Even When There’s Trouble, Simple’s Customer Experience Matches Brand Promise

I brag about my bank all the time. And even when a recent snafu caused my card to stop functioning for nearly a day, I kept bragging. Banks, how often can your customers say that?

Here’s why I can: I’m a Simple customer, and from day one, the Simple Bank customer experience has been nothing but amazing. Not only are the mobile app and online banking capabilities far ahead of my previous bank’s, but the customer service experience was different, as well. If, in the beginning, I had any concerns about receiving personal service from an online bank, Simple quickly – and very congenially – put them to rest. The bank used every interaction as a chance to build a relationship with me as a person, not just an anonymous virtual account holder.

Whenever I had a question or needed an issue resolved, I used the messaging feature on the app. And every time, without fail, the response was timely and the resolution efficient… and always, always, accomplished via a support team member who used his/her first name and communicated in a casual, personable manner. They responded with comments like:

- “Whoops!”

- “Sorry about that :/”

- “Aw, we <3 you too!” (a reply to my message: “You guys are so speedy! I <3 Simple!”)

- “Oh, those pesky gas holds!”

- “Ah, very annoying.”

With Simple, the customer service approach seems to be to respond with both help and (something like) a spirit of camaraderie. What is conveyed is “I hear you,” “I get it” and “I care about fixing it for you.”

That’s why, when my debit card failed to function after some scheduled downtime for maintenance, I was patient and calm. I knew that Eric and Emily and Kelly and all the other members of the support team would handle it. In addition, I’d come to respect them as much as they’d respected me. I knew we’d be “in it” together, and so I waited it out.

Now, the experience wasn’t without surprises. There were a few… but they were very nice surprises. For example:

- I received an email asking me to complain. Simple knew it was having issues getting cards back online, and it asked customers to let the bank know where the issues were.

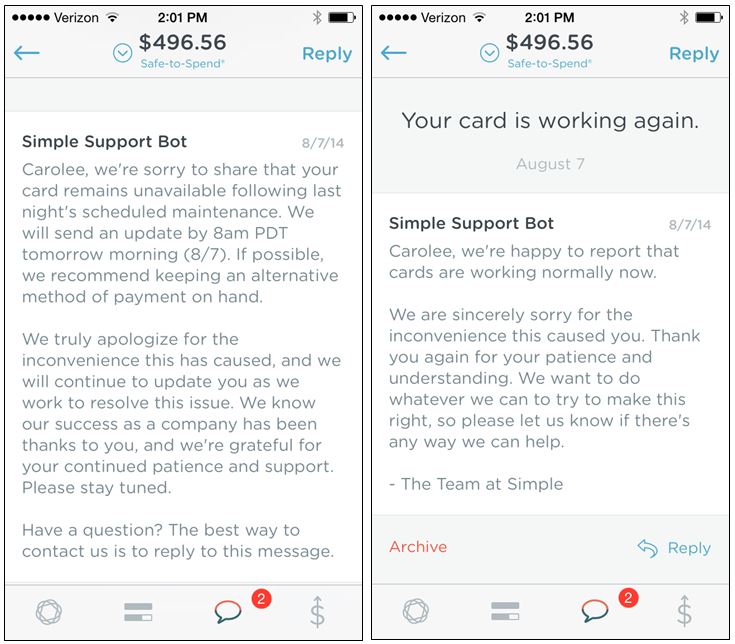

- Via the app, I received updates and apologies both while the issue was ongoing and once it had been resolved.

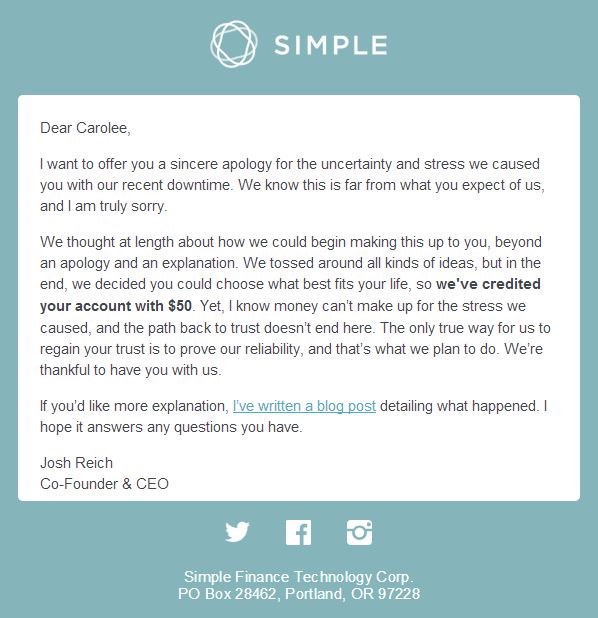

- In addition, I received an email from CEO Josh Reich offering both an apology and a $50 “courtesy credit from Simple” (as it was listed in my transactions). A what? I had never even heard of a courtesy credit before, but yes: $50 for my trouble. But that’s not all that impressed me about the apology: it was also brief, sincere and made no excuses. Often, when CEOs apologize, they do a lot of explaining, and that can come off as failure to accept responsibility. As you can see in the email, instead of diluting his apology with explanation, Reich detailed the reasons for the outages in a blog post.

When I joined Simple, I was looking for everything it had to offer, including free ATMs and a smart phone app that tells me how much I have to spend in real time (it’s so fast, in fact, that at restaurants the app tells me about the swipe even before the server has returned with my card). I also wanted something intangible, something new, something like what Reich describes in a recent Forbes article on how a bank can be a brand you love; he says, “We wanted to build this modern lifestyle brand that relies on new technology to help customers feel more at ease with what’s going on with their money.” Bank as lifestyle brand? Well, it’s about as close as they come. In fact, for the first time I do feel more at ease with my money; I would even go so far as to say I feel empowered and in charge.

And what’s incredible is that while delivering a product based on technology, Simple still emphasizes people and relationships, not only when there’s an issue, but as a brand promise. Here’s the bank’s customer service promise from its website:

As an online/app bank (or more aptly, as described by The New Yorker, “a service to manage your bank account”), Simple had to prove that it could offer excellent customer service. And for this banking customer’s money, with or without that $50 boost, Simple nails it again and again. And yes: “with smarts and heart.”

What can other banks learn from Simple’s example? It’s pretty, excuse the pun, simple: tools, access… and well-trained, positive people staffing the support teams.