RP+: Where Gaming, Prepaid Cards and Millennials Meet

Arguably the biggest entertainment opening this fall has not been a Hollywood blockbuster, but a video game. After just three days on the market, Grand Theft Auto V grossed $1 billion in sales worldwide (that’s billion, with a “b”). Of course, the growth in video games sales is not news, but the number can be surprising. Last year Forbes reported that some estimates project annual worldwide video games sales (hardware and software) will grow from $67 billion in 2012 to $82 billion in 2017.

With sales numbers like that, the big financial institutions can’t afford to ignore the gaming community… especially the large sub-set of Millennial gamers. This particular age group has been a bit elusive for financial service marketers. These consumers seem to be ditching credit cards (normally a foundational “point of entry” product), and they make up a significant portion of the un- and under-banked, often searching for alternatives to “traditional” banking relationships.

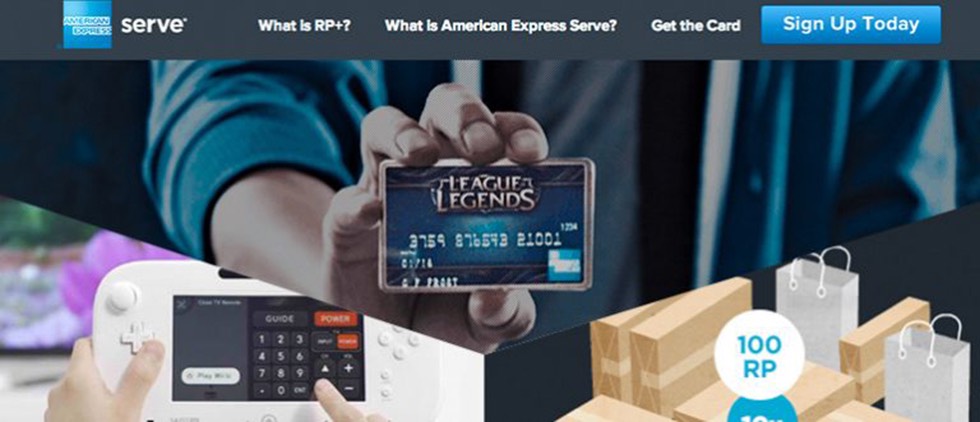

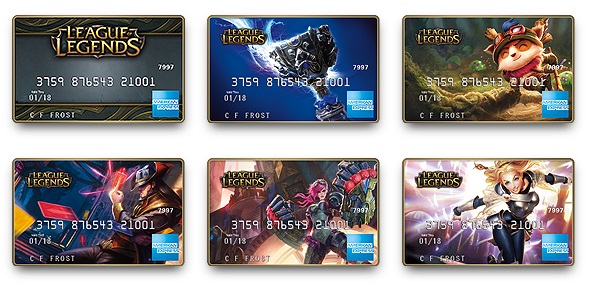

When you consider all of these factors, the recent launch of the RP+ from American Express Serve seems like a no-brainer. RP+ is a rewards program tied to an Amex Serve pre-paid debit card that targets players of the wildly popular online game League of Legends. Card designs feature characters and images from the game, and cardholders earn RP (Riot Points) when they sign up, load the card, link it to a direct deposit account and use it for purchases. The RP currency already exists in the game, but until now RP could not be earned, just purchased with real money.

American Express has a number of things going for it with this product:

- Existing affinity – League of Legends has 32 million players. Most of them are males, ages 18-24, and Amex is tapping into the passion that these players feel for the game with both the card design and value proposition of the program.

- Low barrier of entry – The card does not require a credit check, so credit-averse Millennials only need a few dollars to load it and start using it.

- Relevant rewards – By using a currency the gamers are familiar with, Amex does not need to explain the value of the points, and it gets the benefit of associating card usage with rewards.

- Benefit reinforcement – By using the Serve pre-paid platform, Amex can include features like protection and account management, allowing the brand to highlight benefits it brings to the table.

RP+ seems like a smart move for American Express, especially since it lacks other “entry level” products, like savings and checking accounts. With the launch of this program, Amex is making a bet that a highly targeted product can be a way to reach one very large segment of the Millennial audience.