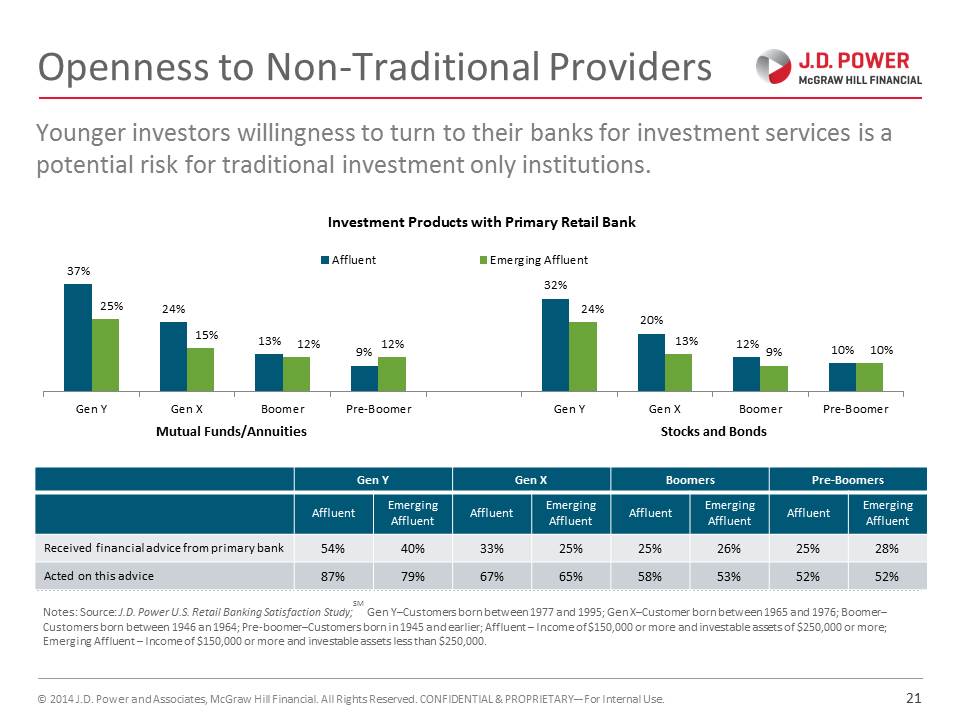

“J.D. Power’s U.S. Retail Banking Satisfaction Study finds that younger investors have greater willingness to open investment accounts/products at their primary retail banking institution.” [Source: “Investing at ‘banks’ – A potential risk for investment-only institutions?” J.D. Power Banking Blog.]

Implication: J.D. Power indicates that while this may be bad news for traditional investment firms, it is good news for banks looking to increase their investable asset holdings.

Many banks are trying to expand the way their retail banking clients think of them and steal share of investments from traditional investment firms. From our perspective, the key will be for banks to broaden their efforts beyond targeting the more established pre-Boomer and Boomer segments with switch campaigns and win the business of Gen Y affluent and emerging affluent segments. These segments are less established in their investments and seeking to put their money somewhere potentially for the first time. This strategy is similar to trying to be the first credit card in a young adult’s wallet; investments, obviously, require a bigger commitment. Given that Gen Y is more willing to act on advice from their banks, proactive and early investment education will be critical in converting this segment’s banking-only relationships into broader relationships inclusive of investments.