Concierge Services Help Consumers Become Smarter Healthcare Shoppers

In January 2014, non-employed individuals and employees at companies all over the United States had to adjust to big changes in how they received their healthcare – and what they paid for it. Employees at Media Logic were no different; just because our day jobs are at an agency with expertise in healthcare marketing (and therefore we have a leg up on a lot of other consumers out there), as “regular people” we still had to learn the “ins and outs” of being healthcare shoppers in an evolved healthcare industry – one with different rules of engagement and new responsibilities for consumers (including ourselves).

To help us make the best decisions regarding our healthcare and healthcare costs, Media Logic offered to subscribe us to a third-party service (i.e., not affiliated with Media Logic or our healthcare provider) called Compass. Compass, essentially, is team of advisers whose job it is to make sure we get the full benefits from our healthcare coverage. Some of the services that they provide include:

- unlimited access to a healthcare expert,

- unbiased doctor recommendations,

- hospital and provider cost and quality information,

- straight answers about our benefits,

- bill reconciliation and

- insider information on saving money.

Since becoming Compass members, many of my coworkers have talked about the helpful tips and guidance they’ve received from their advisers. For example, one coworker was pointed to the best physical therapy facility for his needs. Another was told where she could find the cheapest (but still high quality) MRI. As a member myself, I receive occasional emails reminding me of not only my Compass benefits, but of things that I should be thinking about when it comes to my healthcare costs. Here are screenshots of some recent examples:

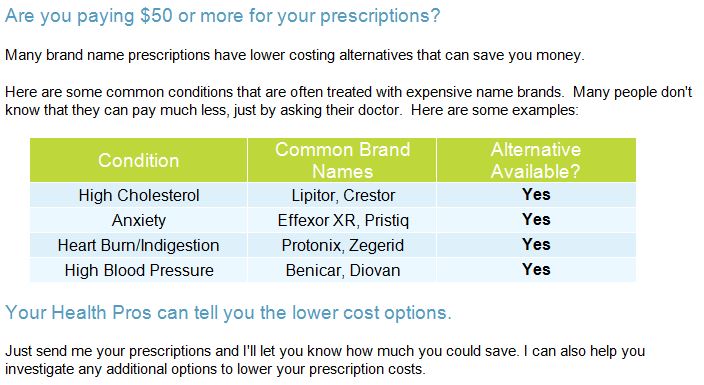

Regarding prescriptions:

The CTA — “just send me your prescriptions and I’ll let you know how much you can save” — is more than enticing and something that I certainly don’t feel like investigating myself.

Regarding anxiety over surgery expenses:

Again, I’m reminded that I have someone who can help me. What could be an overwhelming and headache-inducing experience (especially now that all these costs actually matter with my new-as-of-2014 high-deductible health plan) is really not sounding so terrible.

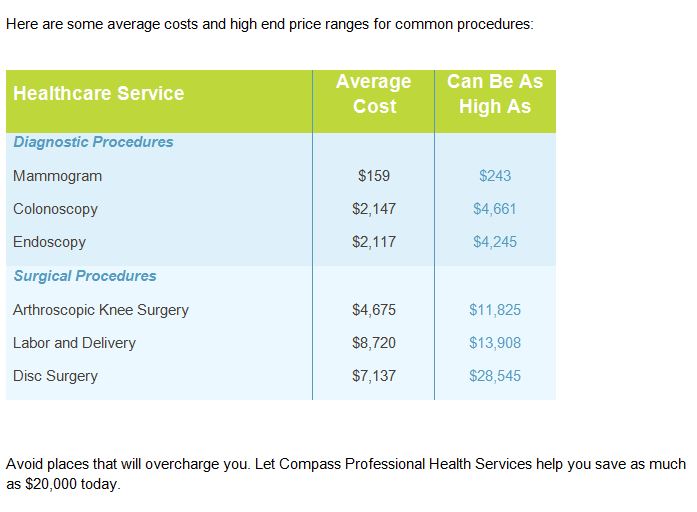

Regarding actual costs I might encounter:

Wow — who knew that a single procedure might be billed at almost $12,000 but, on average, it should only cost around $5,000! That’s a huge difference in cost. And I wouldn’t have learned about it on my own. Good to know for the future, I’d say.

What this means for payers and providers

We’ve talked about health plans and price transparency before and how consumers need data to help them make important decisions about both the cost and quality of their healthcare. Tools like Compass are a great way to get that information out to those consumers, and we believe payers would be wise to fold Compass-like services into their offerings. After all, now that consumers are required to pay all this money that they never even had to think about paying for before, it would behoove health plans to provide this as a service to their members – who would surely find it a valuable service and selling point of the plan itself.

But price transparency shouldn’t be a goal just for payers – it should be top-of-mind for providers, as well. Hospitals, physician practices and other medical facilities need to recognize that the numbers are out there – that’s how tools like Compass are able to function. It would be a smart move for these providers to take a leadership role in this price transparency movement: instead of letting it happen around them, they should take a leadership role in providing the price information as a benefit for their customers.

Also, once providers realize that consumers really are looking at these numbers – and basing their medical care decisions on them – perhaps it will make them more aware of competitive price points and adjust their fees and costs accordingly (see our recent blog post on hospital chargemasters for more insight into this point specifically). In other words, now that consumers can “shop around” for the best price in medical procedures, the healthcare industry isn’t so different from other consumer-facing industries anymore – and those industries don’t hide their prices or go out of their way to make their prices higher than anyone else’s. That would just be bad business and not good for their bottom line.

At the end of the day, what price transparency really means for payers and providers is that they need to step up and help consumers be better shoppers when it comes to their healthcare. Just like some people are willing to pay more for a higher-end car because of its safety record, some people may be willing to pay more for the higher-end MRI to make sure nothing is missed in their scans. Payers and providers need to find (or revise) their value propositions, tailored to a new kind of consumer in a new kind of healthcare era.