Capital One Taps Latest Celebrity Pitchman’s Fan Base Like a Total Pro

NFL tight end Rob Gronkowski is extremely popular with both fans and brands. Recently tapped by Capital One to promote a suite of online banking products, Gronkowski has worked with several large brands, including Dunkin’ Donuts, JetBlue, Monster Energy and Nike. However, Capital One recognized that “Gronk” (as the New England Patriot player is known) might be a tough sell in parts of the country. Team loyalties – and rivalries – run deep, after all. In order to take full advantage of the energy around Gronk’s celebrity, Capital One determined, its partnership with Gronkowski ought to focus with great precision on the player’s existing fans.

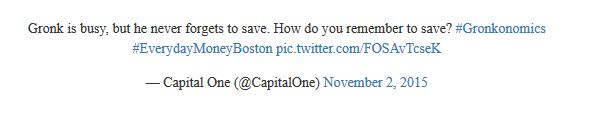

And that’s exactly what the brand has done with the #GRONKonomics campaign for its Capital One 360 line of products:

In a very smart strategic move, Capital One ran the #GRONKonomics campaign in Gronkowski’s personal social media profiles instead of its own social streams.* Gronk has over a million fans on Facebook and over a million followers on Twitter. These large audiences already have great affinity for him and are more likely than a broader national audience to be interested in what the athlete has to say.

But focusing on the tight end’s social media popularity isn’t the only thing Capital One did right in its Gronk campaign. Here are some other elements of the marketing effort that show how Capital One tapped Gronkowski’s celebrity like a total pro:

Capital One worked the “WTF” factor

At first glance, Rob Gronkowski isn’t a natural pick for a financial institution spokesperson. In addition to breaking records on the football field, Gronkowski is famous (or infamous) for “breaking the Internet,” as SB Nation joked, via a very strange photo shoot he did for ESPN… with kittens. He’s also known to party hard, a reputation he embraces so much that he and his family have launched a party bus business. And then there’s Gronk’s team, the New England Patriots; it has been plagued by heated debates nationwide surrounding cheating allegations.

So what makes “Gronk” appealing to a financial services brand?

For starters, as one of five super-sized brothers, Rob Gronkowski has a great story of growing up as part of a big, active family and working hard to get where he is. But of far greater relevance to a financial institution marketing team is that Gronkowski revealed in a recently published memoir that he’s really good with his money – spending income from endorsements and saving the proceeds from his NFL contract.

This reported financial savvy was a hook for Capital One, which more than likely was fully aware that the mash-up of “party boy” + “financial advisor” would make people scratch their heads… just enough to create buzz around the campaign. (See, for example, Fast Company’s coverage: “Capital One Taps Rob Gronkowski to Educate Us About ‘GRONKonomics’ for Some Reason.”)

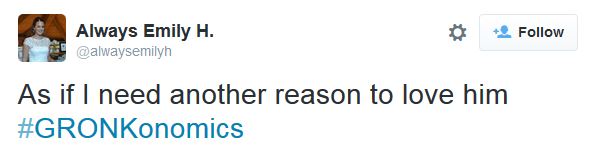

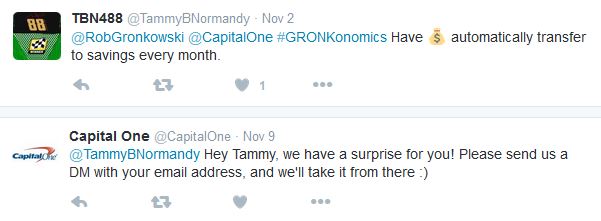

Capital One rewarded Gronk fans who joined the conversation

When Gronkowski first tweeted about #GRONKonomics on November 2, he asked, “How do you save?” When followers replied with savings tricks they use, Capital One reached out to them offering a surprise:

Capital One aligned the campaign with a specific product and its features

#GRONKonomics isn’t a brand campaign: it’s a product-specific campaign. As a result, the campaign’s marketing assets were able to promote particular product features. For example, some of the Gronkowski posts and images focused on Capital One 360’s savings tools, such as the ability to nickname sub accounts and track savings goals.

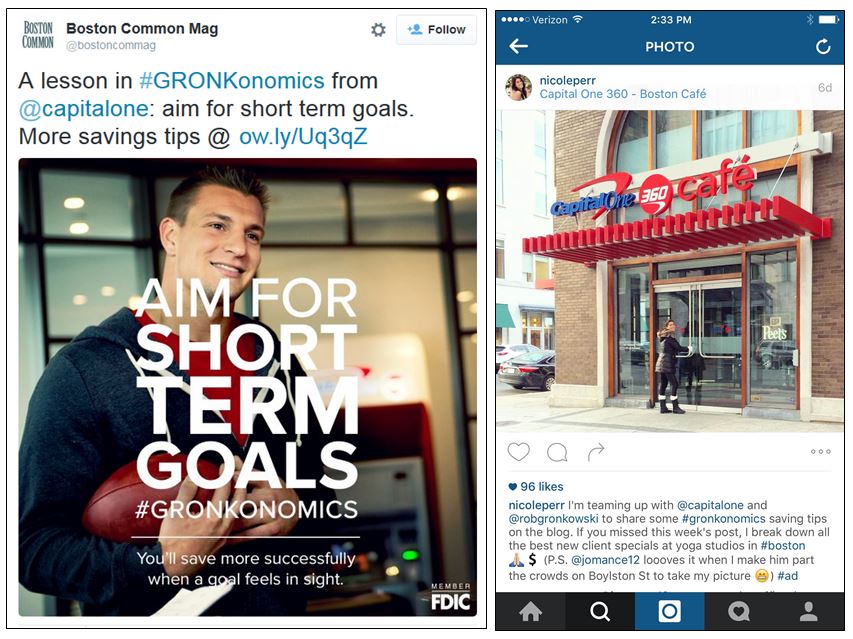

Capital One used Boston-area influencers to give the campaign an extra boost

Ground zero for Gronk fever is Boston, and so Capital One turned to Boston media and influencers to help spread the buzz about #GRONKonomics. In addition to earning coverage in the Boston Globe, Capital One sponsored online content in Boston-based publications and blogs. Here are a few examples:

- How Has Gronk Managed Not to Spend a Dollar of His Salary? / This piece in Boston Common, a luxury lifestyle publication, features five savings tips from Gronk, i.e. Capital One 360.

- How to Pay $1.67/Class for 4 Months of Yoga in Boston / This post at “Pumps & Iron,” a blog by a popular personal trainer in Boston, is about special rates for local yoga classes. The post is sponsored by #GRONKonomics and includes some of the campaign assets.

- Patriots TE @RobGronkowski is Teaching #GRONKonomics / This sponsored content appears at “patsfans.com,” a website dedicated to Patriots football.

- Financial-Gronk Is Back With More #GRONKonomics Tips / The website “Boston Sports Then and Now” published this sponsored content, which links directly to the savings goals page at Capital One 360 and to the location finder for Capital One 360 cafés.

In addition to hosting the sponsored content, the publications and bloggers promoted it in their social streams:

Takeaway

We love the spirit behind Capital One’s #GRONKonomics. Its targeting is precise (demonstrated by its laser focus on Gronk fans). The campaign is timely (on the heels of Gronk’s memoir and mid-way through a stellar football season for Gronk). And its message is relevant (it maintains its connection to financial services and the product).

In addition, #GRONKonomics fits right into the tradition of the brand, which promotes itself via marketing campaigns that are far edgier than most of the advertising produced by its competitors. Rob Gronkowski’s own edge earns him a spot on the Capital One marketing team alongside the brand’s other icons, including David Spade, Samuel L. Jackson and those extremely memorable Vikings.

***

* Even though we cannot find any posts, it’s possible that Capital One may have used geo-targeting for posts in its own social streams so that the campaign would be visible only to those in the New England region. In fact, Fox Sports cited a Capital One tweet that contains a Boston-specific hashtag, but the tweet doesn’t seem to exist, at least for us here in Upstate New York: