Building buzz – and leads – within payment organizations.

EverC is a leader in software technology for risk management and cyber-intelligence in e-commerce. Their “Merchant Underwriter” was an important new product that helped payment organizations looking to vet the integrity of new merchants. Servicing a merchant that is not compliant or is conducting illegal business is a serious issue that leads to prosecution and/or being banned from doing e-commerce, as well as steep fines and penalties.

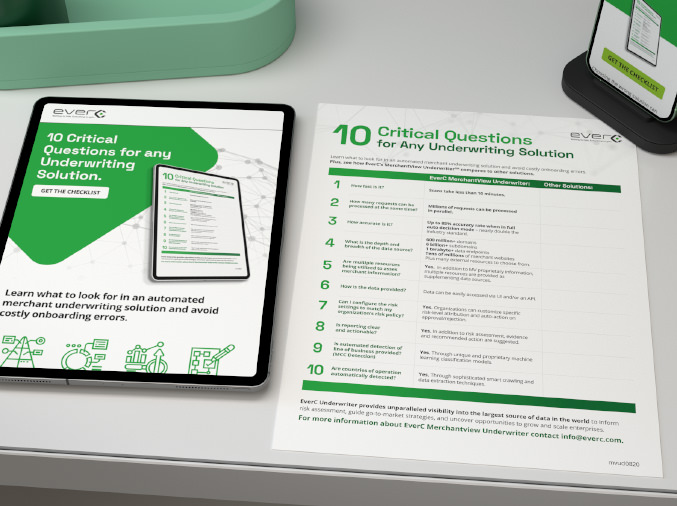

Working with EverC, Media Logic developed a strong, integrated lead gen/lead nurture campaign to engage and convert prospects – leveraging email, landing pages, digital ads, podcast appearances and multiple digital assets to connect qualified leads with the sales team.

All pieces worked in concert, helping to explain Merchant Underwriter’s value proposition and make the case for action, while capturing leads and building thought leadership.