Medical liability insurer gains competitive advantage with provider partnership.

As a provider network, MagnaCare represents a large pool of potential policyholders for Media Logic client (and leading medical professional liability insurer) MLMIC Insurance Company. For years, MagnaCare held a contract for discounts with a prime MLMIC competitor. But that contract was expiring and MagnaCare was entering into a new partnership with MLMIC, creating a win-win for both organizations. The partnership gave MagnaCare providers an important discount on their medical malpractice insurance while helping MLMIC find a valuable way to incentivize a largely untapped pool of prospects.

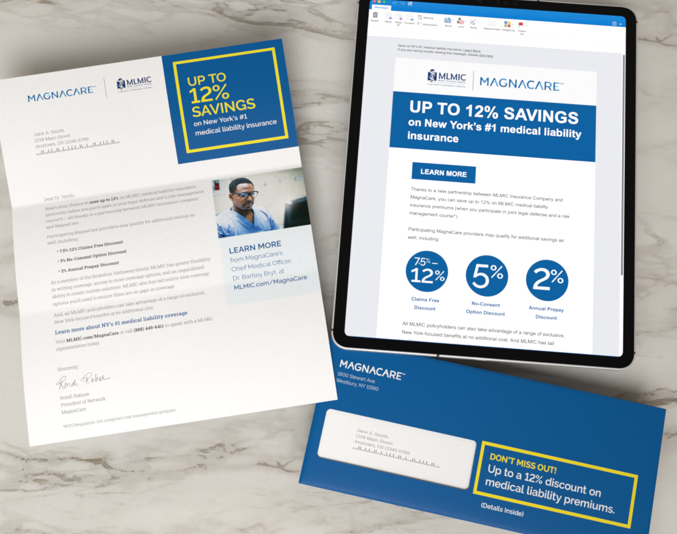

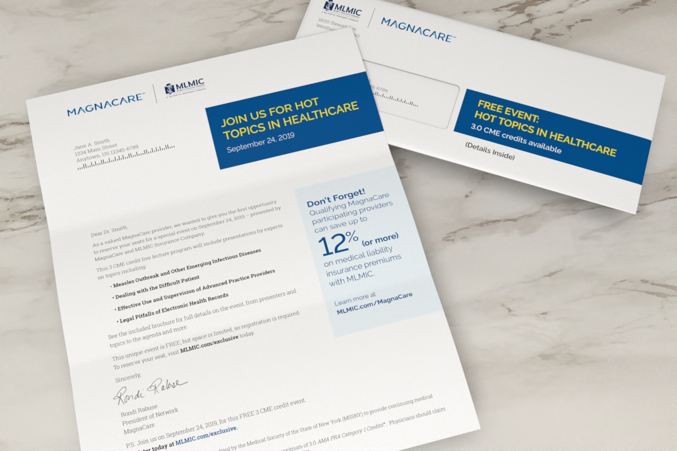

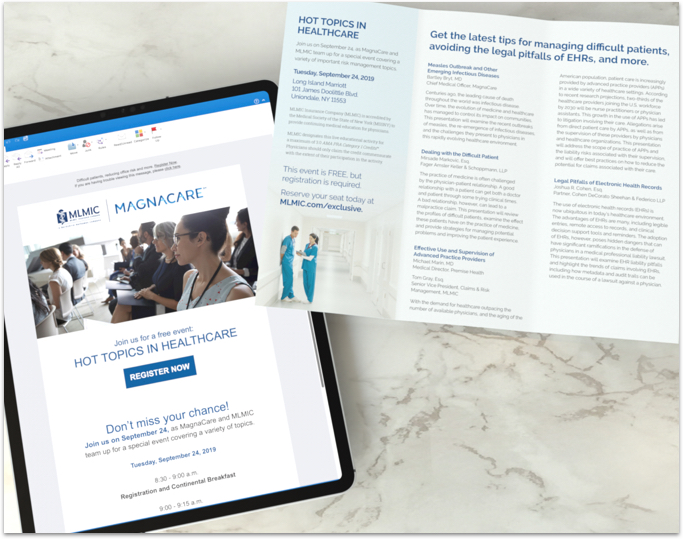

Building off the launch of a co-sponsored risk management/CME event, Media Logic created a comprehensive, integrated effort that individually targeted existing MagnaCare members and brokers – incorporating everything from both MLMIC and MagnaCare owned channels (blog, web, social accounts), to email, landing pages, print, direct mail and more. In addition, multiple pieces leveraged a short video that featured MagnaCare’s CEO making a personal pitch for the new relationship with MLMIC.

No proverbial stone was left unturned in this effort to generate attention, assert leadership and drive prospects to move over to New York’s #1 medical professional liability insurer.