Top 10 Financial Services Marketing Blog Posts of 2025

Explore Media Logic's top financial services marketing blog posts of 2025, including valuable commentary by group director, Nicole Johnson.

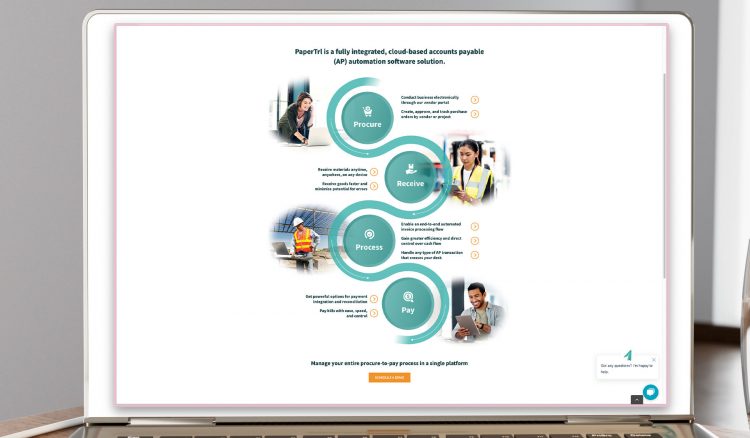

PaperTrl is a startup fintech that allows companies to manage the entirety of their accounts payable (AP) process — from invoices to approvals to payments. While their product offered advantages over their competitors, they needed help in telling their story. Media Logic worked side-by-side with Visa and PaperTrl to find the best way to turn a complex solution targeted at a specific audience into a digestible narrative.

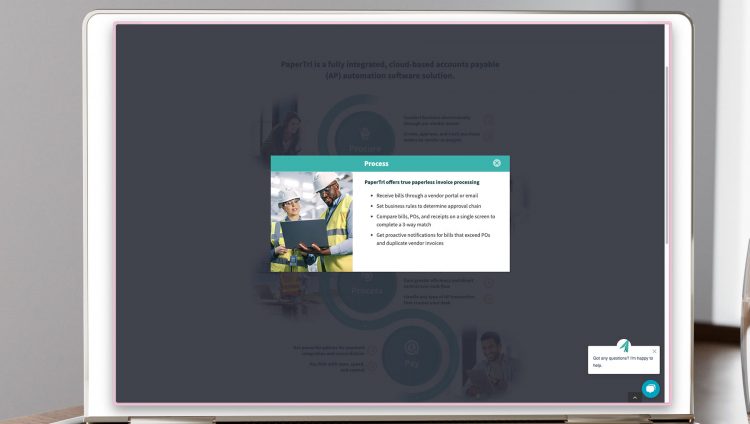

It started by learning about PaperTrl’s key benefit, which was that you could review and automate purchases, bills, and payments on a single, cloud-based platform. Media Logic was then able to take their variety of features, like being able to audit approval trails or complete a 3-way match of POs, bills and receipts, and organize them into an easy-to-read interactive infographic. By working together, we were able to create a dynamic visual representation that shows a comprehensive overview of PaperTrl’s benefits and allows users to dig deeper into the ones that are most applicable to their needs. Media Logic created a compelling visual narrative to simplify the story of PaperTrl’s innovative (but potentially complex) accounts payable solution.

Ready to find your edge?

Get smarter strategy and breakthrough creative. Backed by unmatched client support.

Explore Media Logic's top financial services marketing blog posts of 2025, including valuable commentary by group director, Nicole Johnson.

In this intriging Q&A session, Media Logic's resident expert, Nicole Johnson, Group Director and FS Practice Lead, shares her perspective on the Lower Midde Market segment honed by decades of commercial payments and retail banking marketing experience.

American consumers are currently facing a dramatic financial landscape. With recent data indicating that 70% of U.S. consumers face difficulty paying monthly bills, economic fragility is increasing (PYMNTS). As we approach the end of 2025, this increasing trend has many wallets taught, and the implications for financial services marketers are becoming clearer.